- France

- /

- Basic Materials

- /

- ENXTPA:VCT

Discovering Undiscovered Gems In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by fluctuating indices and economic indicators. While U.S. stocks have experienced volatility due to AI competition fears and tariff risks, European markets have been buoyed by strong earnings and interest rate cuts from the ECB. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential amidst shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Vicat (ENXTPA:VCT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vicat S.A., along with its subsidiaries, operates in the construction industry by producing and selling cement, ready-mixed concrete, and aggregates, with a market capitalization of approximately €1.79 billion.

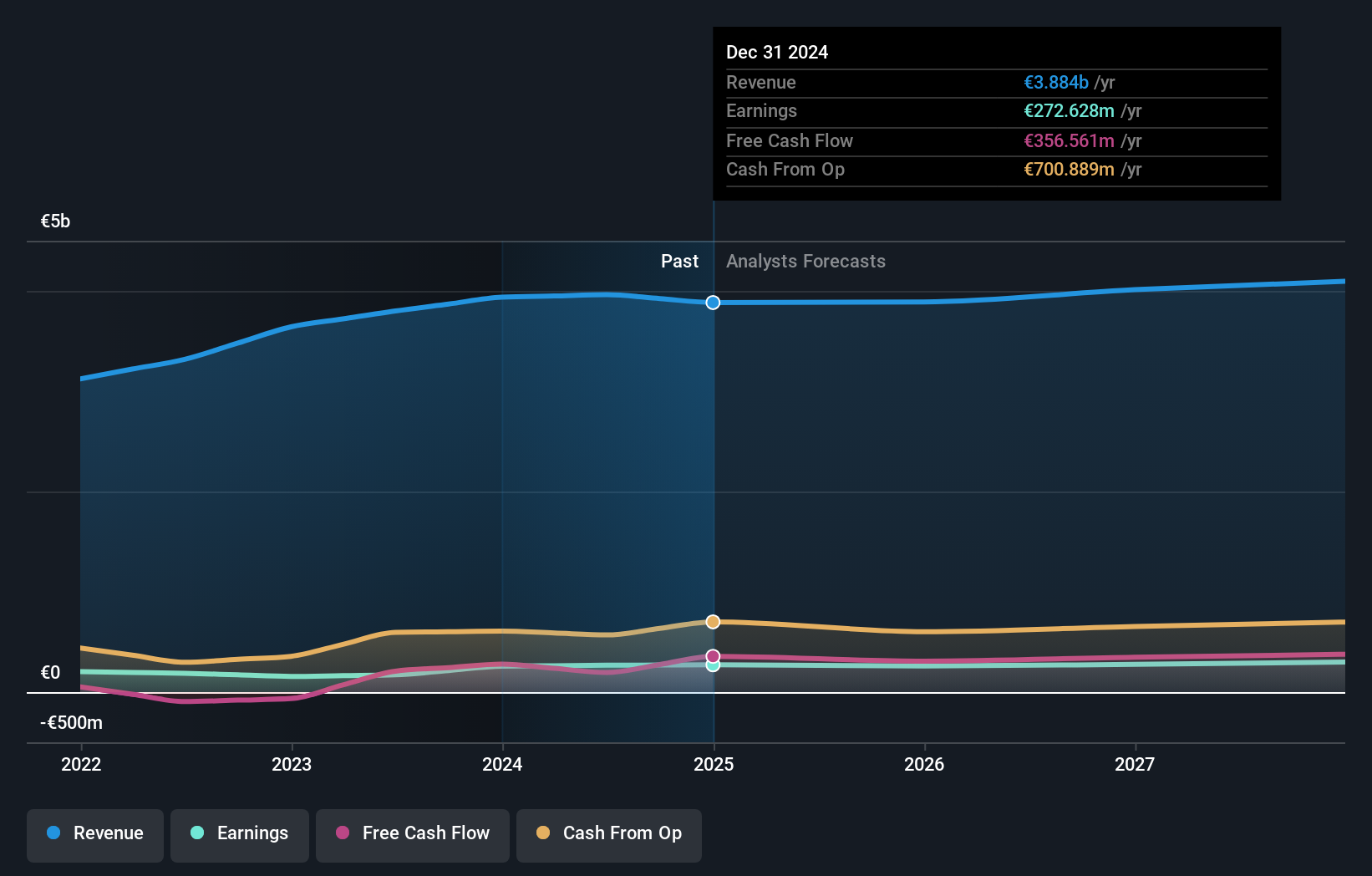

Operations: Vicat generates revenue primarily from its Cement segment (€2.52 billion) and Concrete & Aggregates segment (€1.55 billion). The company's net profit margin has shown notable variation, reflecting changes in operational efficiency and market conditions.

Vicat, a promising player in the Basic Materials sector, has demonstrated impressive earnings growth of 55% over the past year, outpacing its industry peers who saw an -11% change. Despite a high net debt to equity ratio of 45%, interest payments are well covered by EBIT at 8.8 times. The company appears undervalued, trading at 63% below estimated fair value and maintaining positive free cash flow. With a reduction in debt to equity from 64% to 62% over five years and high-quality earnings, Vicat seems poised for steady progress amidst industry challenges.

- Navigate through the intricacies of Vicat with our comprehensive health report here.

Gain insights into Vicat's past trends and performance with our Past report.

Etihad Atheeb Telecommunication (SASE:7040)

Simply Wall St Value Rating: ★★★★★★

Overview: Etihad Atheeb Telecommunication Company offers telecommunication products and services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR3.54 billion.

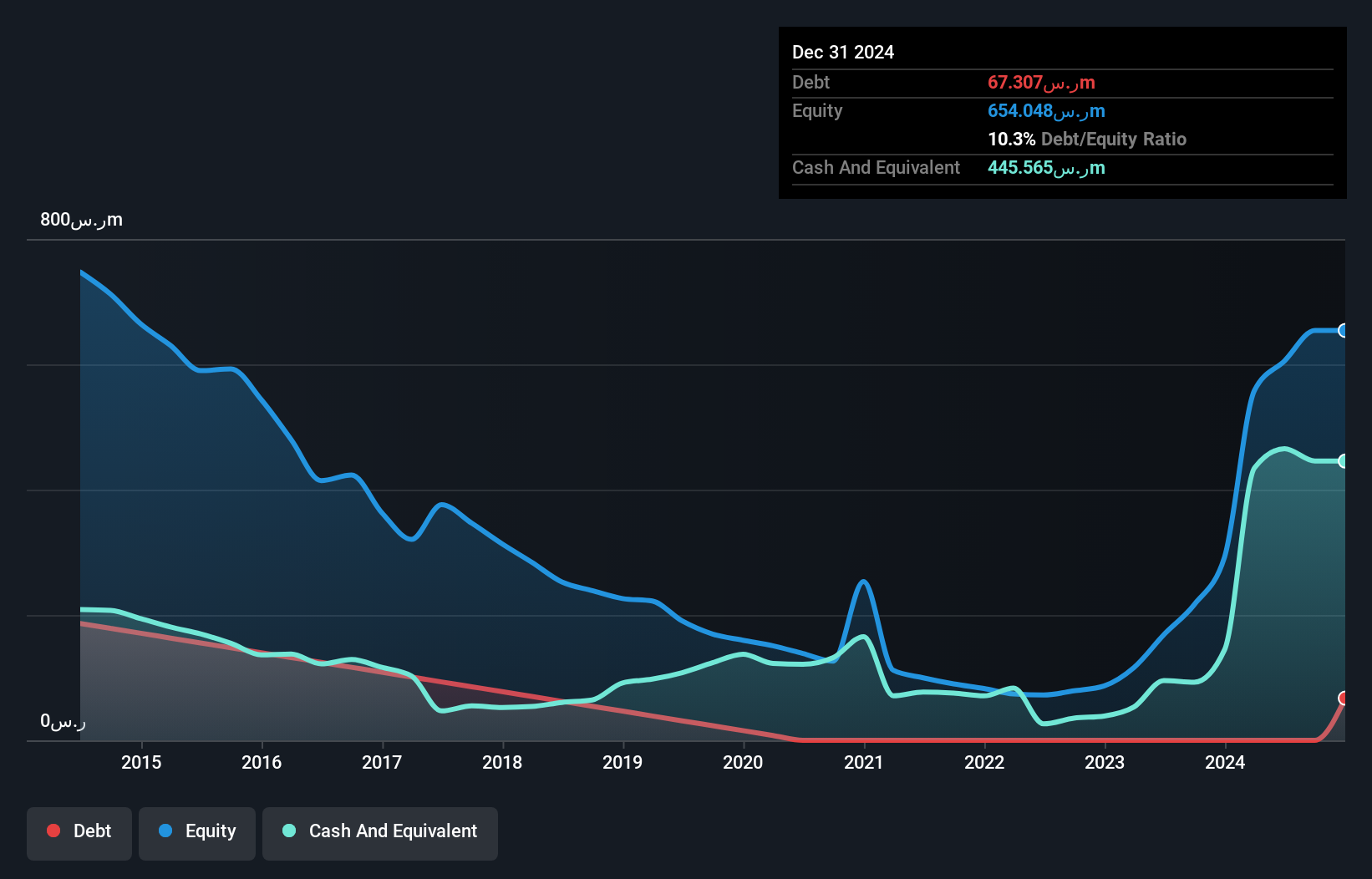

Operations: Etihad Atheeb Telecommunication generates revenue primarily from data services amounting to SAR729.22 million and voice services contributing SAR499.77 million.

Etihad Atheeb Telecommunication, a smaller player in the telecom sector, has been making waves with its impressive earnings growth of 44.6% over the past year, outpacing the industry average of 1.3%. The company is debt-free and trading at 76.4% below its estimated fair value, suggesting potential undervaluation. However, a significant one-off gain of SAR50 million impacted its recent financial results up to September 2024, which might skew perceptions of performance quality. Despite these gains, shareholder dilution has occurred in the past year. With positive free cash flow and no debt concerns, Etihad Atheeb seems poised for further exploration by investors seeking hidden opportunities in telecommunications.

Delta Galil Industries (TASE:DELG)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Galil Industries Ltd. is involved in the design, development, production, marketing, and sale of intimate and activewear products with a market cap of ₪5.23 billion.

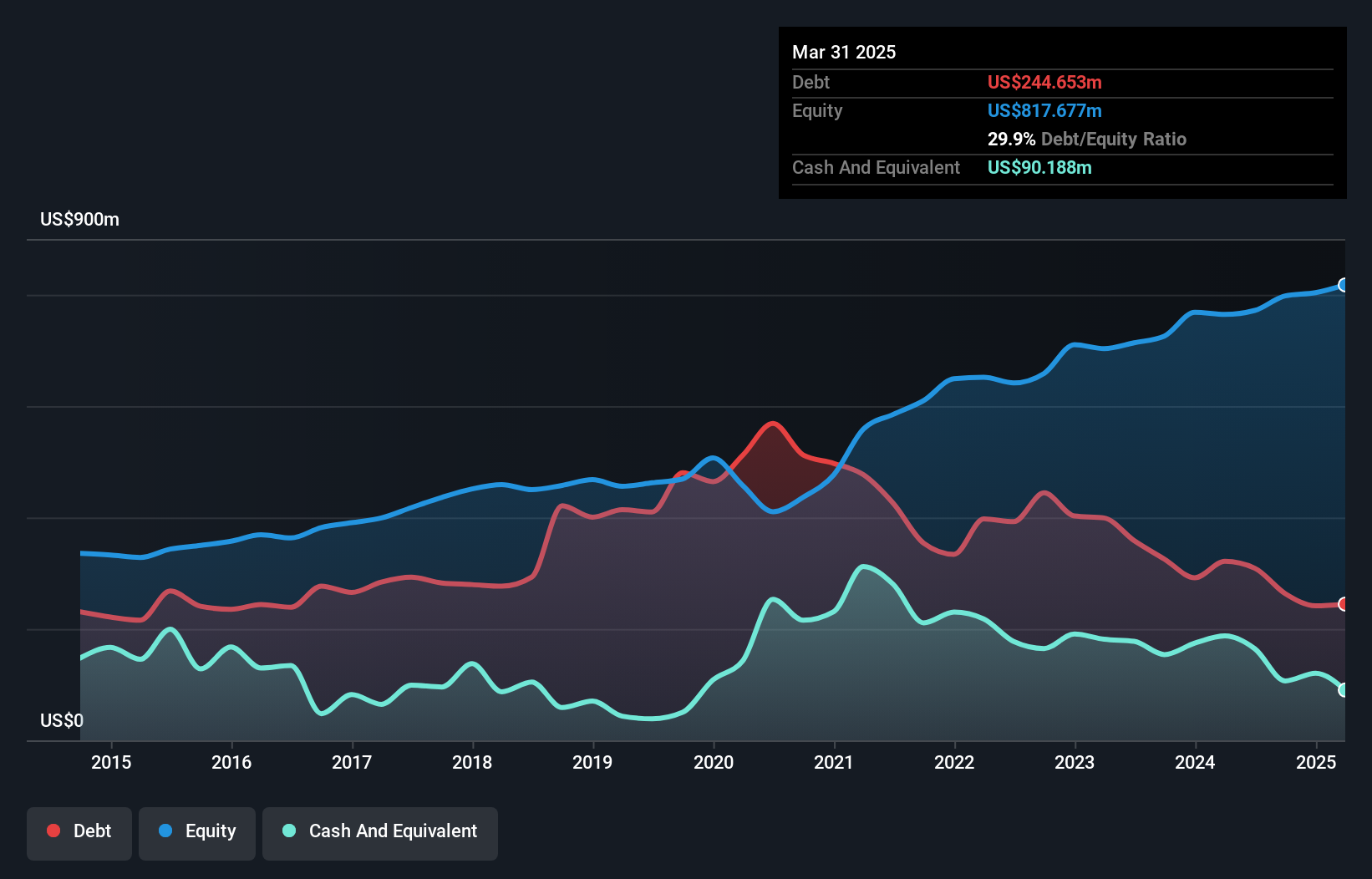

Operations: Delta Galil's revenue is primarily derived from its Private Brands segment, contributing $766 million, followed by the Brands segment at $637.48 million. The Delta Israel and Seven for All Mankind segments add $302.86 million and $202.57 million, respectively, to the company's revenue streams.

Delta Galil Industries, a notable player in the luxury market, has shown impressive financial health with its debt to equity ratio dropping from 102.4% to 33% over five years. This reduction highlights their strategic management of liabilities. Their earnings growth of 17.6% last year outpaced the industry average of 9.6%, showcasing robust performance against peers. Trading at an attractive valuation, it's currently priced at 18.6% below estimated fair value, offering potential upside for investors seeking value opportunities in smaller companies within the luxury sector. Recent earnings reports also reflect positive trends with increased sales and net income figures compared to the previous year.

- Delve into the full analysis health report here for a deeper understanding of Delta Galil Industries.

Assess Delta Galil Industries' past performance with our detailed historical performance reports.

Seize The Opportunity

- Click this link to deep-dive into the 4663 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VCT

Vicat

Engages in the production and sale of cement, ready-mixed concrete, and aggregates for construction industry.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion