- Saudi Arabia

- /

- Infrastructure

- /

- SASE:2190

Market Participants Recognise Sustained Infrastructure Holding Company's (TADAWUL:2190) Earnings Pushing Shares 27% Higher

Sustained Infrastructure Holding Company (TADAWUL:2190) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.5% over the last year.

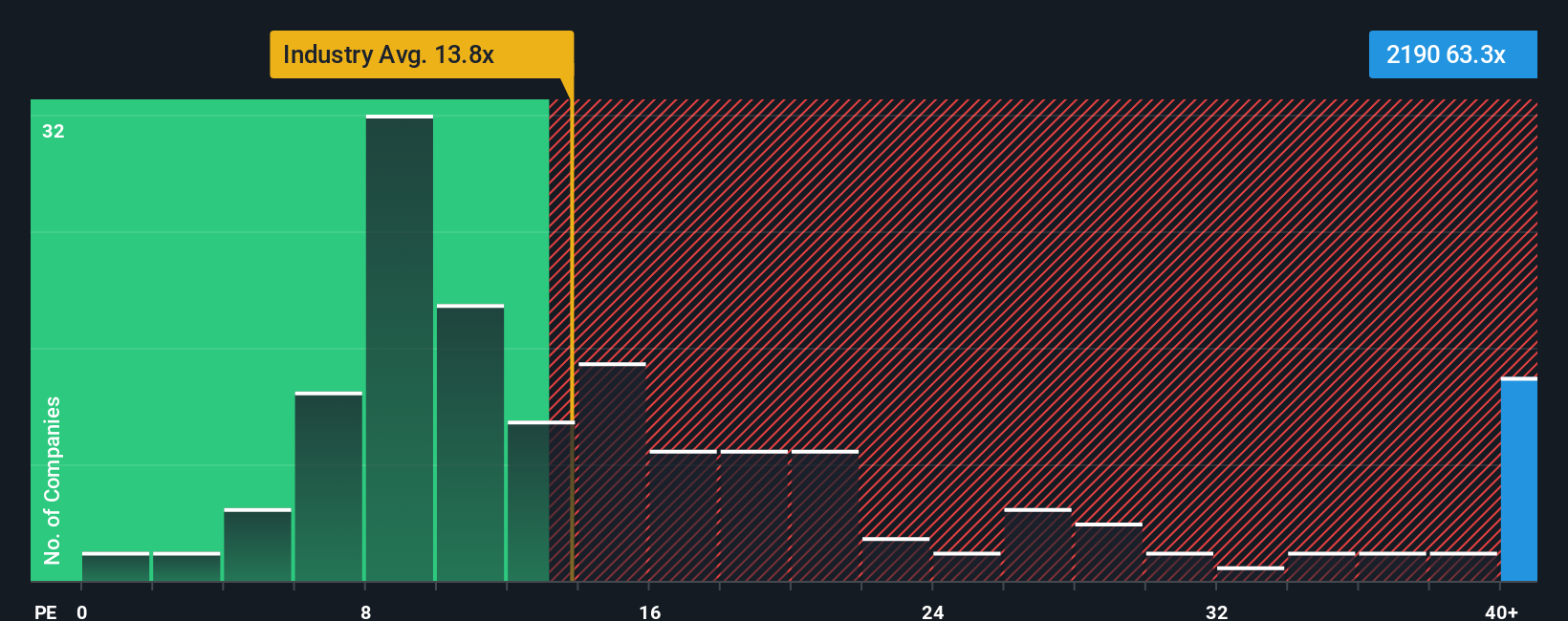

Since its price has surged higher, given close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 21x, you may consider Sustained Infrastructure Holding as a stock to avoid entirely with its 63.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Sustained Infrastructure Holding has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Sustained Infrastructure Holding

Does Growth Match The High P/E?

Sustained Infrastructure Holding's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 48%. The latest three year period has also seen an excellent 72% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 65% each year as estimated by the two analysts watching the company. With the market only predicted to deliver 13% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Sustained Infrastructure Holding is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Sustained Infrastructure Holding's P/E?

The strong share price surge has got Sustained Infrastructure Holding's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Sustained Infrastructure Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Sustained Infrastructure Holding is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Sustained Infrastructure Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2190

Sustained Infrastructure Holding

An investment holding company, engages in ports and logistics, and water solutions businesses in the Kingdom of Saudi Arabia and internationally.

Reasonable growth potential average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026