As global markets navigate a landscape marked by mixed performances and economic uncertainties, investors are keenly observing the shifting dynamics influenced by elevated valuations and cautious monetary policies. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Pharma Mar (BME:PHM) | 12% | 42.6% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 30.3% |

We're going to check out a few of the best picks from our screener tool.

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★☆☆

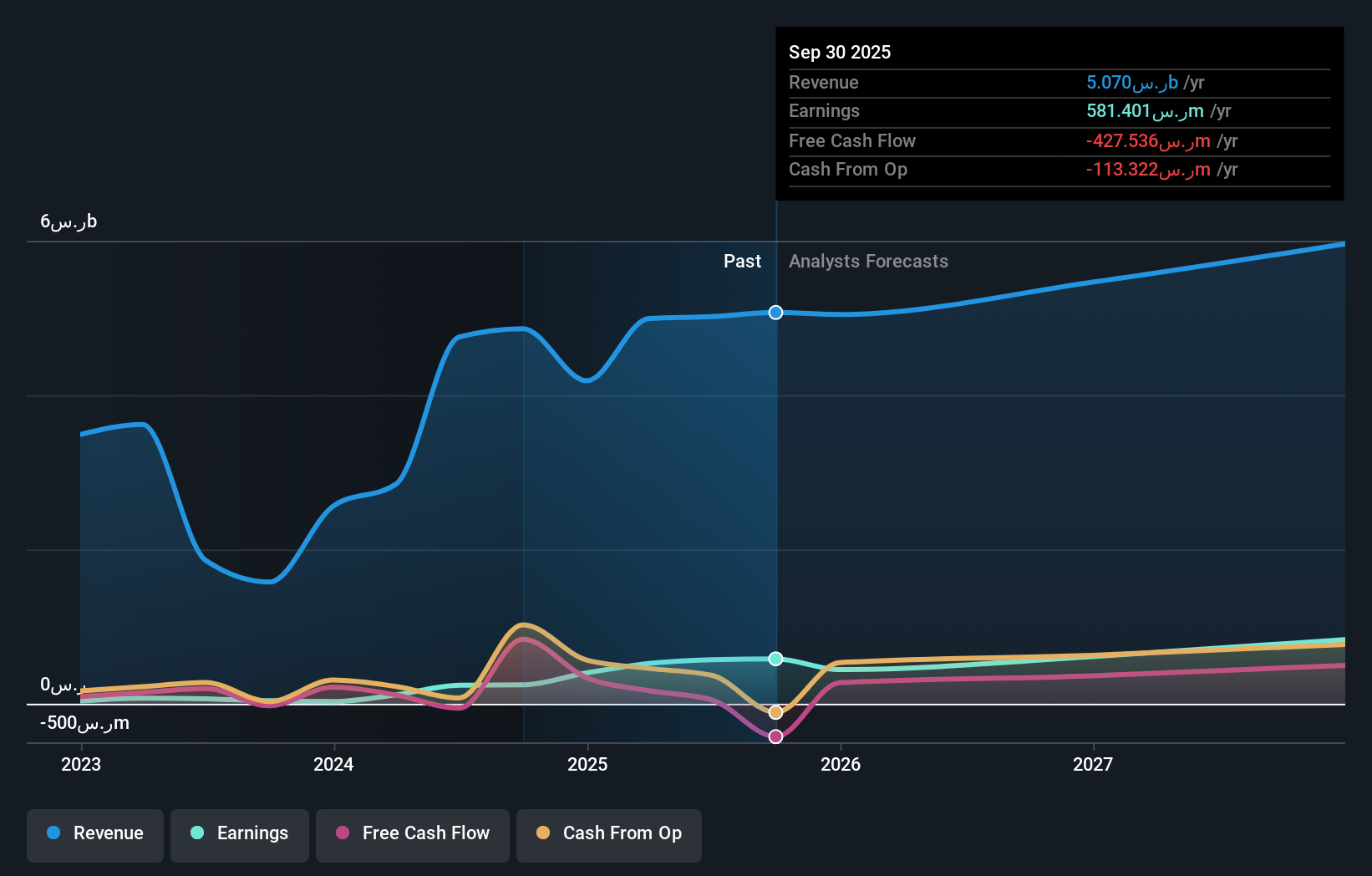

Overview: MBC Group is a media and entertainment company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR11.11 billion.

Operations: The company's revenue segments consist of Shahid generating SAR1.29 billion, M&E Initiatives contributing SAR1 billion, and Broadcasting and Other Commercial Activities bringing in SAR2.79 billion.

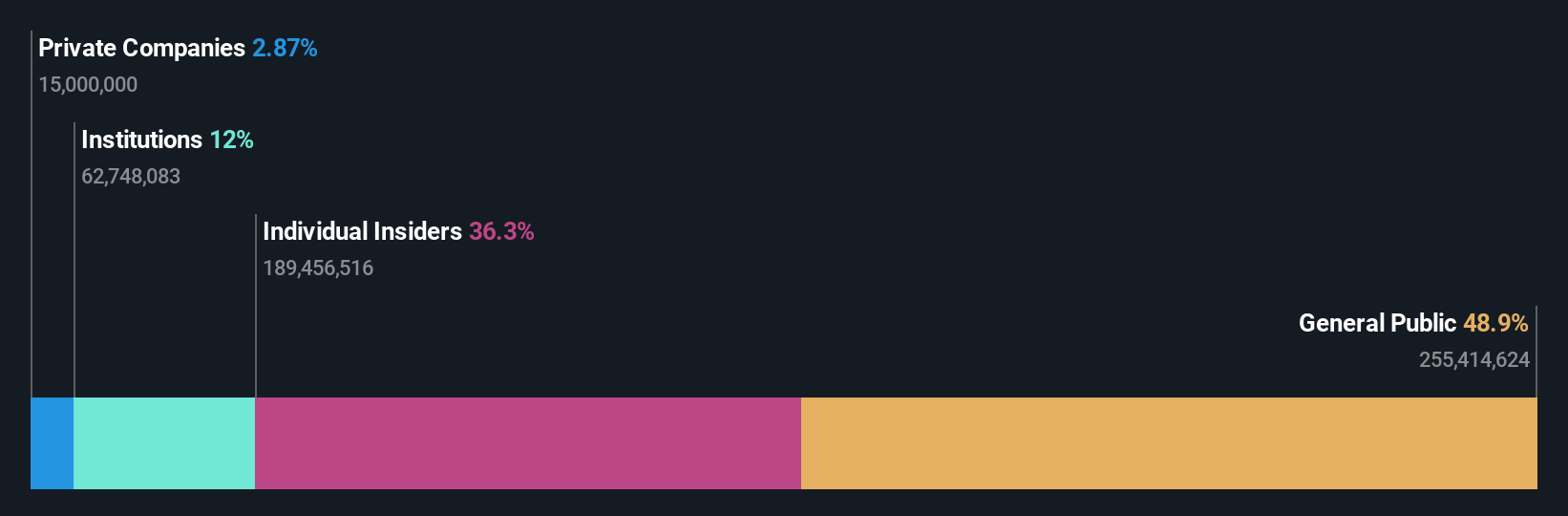

Insider Ownership: 36%

MBC Group's growth trajectory is underscored by its projected 22.1% annual earnings increase, outpacing the SA market's 9.2%. Despite recent share volatility, it trades below estimated fair value. The Public Investment Fund's acquisition of a 54% stake highlights strong insider ownership dynamics. Recent earnings show sales of SAR 810 million and net income of SAR 13.82 million for nine months ending September 2025, alongside a significant project award to MBC Media KSA Limited boosting future prospects.

- Navigate through the intricacies of MBC Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report MBC Group implies its share price may be too high.

Changsha Jingjia Microelectronics (SZSE:300474)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changsha Jingjia Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on the design and manufacture of microelectronic products, with a market cap of CN¥37.75 billion.

Operations: The company generates revenue primarily from the Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥519.90 million.

Insider Ownership: 35.7%

Changsha Jingjia Microelectronics is positioned for significant growth, with revenue expected to rise 45.2% annually, surpassing the CN market's 14.4%. Despite reporting a net loss of CNY 72.53 million for the nine months ending September 2025, compared to a net income of CNY 23.87 million last year, it is forecasted to become profitable within three years. The recent amendments to its articles of association may influence future strategic direction and governance practices.

- Take a closer look at Changsha Jingjia Microelectronics' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Changsha Jingjia Microelectronics is trading beyond its estimated value.

Caliway Biopharmaceuticals (TWSE:6919)

Simply Wall St Growth Rating: ★★★★★☆

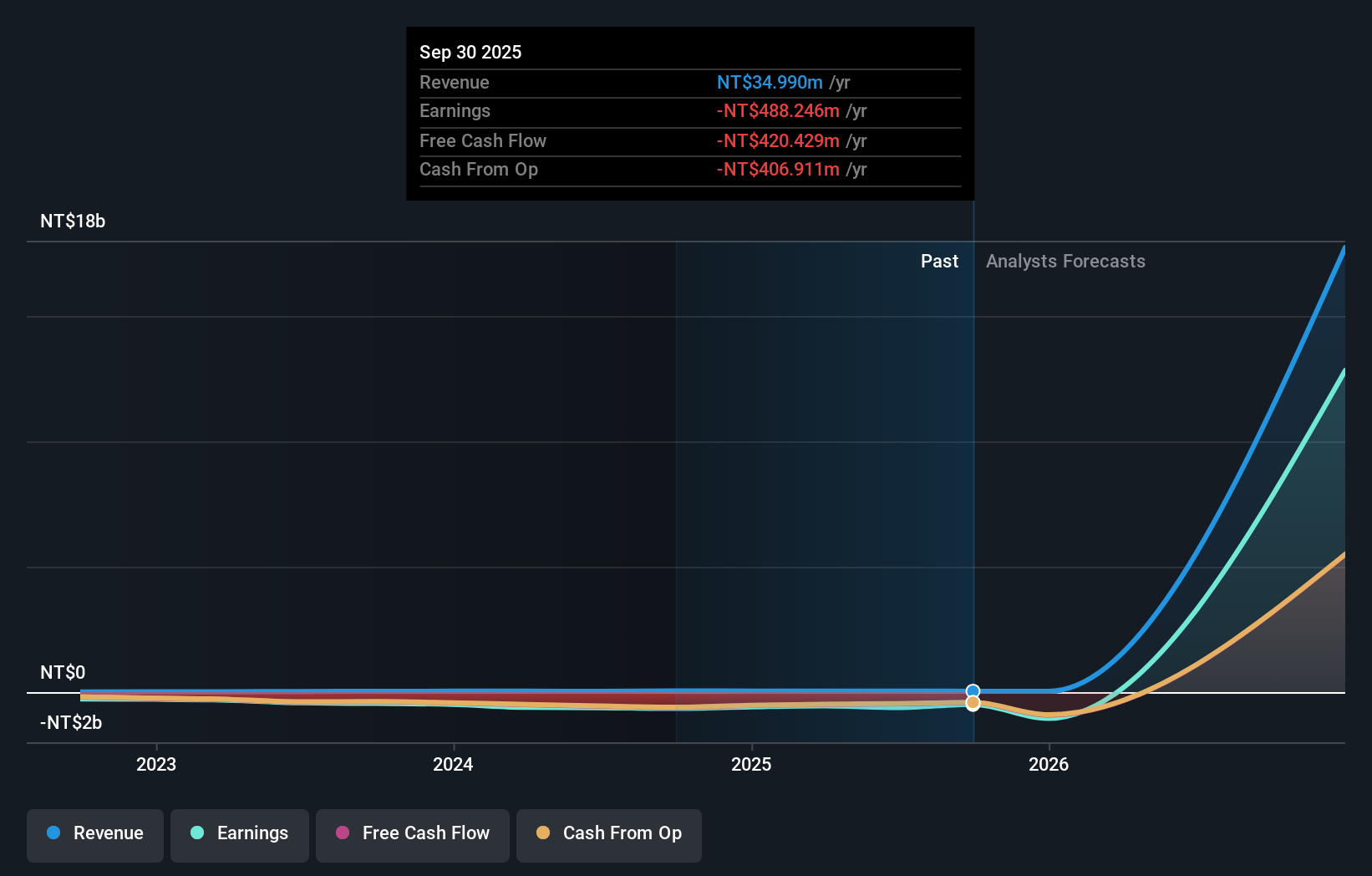

Overview: Caliway Biopharmaceuticals Co., Ltd., along with its subsidiaries, focuses on developing drugs for aesthetic medicine and chronic inflammation, with a market cap of NT$189.99 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to NT$34.99 million.

Insider Ownership: 24.3%

Caliway Biopharmaceuticals is poised for substantial revenue growth, with forecasts indicating a 255.5% annual increase, outpacing the TW market's 13.3%. Despite recent earnings showing a TWD 7.73 million net loss for Q3, improved from TWD 137.57 million last year, profitability is expected within three years. The company trades significantly below fair value and has initiated a share buyback program worth TWD 450 million to enhance shareholder value and employee incentives.

- Click to explore a detailed breakdown of our findings in Caliway Biopharmaceuticals' earnings growth report.

- The valuation report we've compiled suggests that Caliway Biopharmaceuticals' current price could be inflated.

Summing It All Up

- Discover the full array of 834 Fast Growing Global Companies With High Insider Ownership right here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6919

Caliway Biopharmaceuticals

Engages in the development of drugs for aesthetic medicine and chronic inflammation.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives