- Saudi Arabia

- /

- Real Estate

- /

- SASE:9521

Undiscovered Gems These 3 Small Caps Show Strong Potential

Reviewed by Simply Wall St

As global markets react to policy shifts and economic indicators, small-cap stocks have been somewhat overshadowed by their larger counterparts, with the S&P 600 index showing a more modest performance compared to large-cap indices. Despite this, small caps often present unique opportunities for investors seeking growth potential in under-the-radar companies that can thrive amid evolving market dynamics. Identifying such promising prospects involves looking for strong fundamentals and innovative business models that align well with current economic trends and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITE Tech | NA | 8.91% | 16.50% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Donpon Precision | 35.22% | -2.30% | 36.96% | ★★★★★★ |

| Jiin Ming Industry | 9.39% | -8.97% | -9.24% | ★★★★☆☆ |

| ILSEUNG | 39.02% | -4.46% | 33.48% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Steel Pipes Company manufactures and sells steel pipes in the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR3.45 billion.

Operations: The primary revenue stream for Saudi Steel Pipes comes from its steel pipes segment, generating SAR1.86 billion.

Saudi Steel Pipes, a smaller player in the industry, showcases robust financial health with high-quality earnings and a satisfactory net debt to equity ratio of 24.7%. Over the past five years, its debt to equity ratio has decreased from 54% to 34.5%, indicating prudent financial management. The company reported third-quarter sales of SAR 380.77 million, up from SAR 317.47 million the previous year, while net income rose to SAR 64.52 million from SAR 37.92 million. Despite not outpacing industry growth last year, its earnings have grown at an impressive rate of 77.5% annually over five years.

Enma Al Rawabi (SASE:9521)

Simply Wall St Value Rating: ★★★★☆☆

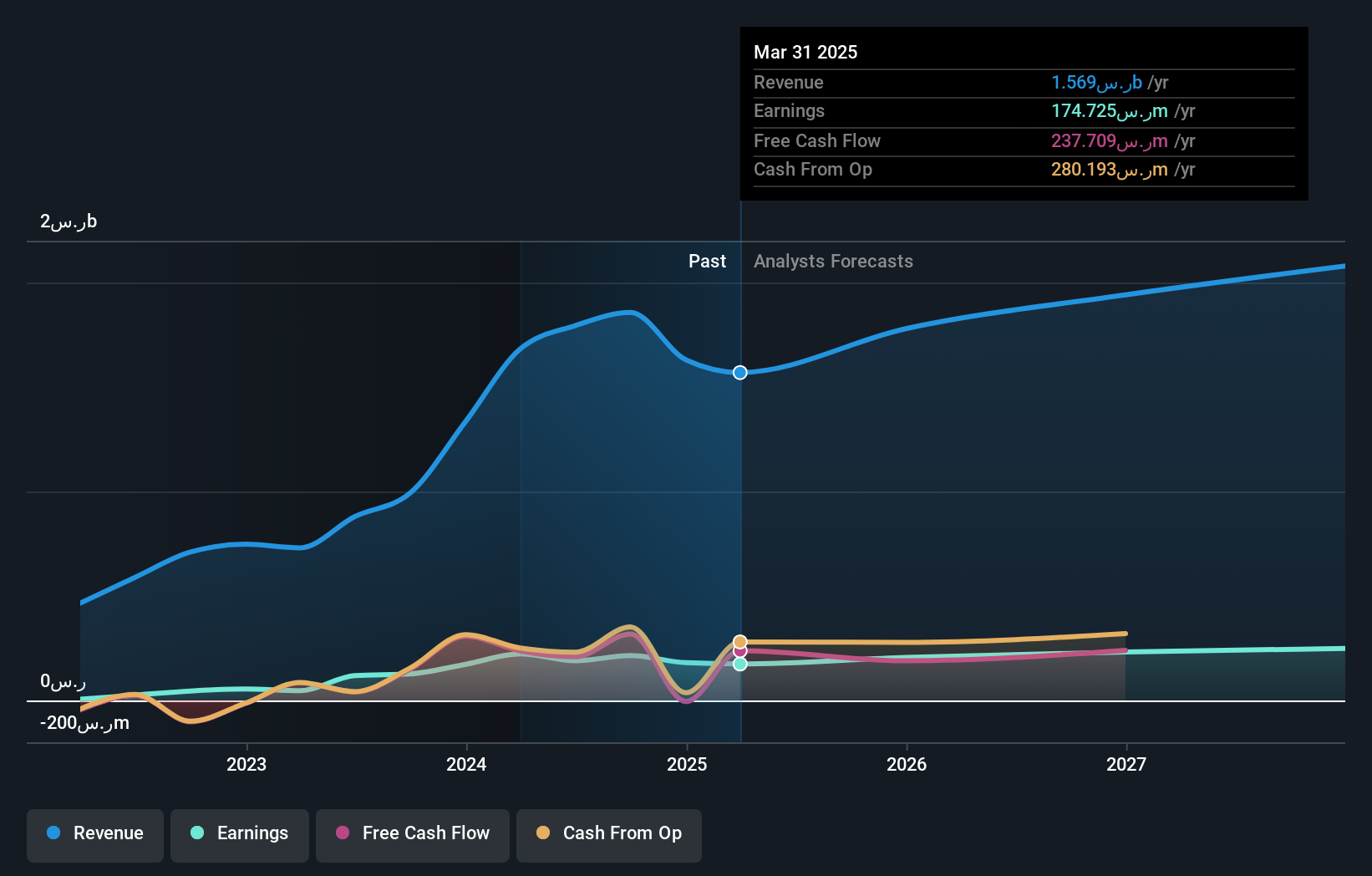

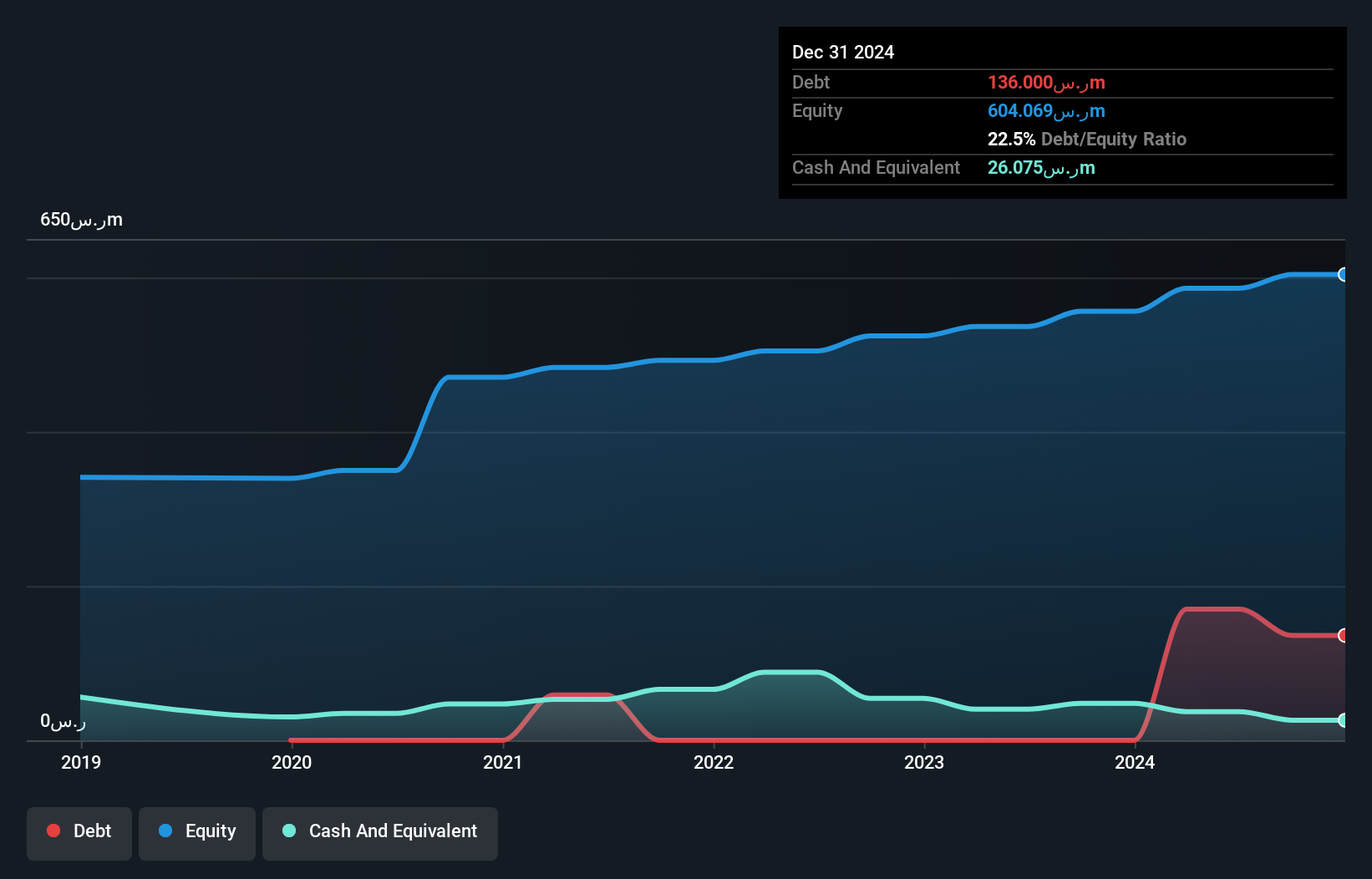

Overview: Enma Al Rawabi Company is involved in establishing and owning real estate properties in the Kingdom of Saudi Arabia, with a market capitalization of SAR992 million.

Operations: Enma Al Rawabi generates revenue primarily from its real estate properties in Saudi Arabia. The company's financial performance is reflected in its market capitalization of SAR992 million.

Enma Al Rawabi, a nimble player in its sector, has shown impressive earnings growth of 120.4% over the past year, outpacing the Real Estate industry's 15%. This remarkable performance is backed by high-quality earnings and a satisfactory net debt to equity ratio of 22.7%, indicating prudent financial management. Despite recent share price volatility, it remains an attractive value with a Price-To-Earnings ratio of 15.5x compared to the SA market's 24.2x. The company seems well-positioned financially with positive free cash flow and sufficient interest coverage, suggesting resilience amidst industry fluctuations.

- Unlock comprehensive insights into our analysis of Enma Al Rawabi stock in this health report.

Gain insights into Enma Al Rawabi's past trends and performance with our Past report.

Scholar Education Group (SEHK:1769)

Simply Wall St Value Rating: ★★★★★★

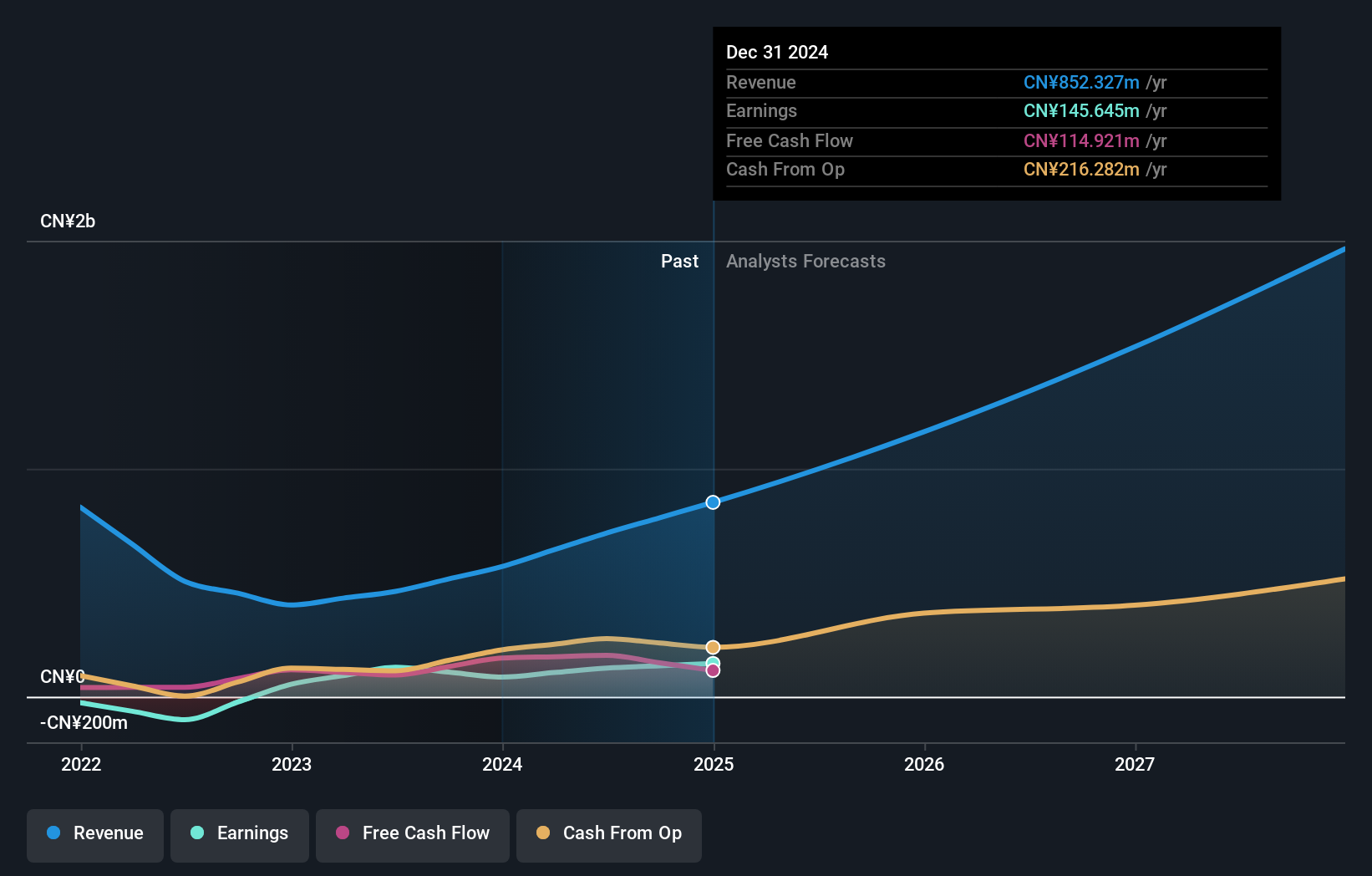

Overview: Scholar Education Group is an investment holding company that offers K-12 after-school education services in the People’s Republic of China, with a market cap of HK$2.26 billion.

Operations: Scholar Education Group generates revenue primarily from private education services, amounting to CN¥718.40 million.

Scholar Education Group, a smaller player in the education sector, is trading at a substantial discount of 88.5% below its estimated fair value. The company boasts high-quality past earnings but faced negative earnings growth of 2.8% last year, contrasting with the industry average growth of 5.5%. Its financial health appears robust with more cash than total debt and a reduced debt-to-equity ratio from 9% to just 5.6% over five years. Despite these strengths, profit margins have slipped to 17.5%, down from last year's 28%. Looking ahead, revenue is projected to grow by an impressive annual rate of 36.46%.

Seize The Opportunity

- Delve into our full catalog of 4677 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9521

INMAR

Engages in establishing and owning real estate properties in the Kingdom of Saudi Arabia.

Excellent balance sheet and good value.

Market Insights

Community Narratives