- Saudi Arabia

- /

- Real Estate

- /

- SASE:4300

Analysts Are More Bearish On Dar Al Arkan Real Estate Development Company (TADAWUL:4300) Than They Used To Be

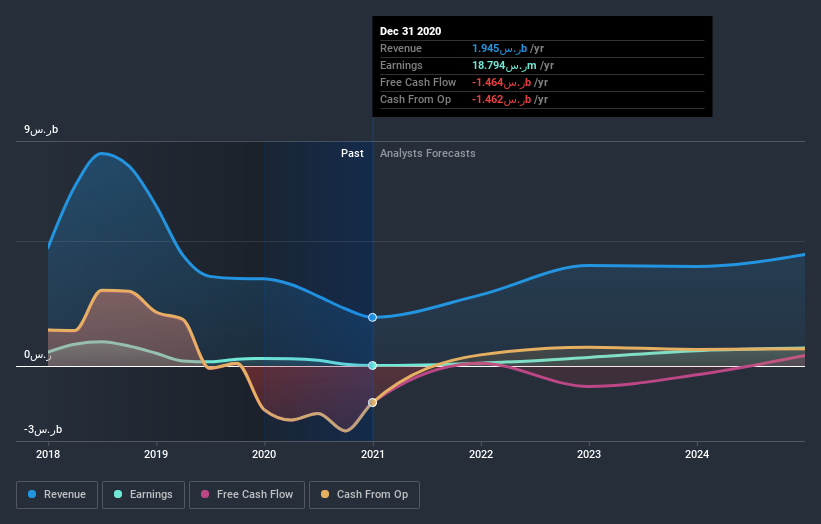

One thing we could say about the analysts on Dar Al Arkan Real Estate Development Company (TADAWUL:4300) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

Following the downgrade, the current consensus from Dar Al Arkan Real Estate Development's two analysts is for revenues of ر.س2.8b in 2021 which - if met - would reflect a huge 46% increase on its sales over the past 12 months. Statutory earnings per share are presumed to leap 475% to ر.س0.10. Before this latest update, the analysts had been forecasting revenues of ر.س4.0b and earnings per share (EPS) of ر.س0.29 in 2021. Indeed, we can see that the analysts are a lot more bearish about Dar Al Arkan Real Estate Development's prospects, administering a sizeable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Dar Al Arkan Real Estate Development

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Dar Al Arkan Real Estate Development's rate of growth is expected to accelerate meaningfully, with the forecast 46% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 7.6% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Dar Al Arkan Real Estate Development to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Dar Al Arkan Real Estate Development, and their negativity could be grounds for caution.

That said, the analysts might have good reason to be negative on Dar Al Arkan Real Estate Development, given its declining profit margins. For more information, you can click here to discover this and the 1 other flag we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Dar Al Arkan Real Estate Development, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4300

Dar Al Arkan Real Estate Development

Primarily engages in the development, management, lease, and sale of real estate projects and associated activities in the Kingdom of Saudi Arabia.

Solid track record with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.