- Saudi Arabia

- /

- Water Utilities

- /

- SASE:2084

Unveiling Undiscovered Gems in the Middle East in June 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have been buoyant recently, with indices across the region advancing following a ceasefire between Iran and Israel, which has improved investor sentiment and risk appetite. As these markets continue to recover, identifying promising small-cap stocks becomes crucial for investors looking to capitalize on emerging opportunities in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Miahona (SASE:2084)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Miahona Company Limited operates in the Kingdom of Saudi Arabia, offering water facilities and treatment services with a market capitalization of SAR3.82 billion.

Operations: The primary revenue stream for Miahona comes from its water utilities and wastewater treatment services, generating SAR478.66 million. The company's market capitalization is SAR3.82 billion.

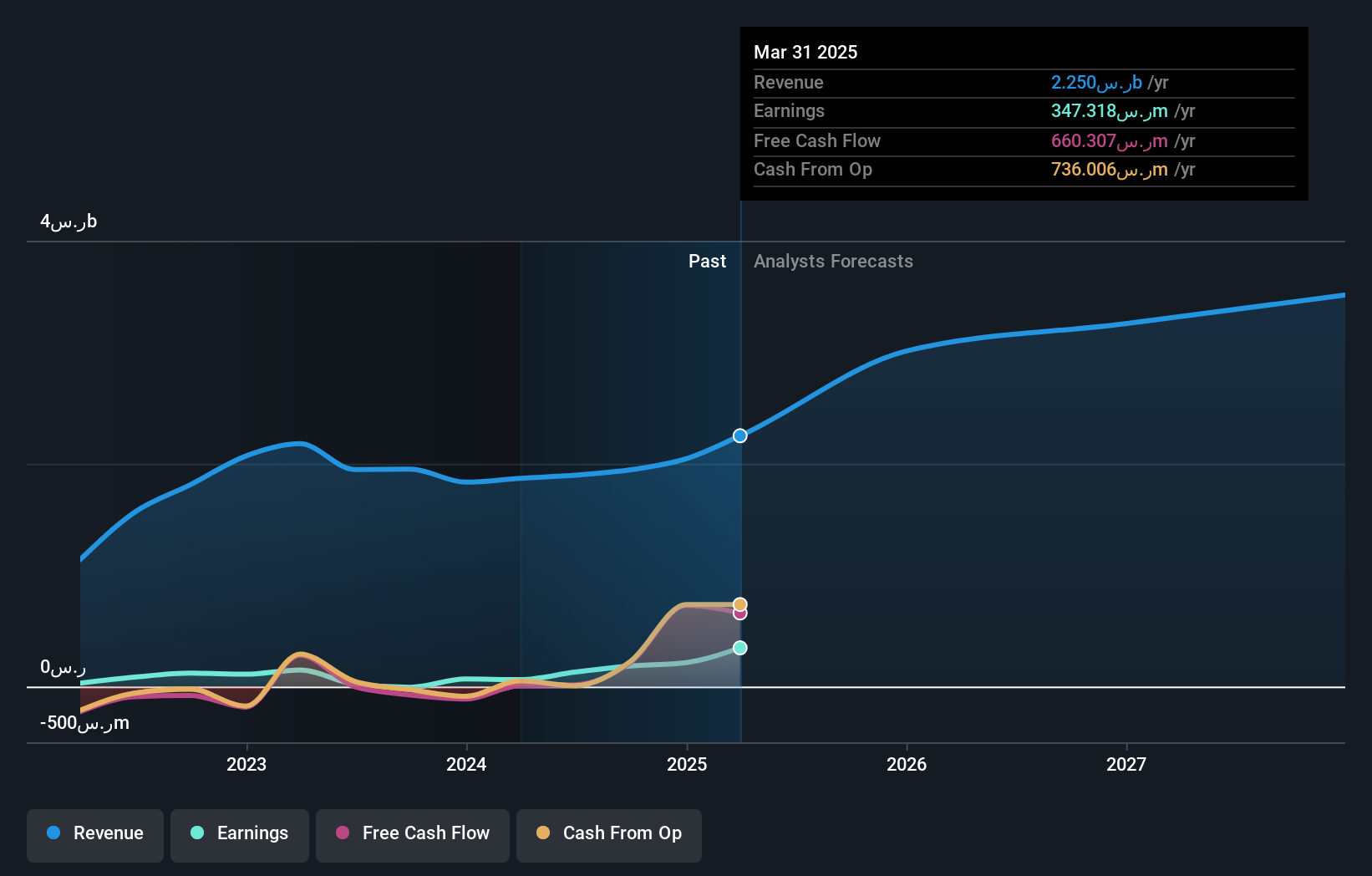

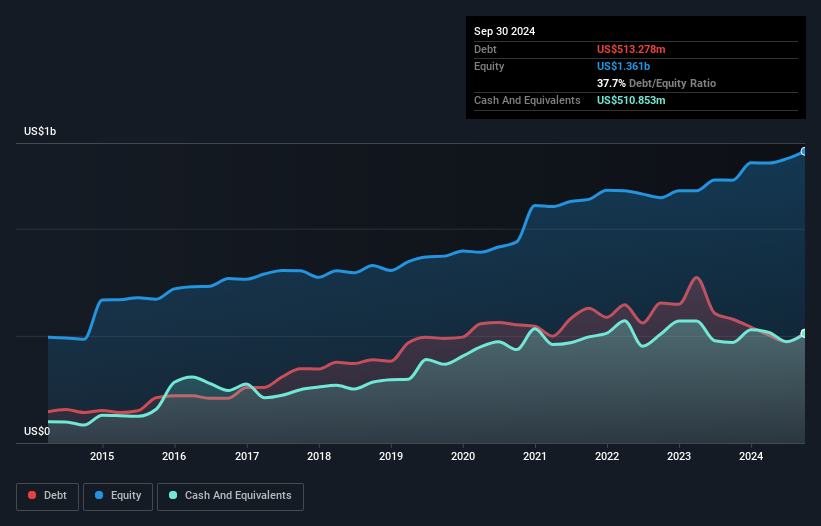

Miahona's recent strategic moves highlight its growth potential in the Middle East. The company's earnings surged by 29.1% over the past year, outpacing industry growth of 5.3%, with Q1 2025 net income reaching SAR 61.43 million compared to SAR 19.67 million a year ago. Miahona's debt management is noteworthy, as its net debt to equity ratio decreased from 194.6% to 102.4% over five years, though it remains high at 48%. A new SAR 1 billion contract for wastewater treatment in Jeddah underlines its expansion strategy and commitment to sustainable water solutions, reinforcing its position as a key player in this sector.

- Delve into the full analysis health report here for a deeper understanding of Miahona.

Gain insights into Miahona's historical performance by reviewing our past performance report.

Saudi Real Estate (SASE:4020)

Simply Wall St Value Rating: ★★★★★☆

Overview: Saudi Real Estate Company, with a market capitalization of SAR 7.49 billion, operates as a real estate development company in Saudi Arabia through its various subsidiaries.

Operations: The company generates revenue primarily from property sales and infrastructure projects, with property sales contributing SAR 821.85 million and infrastructure projects adding SAR 938.01 million. Rental income also plays a significant role, bringing in SAR 344.77 million. Facility management and construction projects contribute smaller portions to the overall revenue at SAR 66.45 million and SAR 73.98 million, respectively.

Saudi Real Estate, a notable player in the region's real estate sector, has shown impressive financial resilience and growth. Over the past year, its earnings skyrocketed by 463%, significantly outpacing the industry average of 24.2%. The company's debt to equity ratio has improved from 128.6% to a more manageable 53.6% over five years, while interest payments are comfortably covered by EBIT at a rate of 3.3 times. Trading at nearly 74% below estimated fair value, Saudi Real Estate reported net income of SAR 135 million for Q1 2025 compared to SAR 2.92 million last year, reflecting robust operational performance and potential for future growth.

- Navigate through the intricacies of Saudi Real Estate with our comprehensive health report here.

Understand Saudi Real Estate's track record by examining our Past report.

Formula Systems (1985) (TASE:FORTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Formula Systems (1985) Ltd. operates through its subsidiaries to offer software solutions, IT professional services, software product marketing and support, as well as computer infrastructure and integration solutions, with a market cap of ₪6.26 billion.

Operations: The company's revenue streams are derived from software solutions, IT professional services, software product marketing and support, and computer infrastructure and integration solutions. The cost structure primarily involves expenses related to delivering these services. A notable financial metric is the gross profit margin, which reflects the efficiency of its core operations.

Formula Systems (1985) has demonstrated robust financial health, with earnings growth of 26.2% over the past year, surpassing the IT industry average of 25.1%. The company boasts high-quality earnings and a solid interest coverage ratio of 22.9x, indicating strong debt management capabilities. Over five years, its debt to equity ratio improved significantly from 62.6% to 33.7%, reflecting prudent financial strategies. With more cash than total debt and positive free cash flow, Formula Systems seems well-positioned financially despite recent delays in SEC filings and an upcoming dividend payout of approximately $6.8 million scheduled for July 2025.

Key Takeaways

- Investigate our full lineup of 220 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2084

Miahona

Provides water facilities and water treatment services in the Kingdom of Saudi Arabia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives