- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, the technology sector remains a focal point, with small-cap stocks demonstrating resilience amid broader market fluctuations. In this environment, investors often look for tech stocks that exhibit strong fundamentals and innovative potential to weather volatility and capitalize on growth opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.50% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.33% | 69.07% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

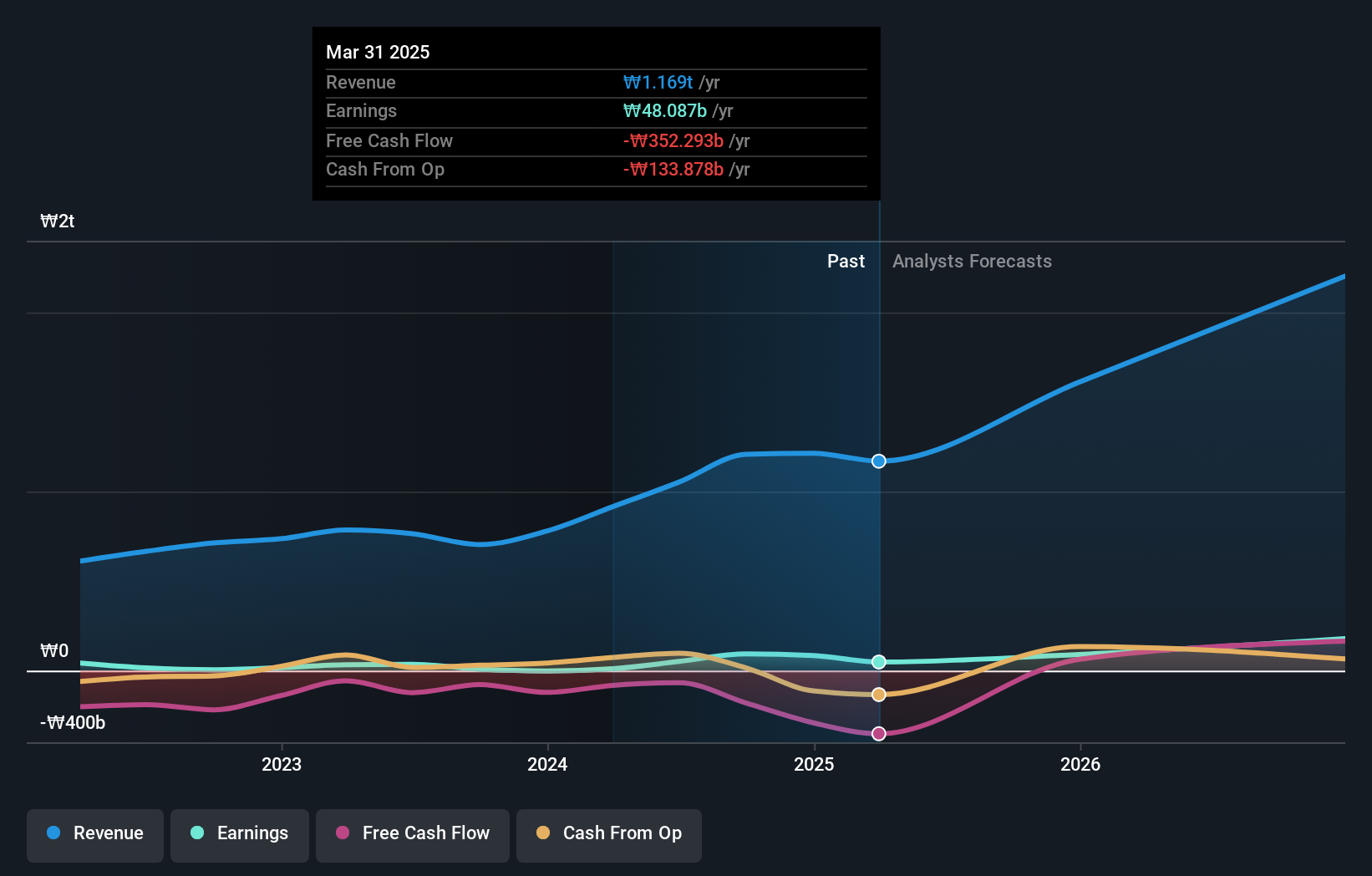

Overview: Seojin System Co., Ltd is a company that offers telecom equipment, repeaters, mechanical products, and LED and other equipment with a market capitalization of ₩1.60 trillion.

Operations: Seojin System Co., Ltd's revenue primarily stems from its EMS Division, contributing ₩1.52 trillion, followed by the Semiconductor segment at ₩169.98 billion. The company experiences a significant adjustment and removal figure of -₩917.37 billion in its financials.

Seojin SystemLtd, amidst a technology landscape where innovation is paramount, has demonstrated robust financial and operational growth. With a 33.4% annual revenue increase and an earnings surge of 49.1%, the company outpaces the broader South Korean market's growth rates significantly. This performance is underpinned by substantial R&D investments, which have not only fueled current advancements but also positioned Seojin for sustained future growth in its sector. The firm’s commitment to research has enabled it to stay ahead in highly competitive tech markets, ensuring it remains at the forefront of technological development and customer satisfaction.

- Dive into the specifics of Seojin SystemLtd here with our thorough health report.

Explore historical data to track Seojin SystemLtd's performance over time in our Past section.

Arabian Contracting Services (SASE:4071)

Simply Wall St Growth Rating: ★★★★★★

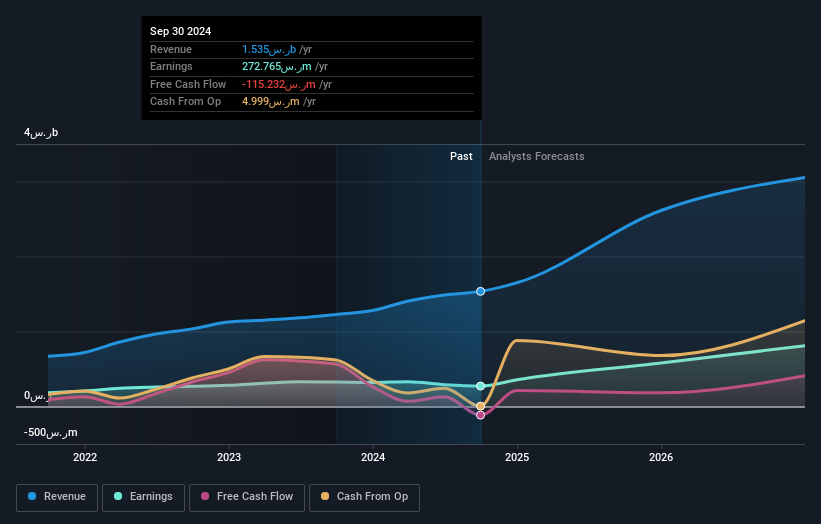

Overview: Arabian Contracting Services Company, with a market cap of SAR8.62 billion, operates in the printing industry across Saudi Arabia and Egypt through its subsidiaries.

Operations: The company generates revenue primarily from its advertising segment, amounting to SAR1.47 billion. Operating in Saudi Arabia and Egypt, it focuses on the printing industry through its subsidiaries.

Arabian Contracting Services, amidst a shifting landscape where tech integration is crucial, has shown promising financial trends with revenue growth forecasted at 22.1% annually, outpacing the Saudi market's 1.3%. This growth is complemented by an anticipated earnings increase of 29.1% per year. Despite a recent dip in net income as reported in their latest semi-annual figures—SAR 148.15 million from SAR 175.86 million—the company's aggressive R&D spending and strategic acquisitions, like the recent purchase of a 4.9% stake by investors for SAR 416.5 million, underline its commitment to expanding its technological capabilities and market reach.

Shanghai Henlius Biotech (SEHK:2696)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Henlius Biotech, Inc. specializes in the research and development of biologic medicines targeting oncology, autoimmune diseases, and ophthalmic diseases with a market cap of HK$11.90 billion.

Operations: Henlius focuses on developing biologic medicines, generating revenue primarily from its pharmaceuticals segment, which amounted to CN¥5.64 billion. The company is engaged in addressing significant medical needs in oncology, autoimmune diseases, and ophthalmic conditions.

Shanghai Henlius Biotech, with a 10.4% forecasted annual revenue growth, outpaces the Hong Kong market's 7.8%, demonstrating robust market positioning. The company's strategic R&D investments are evident in its recent FDA acceptance of HLX14 for osteoporosis treatment, highlighting its commitment to expanding globally through rigorous clinical trials and partnerships like that with Organon. Moreover, an 11.5% expected earnings growth annually underscores its potential in generating value from these innovations while maintaining a competitive edge within the biotech sector.

Seize The Opportunity

- Discover the full array of 1292 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Very undervalued with exceptional growth potential.