- Saudi Arabia

- /

- Real Estate

- /

- SASE:4323

Investor Optimism Abounds Sumou Real Estate Company (TADAWUL:9511) But Growth Is Lacking

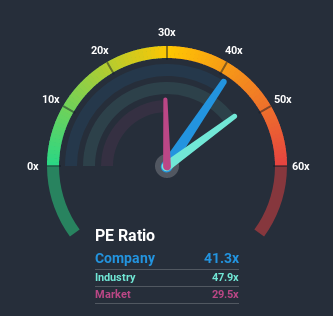

Sumou Real Estate Company's (TADAWUL:9511) price-to-earnings (or "P/E") ratio of 41.3x might make it look like a sell right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios below 29x and even P/E's below 21x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Sumou Real Estate's earnings have been unimpressive. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Sumou Real Estate

Does Growth Match The High P/E?

Sumou Real Estate's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 12% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 14% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Sumou Real Estate's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sumou Real Estate currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Sumou Real Estate that you need to be mindful of.

You might be able to find a better investment than Sumou Real Estate. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

When trading Sumou Real Estate or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4323

Sumou Real Estate

Engages in the construction of residential and non-residential properties in Saudi Arabia.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives