Global's Top 3 Stocks Estimated Below Intrinsic Value In July 2025

Reviewed by Simply Wall St

As global markets reach new heights with the S&P 500 and Nasdaq Composite hitting all-time highs, investors are navigating a landscape shaped by easing geopolitical tensions and positive trade developments. In this environment, identifying stocks that are estimated to be trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sustained Infrastructure Holding (SASE:2190) | SAR32.88 | SAR64.75 | 49.2% |

| Strike CompanyLimited (TSE:6196) | ¥3705.00 | ¥7290.78 | 49.2% |

| Serko (NZSE:SKO) | NZ$3.19 | NZ$6.27 | 49.2% |

| Polaris Holdings (TSE:3010) | ¥211.00 | ¥416.25 | 49.3% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.89 | HK$1.76 | 49.6% |

| Livero (TSE:9245) | ¥1717.00 | ¥3380.20 | 49.2% |

| Koskisen Oyj (HLSE:KOSKI) | €8.80 | €17.40 | 49.4% |

| Kanto Denka Kogyo (TSE:4047) | ¥841.00 | ¥1679.50 | 49.9% |

| GCH Technology (SHSE:688625) | CN¥30.58 | CN¥60.27 | 49.3% |

| Bloks Group (SEHK:325) | HK$141.20 | HK$279.47 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

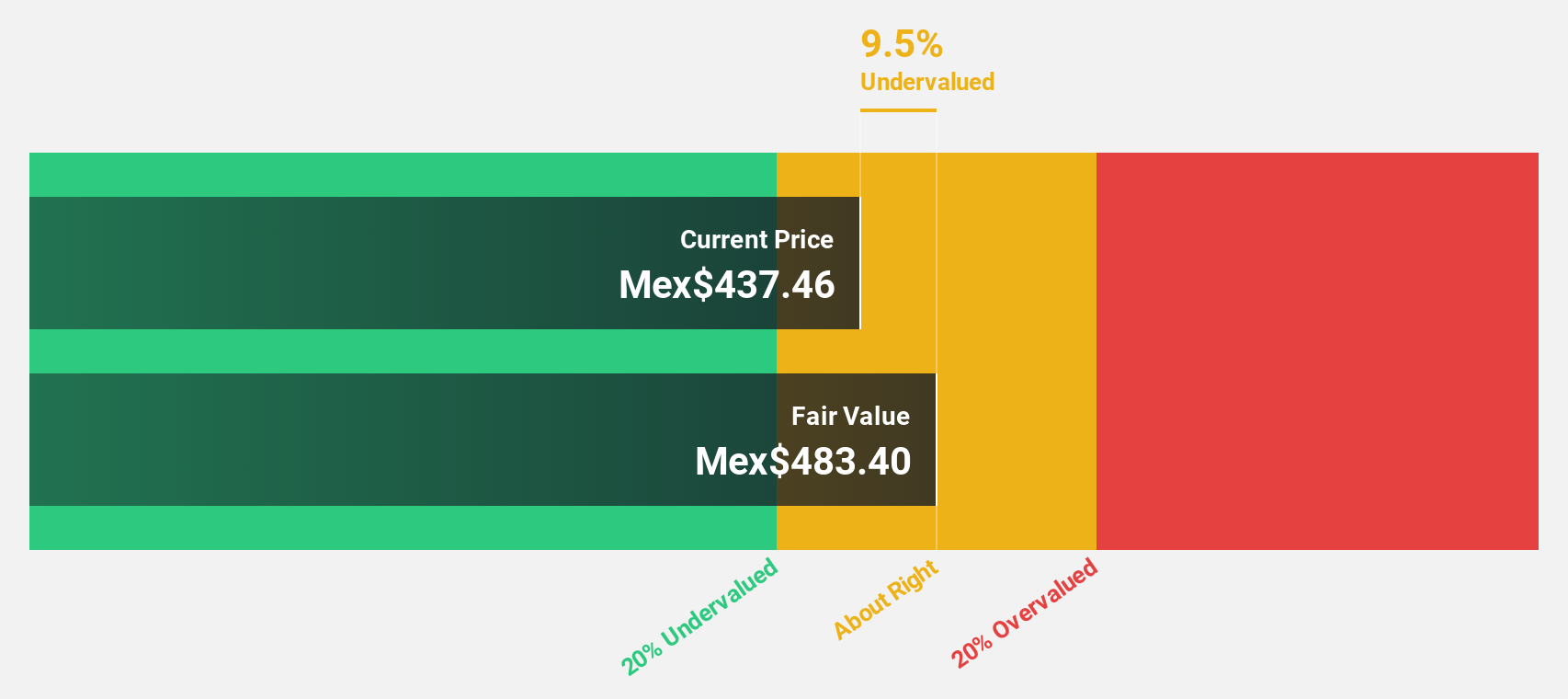

Grupo Aeroportuario del Pacífico. de (BMV:GAP B)

Overview: Grupo Aeroportuario del Pacífico, S.A.B. de C.V., along with its subsidiaries, develops, operates, and manages airports in Mexico and Jamaica with a market cap of MX$217.64 billion.

Operations: The company generates revenue through the development, operation, and management of airports located in Mexico and Jamaica.

Estimated Discount To Fair Value: 10.6%

Grupo Aeroportuario del Pacífico is trading at MX$430.73, slightly below its estimated fair value of MX$482.04, suggesting it may be undervalued based on cash flows. Despite a high debt level, earnings are projected to grow 18.06% annually, outpacing the Mexican market's growth rate of 11.1%. Recent results show increased passenger traffic and improved first-quarter earnings with net income rising from MXN 2.43 billion to MXN 2.75 billion year-over-year.

- Our expertly prepared growth report on Grupo Aeroportuario del Pacífico. de implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Grupo Aeroportuario del Pacífico. de stock in this financial health report.

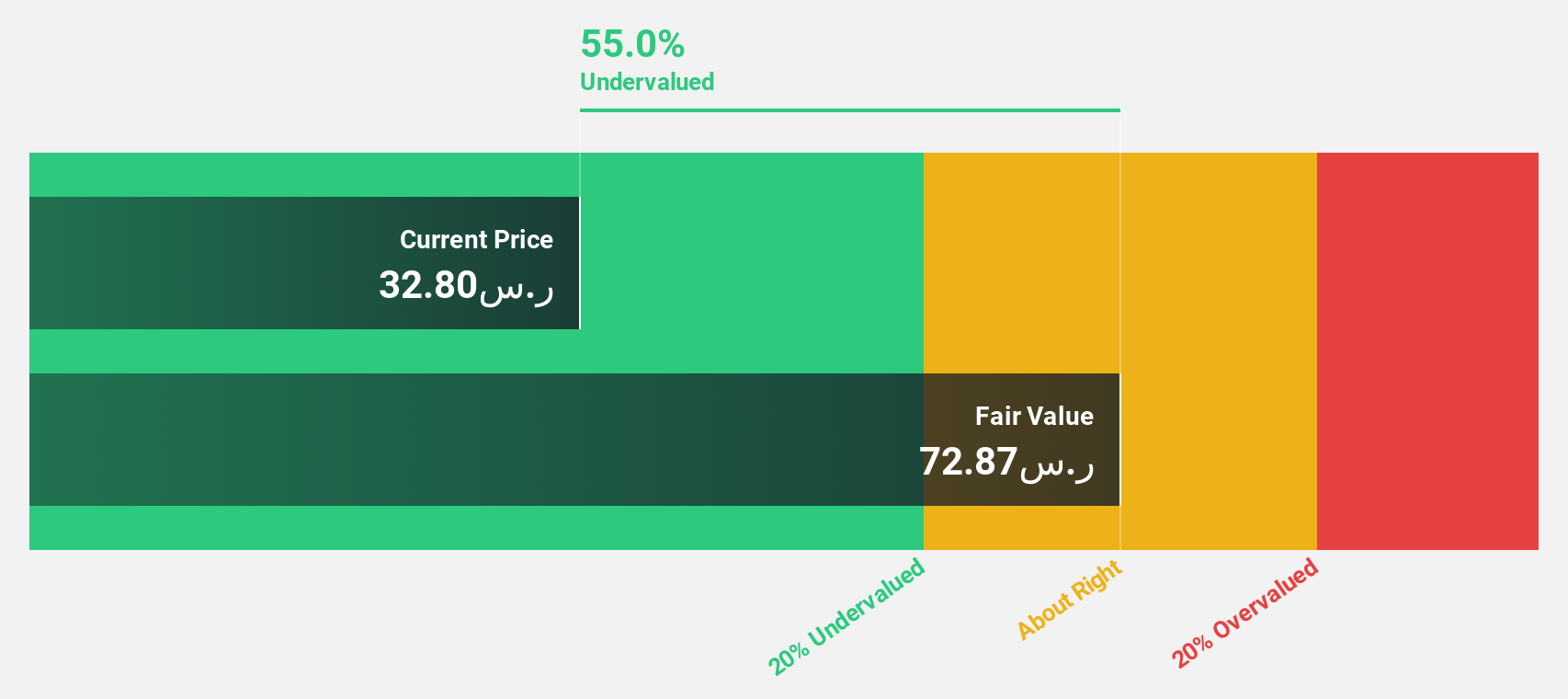

Sustained Infrastructure Holding (SASE:2190)

Overview: Sustained Infrastructure Holding Company is an investment holding company involved in ports, logistics, and water solutions both in Saudi Arabia and internationally, with a market cap of SAR2.62 billion.

Operations: The company's revenue segments include Port Development and Operations at SAR1.18 billion, Logistic Parks and Support Services at SAR165.26 million, and Water Desalination and Distribution at SAR97.52 million.

Estimated Discount To Fair Value: 49.2%

Sustained Infrastructure Holding is trading at SAR 32.88, significantly below its estimated fair value of SAR 64.75, highlighting potential undervaluation based on cash flows. Earnings are projected to grow substantially at nearly 32% annually, surpassing the South African market's growth rate of 7%. Despite recent volatility in share price and a low forecasted return on equity, the company reported improved first-quarter results with net income reaching SAR 24.73 million from a previous loss.

- Our growth report here indicates Sustained Infrastructure Holding may be poised for an improving outlook.

- Click here to discover the nuances of Sustained Infrastructure Holding with our detailed financial health report.

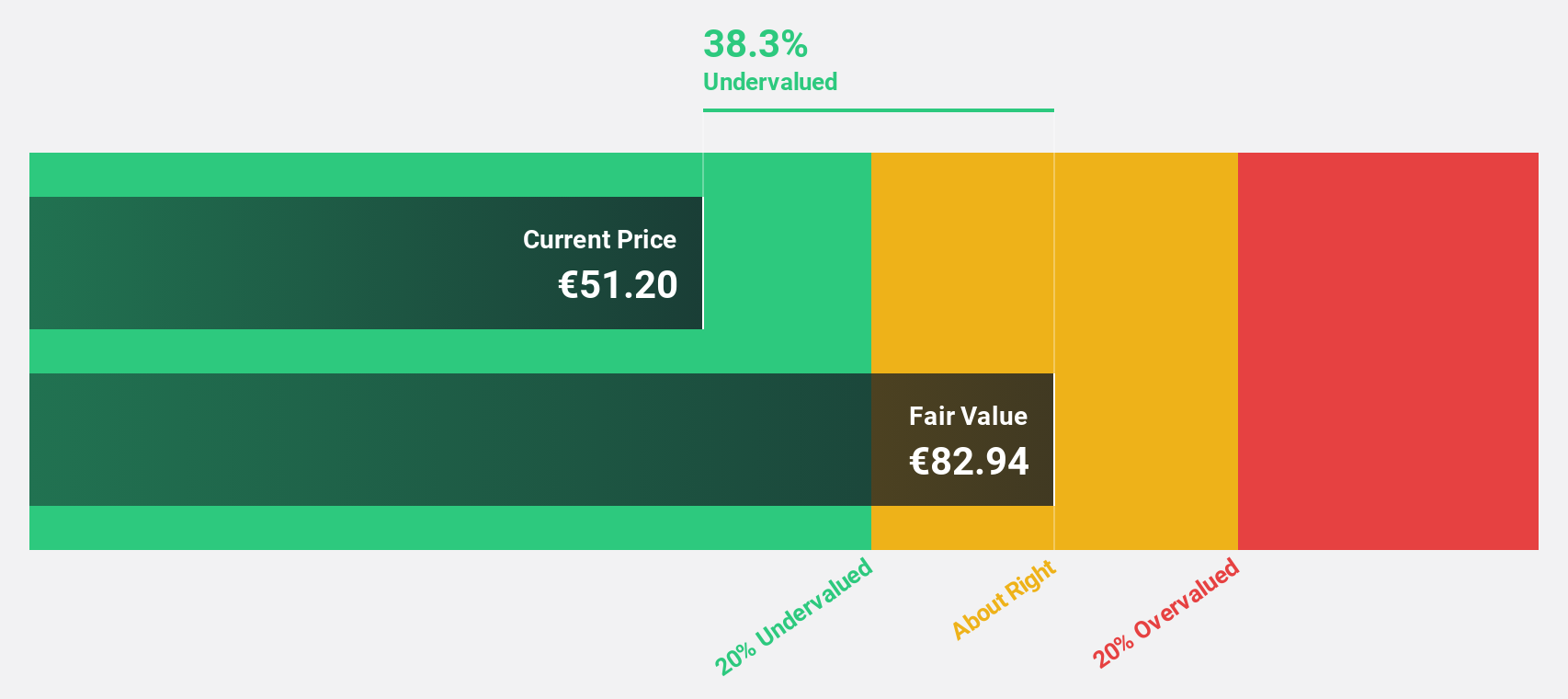

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA operates in the out-of-home and digital out-of-home advertising sectors in Germany and internationally, with a market cap of approximately €2.84 billion.

Operations: The company's revenue segments are comprised of Daas & E-Commerce (€356.69 million), Out-Of-Home Media (€981.11 million), and Digital & Dialog Media (€881.05 million).

Estimated Discount To Fair Value: 38.1%

Ströer SE KGaA is trading at €50.9, considerably below its estimated fair value of €82.17, suggesting undervaluation based on cash flows. Earnings grew by 46.8% last year and are forecast to rise 20% annually, outpacing the German market's growth rate of 16.6%. Despite high debt levels and a dividend yield of 3.63% not fully covered by earnings, recent results showed increased sales (€475.47 million) and net income (€8.54 million).

- Our earnings growth report unveils the potential for significant increases in Ströer SE KGaA's future results.

- Take a closer look at Ströer SE KGaA's balance sheet health here in our report.

Where To Now?

- Unlock our comprehensive list of 494 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAX

Ströer SE KGaA

Provides out-of-home (OOH) media and digital out-of-home advertising services in Germany and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives