- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4191

Abdullah Saad Mohammed Abo Moati for Bookstores (TADAWUL:4191) Has Announced A Dividend Of SAR0.50

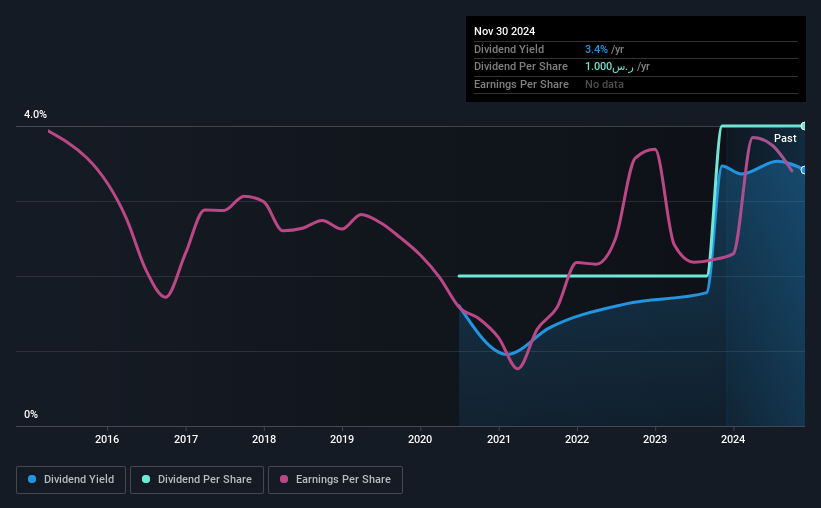

Abdullah Saad Mohammed Abo Moati for Bookstores Company (TADAWUL:4191) will pay a dividend of SAR0.50 on the 22nd of December. Based on this payment, the dividend yield will be 3.4%, which is fairly typical for the industry.

See our latest analysis for Abdullah Saad Mohammed Abo Moati for Bookstores

Abdullah Saad Mohammed Abo Moati for Bookstores' Payment Could Potentially Have Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, Abdullah Saad Mohammed Abo Moati for Bookstores was paying out a fairly large proportion of earnings, and it wasn't generating positive free cash flows either. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Earnings per share could rise by 6.3% over the next year if things go the same way as they have for the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 93%, which is on the higher side, but certainly still feasible.

Abdullah Saad Mohammed Abo Moati for Bookstores Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 4 years, which isn't that long in the grand scheme of things. The dividend has gone from an annual total of SAR0.50 in 2020 to the most recent total annual payment of SAR1.00. This implies that the company grew its distributions at a yearly rate of about 19% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Has Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Abdullah Saad Mohammed Abo Moati for Bookstores has impressed us by growing EPS at 6.3% per year over the past five years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments are bit high to be considered sustainable, and the track record isn't the best. We don't think Abdullah Saad Mohammed Abo Moati for Bookstores is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Abdullah Saad Mohammed Abo Moati for Bookstores that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4191

Abdullah Saad Mohammed Abo Moati for Bookstores

Engages in the retail and wholesale trading of stationery, computers, and other accessories in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.