- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Undiscovered Gems in Middle East Stocks to Explore December 2025

Reviewed by Simply Wall St

As most Gulf markets experience gains ahead of the Federal Reserve's anticipated interest rate decision, regional investors are closely watching monetary policies that could impact economic stability and corporate earnings. With key indices like Dubai's main share index rising and Saudi Arabia's benchmark stock index showing positive momentum, the Middle East market presents intriguing opportunities for those seeking potential growth in less explored sectors. In this dynamic environment, identifying stocks with strong fundamentals and resilience to economic shifts can be key to uncovering hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

We'll examine a selection from our screener results.

Al Hassan Ghazi Ibrahim Shaker (SASE:1214)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Hassan Ghazi Ibrahim Shaker Company, with a market cap of SAR1.31 billion, operates in Saudi Arabia through trading, wholesale, and maintenance services for spare parts, electronic equipment, household equipment, and air-conditioners.

Operations: Shaker generates revenue primarily from its Home Appliances and Heating, Ventilation, and Air-Conditioning Solutions (HVAC) segments, with the latter contributing SAR1.03 billion. The company's focus on these segments highlights its strategic emphasis on HVAC solutions as a significant revenue driver.

Al Hassan Ghazi Ibrahim Shaker, a relatively small player in the Middle East, showcases promising financial metrics. The company's earnings have grown by 13.7% over the past year, outpacing the industry average of 7.8%. With a price-to-earnings ratio of 16.4x below the Saudi market's 18.2x, it offers attractive valuation potential. Despite high net debt to equity at 43%, interest payments are well covered with an EBIT coverage of 5.4x, indicating strong operational efficiency. Recent board expansion reflects strategic growth ambitions and aligns with projected annual earnings growth of nearly 17.89%, suggesting robust future prospects for investors.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Value Rating: ★★★★★☆

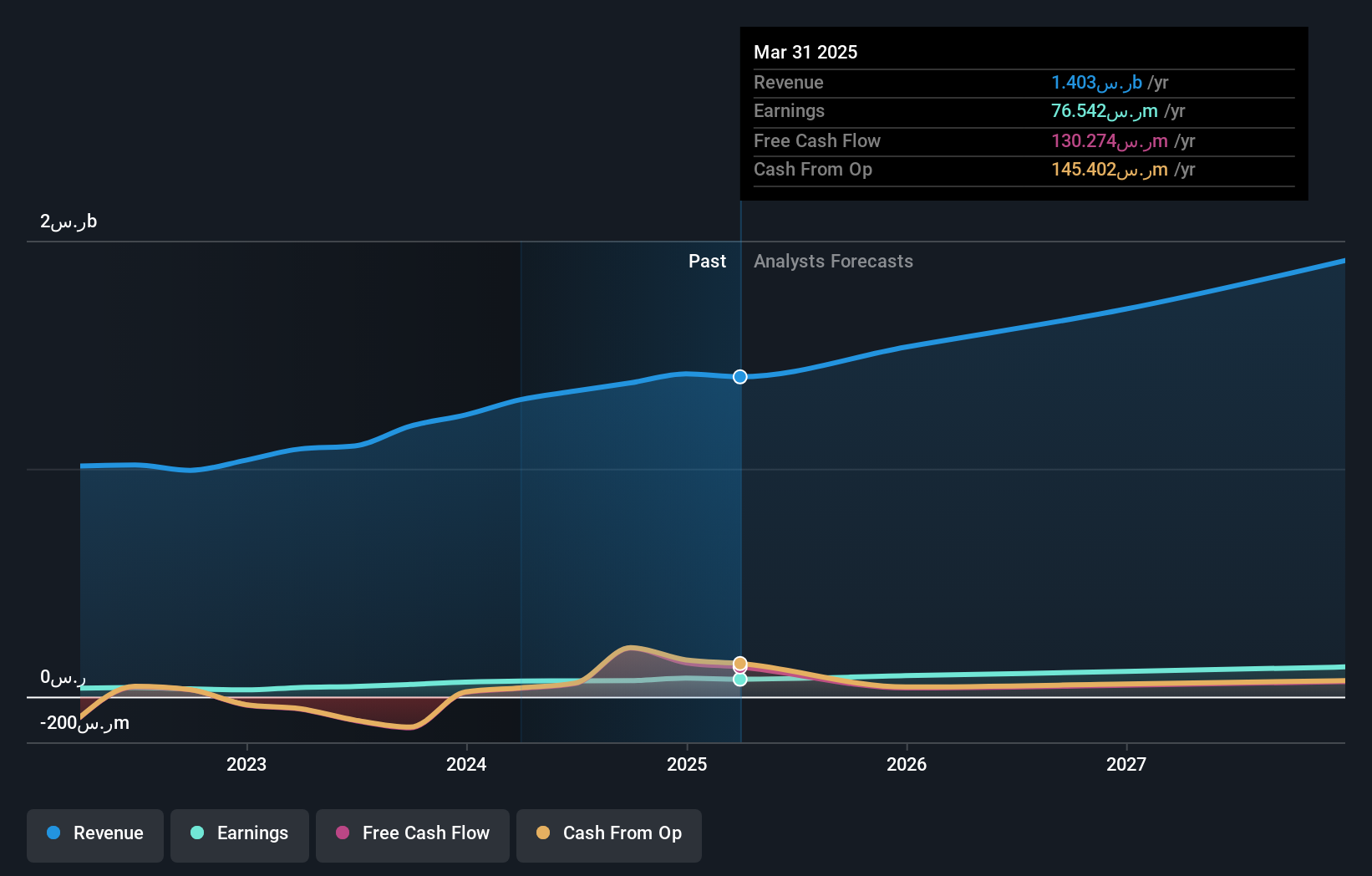

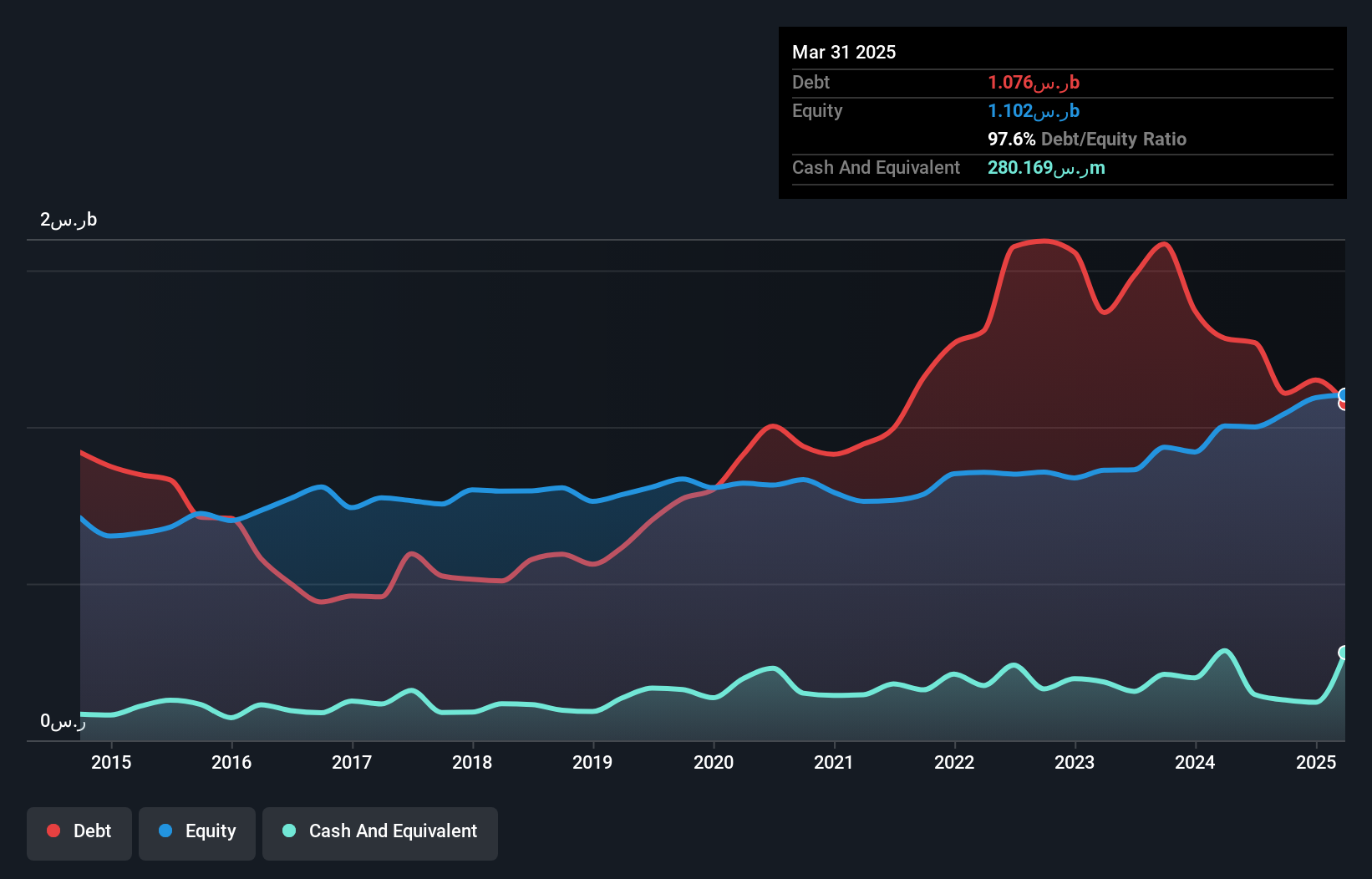

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles, power transmission towers, accessories, and communication towers across the United Arab Emirates, Saudi Arabia, and Egypt with a market cap of SAR4.40 billion.

Operations: The company generates revenue primarily from its Towers and Metal Structures Sector, contributing SAR1.40 billion, followed by Columns and Lighting at SAR552.34 million. Design, Supply and Installation brings in SAR427.34 million, while the Solar Energy Sector adds SAR391.54 million to the revenue stream.

Al-Babtain Power and Telecommunications, a nimble player in the Middle East, showcases solid financial health with its earnings growing by 77.8% over the past year, outpacing the construction industry’s 19% growth. Despite a high net debt to equity ratio of 61.2%, its interest payments are well covered by EBIT at 6.9 times coverage, indicating strong operational efficiency. Trading at a price-to-earnings ratio of 11x below the SA market average of 18.2x suggests attractive valuation relative to peers. Recent quarterly results highlight net income surging to SAR 127 million from SAR 44 million year-on-year, reflecting robust profitability improvements.

- Click here and access our complete health analysis report to understand the dynamics of Al-Babtain Power and Telecommunications.

Learn about Al-Babtain Power and Telecommunications' historical performance.

First Avenue Real Estate Development (SASE:9610)

Simply Wall St Value Rating: ★★★★★☆

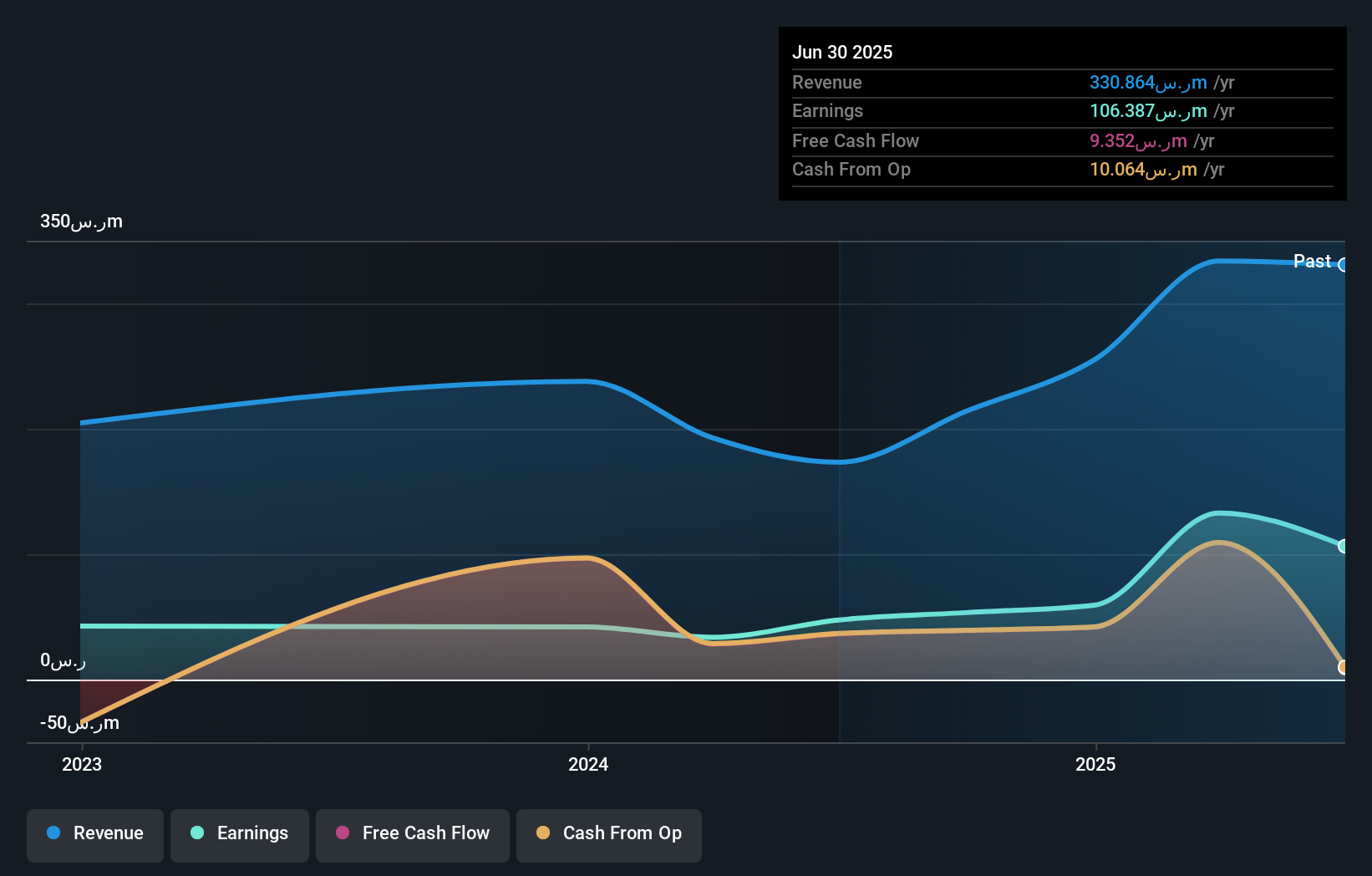

Overview: First Avenue Real Estate Development Company focuses on investing in and developing real estate properties for the private sector in Saudi Arabia, with a market capitalization of SAR1.10 billion.

Operations: First Avenue Real Estate Development generates revenue primarily from contracting (SAR169.24 million) and real estate sales (SAR59.38 million), with a smaller contribution from the rental sector (SAR7.45 million). The company has a market capitalization of SAR1.10 billion, indicating its scale within the industry.

First Avenue Real Estate Development has demonstrated impressive earnings growth of 123.8% over the past year, significantly outpacing the real estate industry's 22.1%. The company maintains a satisfactory net debt to equity ratio of 30.3%, reflecting prudent financial management, while its interest payments are well-covered by EBIT at a robust 8.6x coverage. A notable one-off gain of SAR35M impacted recent results, highlighting potential volatility in earnings quality. The firm recently secured SAR315M in Shariah-compliant financing from Bank AlJazira to support expansion plans, indicating strategic growth initiatives despite existing challenges in maintaining consistent earnings quality without such gains.

- Take a closer look at First Avenue Real Estate Development's potential here in our health report.

Understand First Avenue Real Estate Development's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 180 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)