- Israel

- /

- Basic Materials

- /

- TASE:ACKR

Emerging Middle East Stocks To Watch In July 2025

Reviewed by Simply Wall St

As Middle East markets navigate the complexities of U.S. tariff threats and fluctuating oil consumption, investors are closely monitoring regional indices, with Egypt hitting record highs and Qatar nearing a two-year peak. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience amidst economic shifts and have strong growth potential in sectors buoyed by regional developments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Besler Gida Ve Kimya Sanayi ve Ticaret Anonim Sirketi | 40.12% | 43.54% | 38.87% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| C. Mer Industries | 109.27% | 13.77% | 72.47% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Enma Al Rawabi (SASE:9521)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Enma Al Rawabi Company focuses on establishing and owning real estate properties in Saudi Arabia, with a market capitalization of SAR940 million.

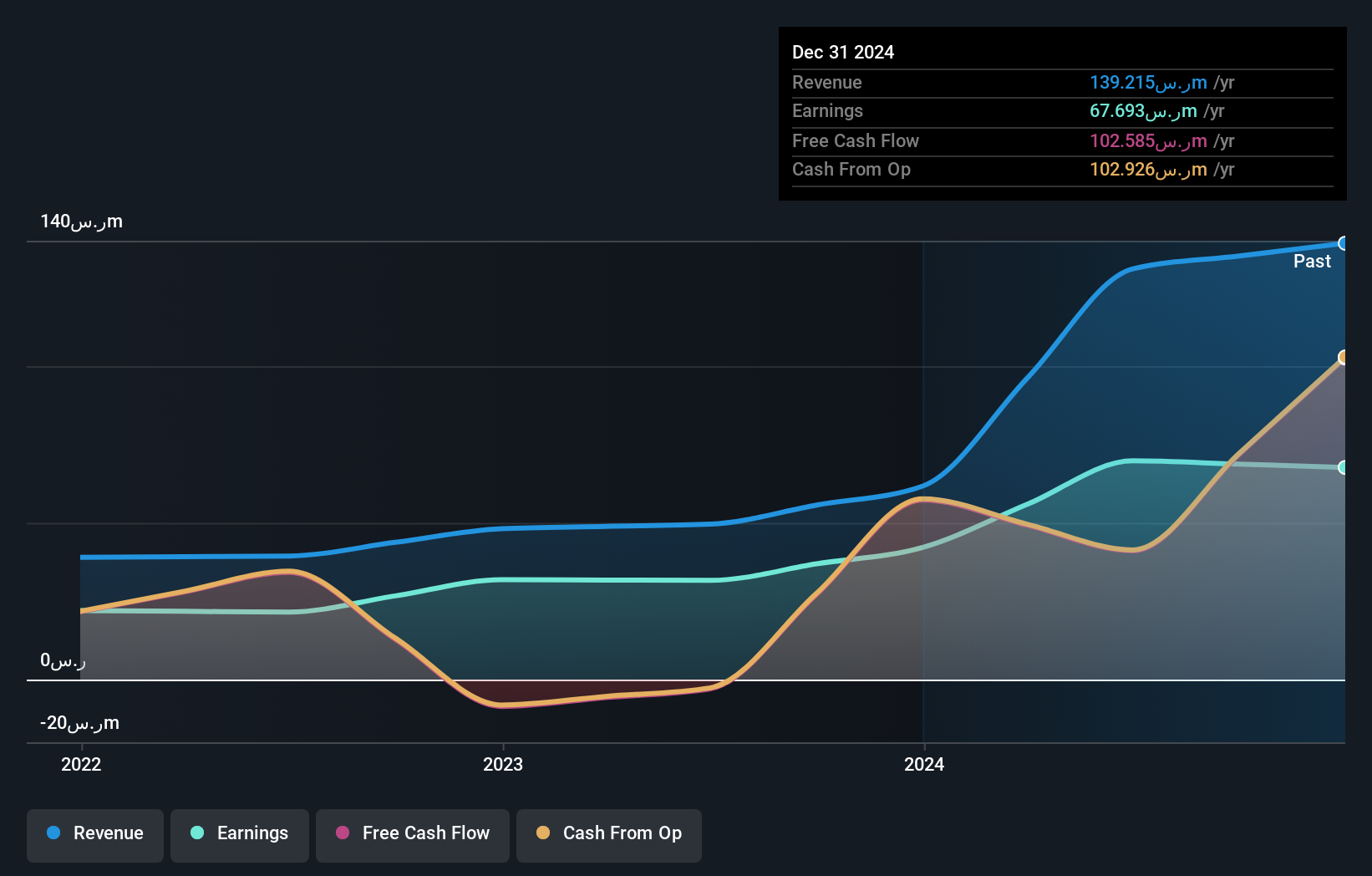

Operations: The company generates revenue primarily from its commercial sector, contributing SAR76.35 million, followed by the development sector at SAR61.25 million and a smaller portion from the residential sector at SAR1.61 million.

Enma Al Rawabi, a dynamic player in the Middle East, has seen its earnings grow by 60.5% over the past year, outpacing the Real Estate industry's 21.9%. This growth is supported by a satisfactory net debt to equity ratio of 18.2%, ensuring financial stability. The company trades at an attractive valuation, currently 74% below estimated fair value, offering potential upside for investors. However, its share price has been highly volatile recently. Despite this volatility, Enma Al Rawabi's interest payments are well-covered with EBIT at 12.7 times interest expenses and it boasts high-quality earnings which further solidify its position in the market.

- Unlock comprehensive insights into our analysis of Enma Al Rawabi stock in this health report.

Gain insights into Enma Al Rawabi's past trends and performance with our Past report.

Ackerstein Group (TASE:ACKR)

Simply Wall St Value Rating: ★★★★★★

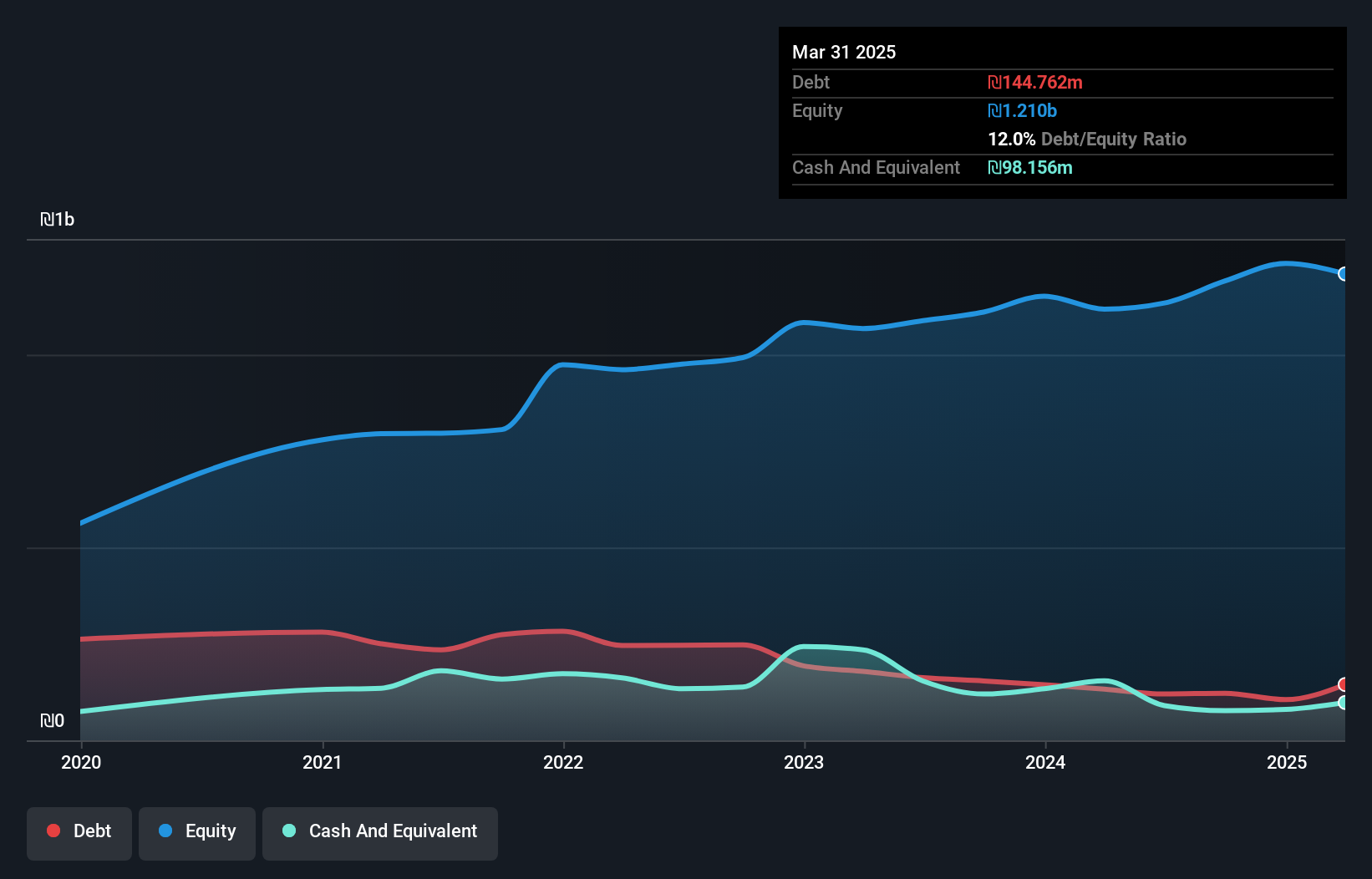

Overview: Ackerstein Group Ltd operates in the production, infrastructure, construction, and development sectors across Israel and the United States, with a market capitalization of ₪2.62 billion.

Operations: Ackerstein Group's primary revenue streams include the Engineering Segment and Industry Sector, generating ₪560.42 million and ₪289.34 million, respectively. The company also derives income from its Real Estate Sector amounting to ₪47.92 million and Industry Sector Abroad at ₪57.57 million.

Ackerstein Group's recent performance highlights its potential as a promising player in the Basic Materials sector. Over the past year, earnings surged by 48.8%, outpacing the industry average of -6.7%. This growth was partly influenced by a non-recurring gain of ₪62.3M, which impacted financial results up to March 2025. The company's debt to equity ratio improved significantly from 43.3% to 12% over five years, indicating effective debt management with interest payments well covered at 50.8x EBIT. Despite these strengths, investors should note the stock's volatility in recent months and consider this when evaluating its prospects in an evolving market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Ackerstein Group.

Evaluate Ackerstein Group's historical performance by accessing our past performance report.

Rotshtein Realestate (TASE:ROTS)

Simply Wall St Value Rating: ★★★★☆☆

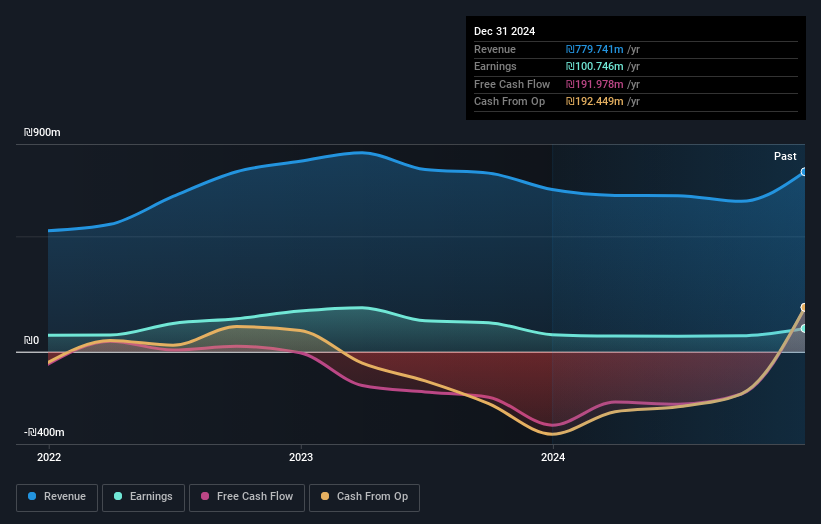

Overview: Rotshtein Realestate Ltd focuses on developing and constructing residential projects in Israel, with a market capitalization of ₪1.51 billion.

Operations: Rotshtein Realestate generates revenue primarily from the development and construction of residential projects, amounting to ₪837.41 million. The investment property segment contributes an additional ₪13.79 million to its revenue streams.

Rotshtein Realestate showcases a promising profile with earnings growth of 61.7% over the past year, outpacing the industry average of 33.1%. Trading at 53.2% below its estimated fair value, it seems undervalued in the market. The company has successfully reduced its debt to equity ratio from 276.7% to 167.3% over five years, although its net debt to equity remains high at 155.5%. Recent financial results highlight revenue growth from ILS 146 million to ILS 198 million and net income rising from ILS 14.6 million to ILS 23.36 million, indicating robust performance despite challenges in covering debt with operating cash flow fully.

Make It Happen

- Gain an insight into the universe of 224 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ACKR

Ackerstein Group

Engages in the production, infrastructure, construction, and development activities in Israel and the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives