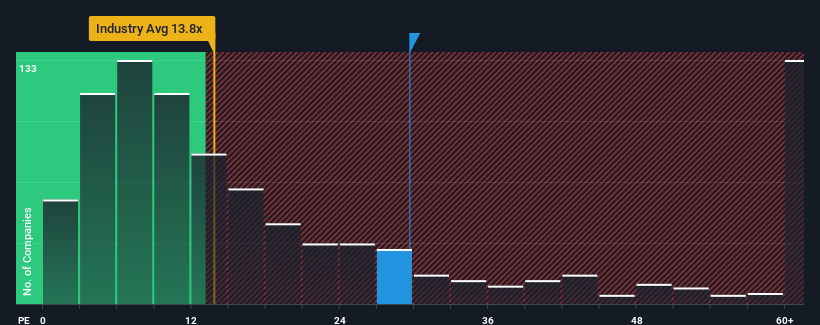

With a median price-to-earnings (or "P/E") ratio of close to 27x in Saudi Arabia, you could be forgiven for feeling indifferent about Taiba Investment Company's (TADAWUL:4090) P/E ratio of 29.6x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Taiba Investment as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Taiba Investment

How Is Taiba Investment's Growth Trending?

The only time you'd be comfortable seeing a P/E like Taiba Investment's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 214% last year. The strong recent performance means it was also able to grow EPS by 54% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 17% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Taiba Investment's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Taiba Investment revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Taiba Investment, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Taiba Investment. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Taiba Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4090

Taiba Investment

Invests in, buys, owns, develops, sells, leases, operates, maintains, markets, and manages real estate properties in the Kingdom of Saudi Arabia.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026