Undiscovered Gems And 3 Promising Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the wake of recent U.S. election results, global markets have experienced notable shifts, with the small-cap Russell 2000 Index leading gains but still trailing its record highs. As investors navigate these dynamic conditions marked by potential policy changes and economic indicators, identifying promising stocks that can enhance a portfolio becomes crucial. A good stock in this environment is one that shows resilience and growth potential amidst regulatory changes and economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 9.01% | 4.39% | 3.03% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★★☆

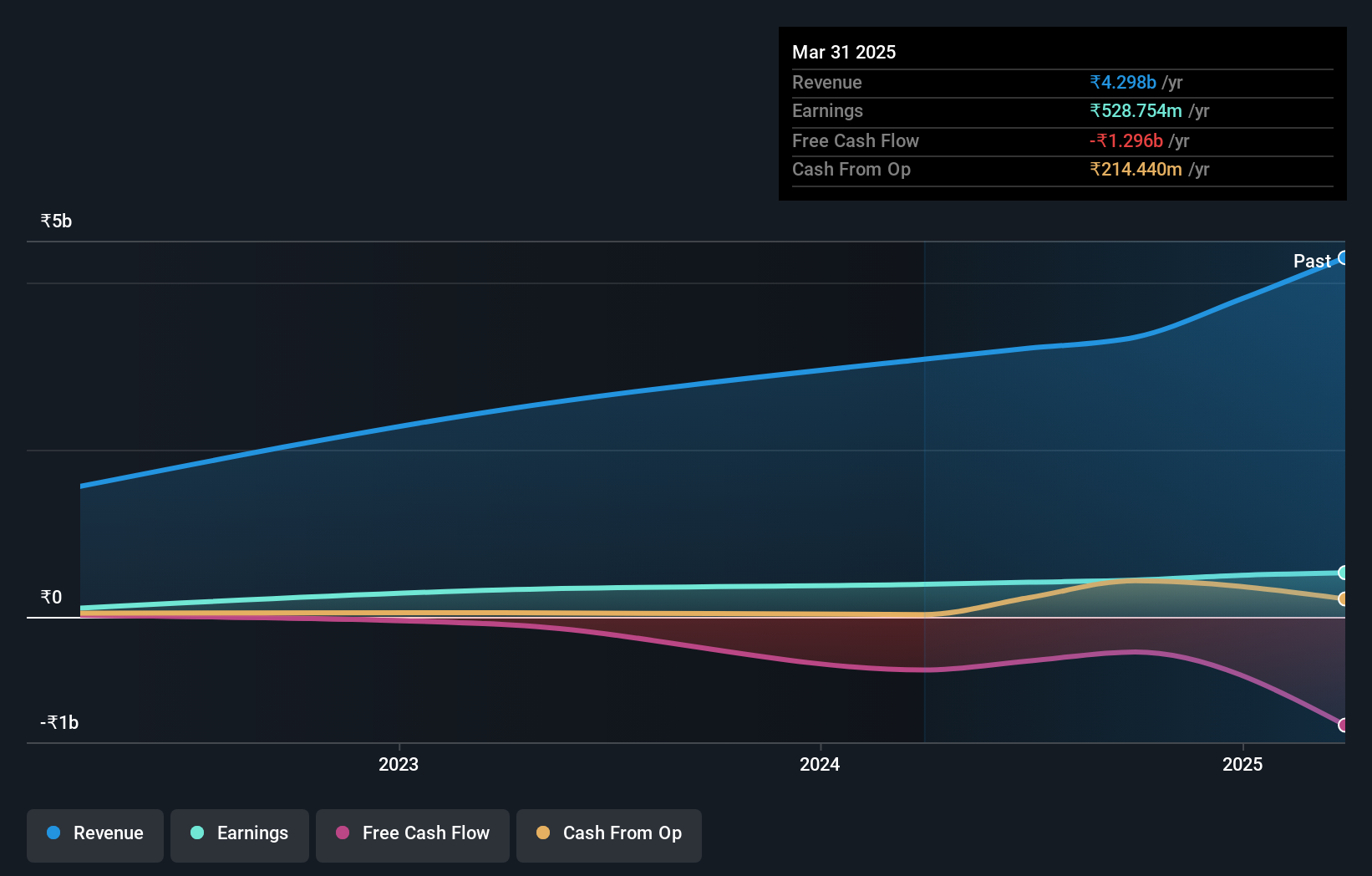

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacturing and sale of aluminum and copper fin and tube-type heat exchangers for the HVACR industry, with a market cap of ₹38.53 billion.

Operations: KRN generates revenue primarily from the manufacture and sale of HVAC parts and accessories, amounting to ₹3.35 billion. The company's financial performance is influenced by its net profit margin trends over time.

KRN Heat Exchanger and Refrigeration, a company with a fresh IPO raising INR 3.42 billion, has shown robust growth in earnings at 22.9% over the past year, outpacing the building industry average of 19.1%. Sales for the second quarter were INR 910.96 million compared to INR 711.94 million previously, while net income rose to INR 123.1 million from INR 86.13 million last year. Despite negative levered free cash flow of -INR 418.96 million as of September end, KRN's interest payments are well covered by EBIT at a ratio of 30x, indicating strong financial health amidst expansion plans for new manufacturing facilities targeting larger clientele like Daikin India and Schneider Electric.

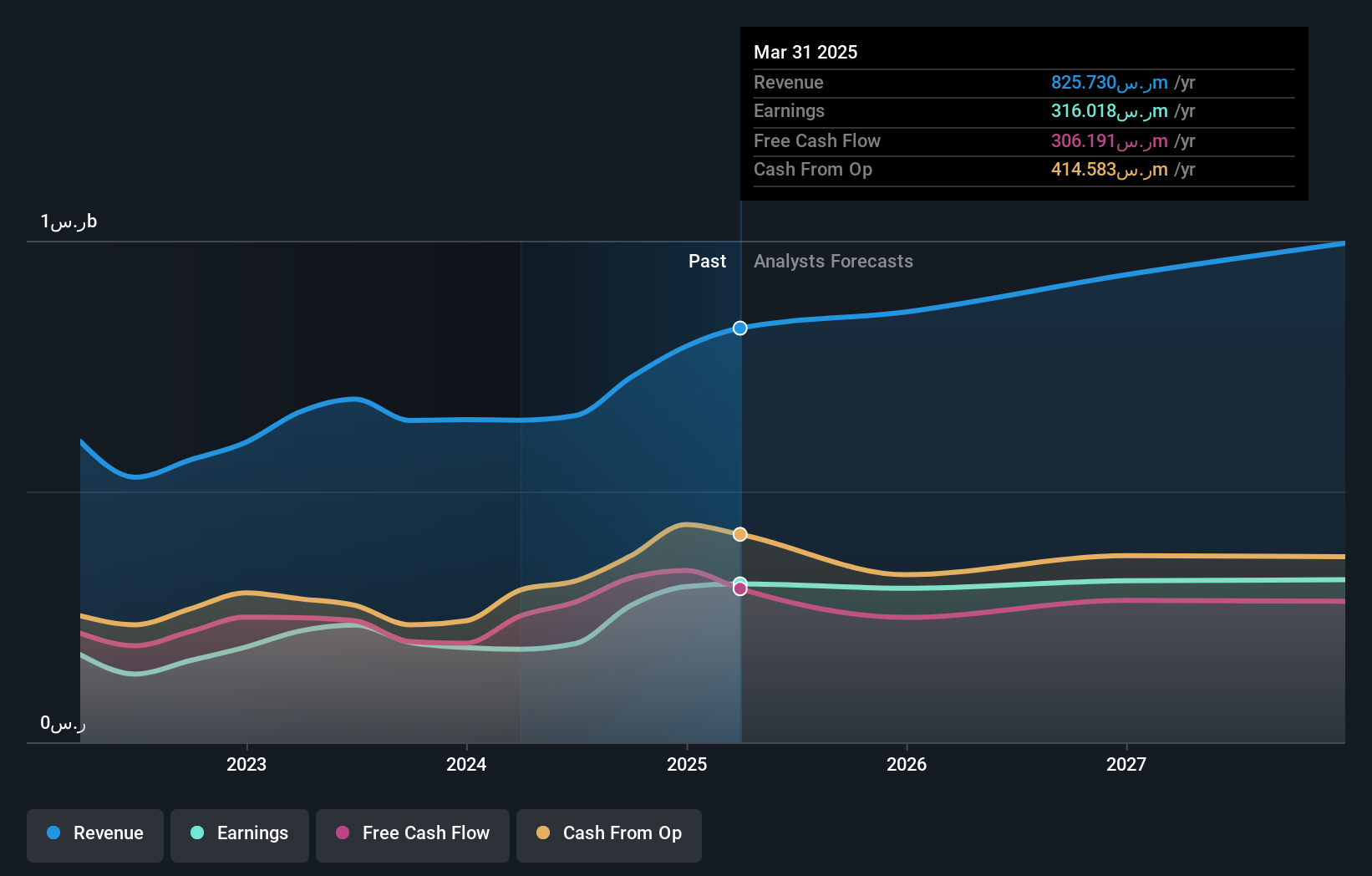

Riyadh Cement (SASE:3092)

Simply Wall St Value Rating: ★★★★★★

Overview: Riyadh Cement Company is engaged in the production and sale of cement across several countries in the Middle East, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman, with a market capitalization of SAR3.79 billion.

Operations: Riyadh Cement generates revenue primarily from the production and sale of cement in the Middle East. The company's financial performance includes a net profit margin that reflects its operational efficiency.

Riyadh Cement, a nimble player in its sector, showcases robust financial health with zero debt compared to a 5% debt-to-equity ratio five years ago. Recent earnings results highlight impressive growth; third-quarter sales reached SAR 203.01 million from SAR 127.15 million last year, while net income surged to SAR 94.58 million from SAR 18.71 million. The company’s price-to-earnings ratio of 14.1x is attractive against the SA market average of 24x, suggesting good relative value amidst peers and industry competitors. Despite forecasted earnings decline of around 6.9% annually over the next three years, its inclusion in major indices reflects potential market confidence.

- Click to explore a detailed breakdown of our findings in Riyadh Cement's health report.

Assess Riyadh Cement's past performance with our detailed historical performance reports.

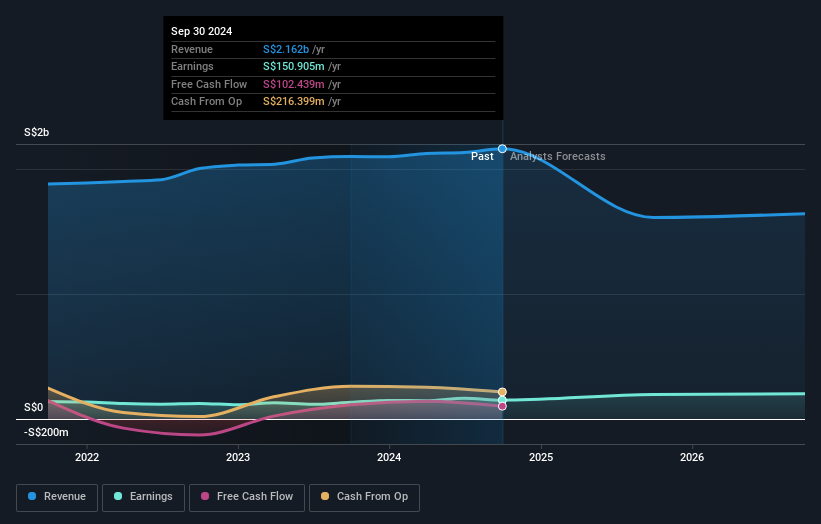

Fraser and Neave (SGX:F99)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fraser and Neave, Limited operates in the food and beverage, as well as publishing and printing sectors across Singapore, Malaysia, Thailand, Vietnam, and internationally with a market capitalization of SGD1.99 billion.

Operations: Fraser and Neave generates revenue primarily from its Dairies segment (SGD1.21 billion) and Beverages segment (SGD672.65 million), with additional contributions from Printing & Publishing (SGD203.25 million).

Fraser and Neave, a promising player in the food industry, reported sales of S$2.16 billion for the year ending September 30, 2024, up from S$2.1 billion previously. This growth is reflected in their net income increase to S$150.91 million from S$133.22 million last year. Basic earnings per share rose to S$0.103 from S$0.092, highlighting robust performance amid industry challenges where their earnings grew by 13% compared to a sector decline of -10%. The company's debt-to-equity ratio has increased over five years but remains satisfactory at 18%, suggesting prudent financial management alongside high-quality past earnings and positive free cash flow.

Next Steps

- Investigate our full lineup of 4643 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KRN Heat Exchanger and Refrigeration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRN

KRN Heat Exchanger and Refrigeration

Manufactures and sells aluminium and copper fin and tube-type heat exchangers for the heat, ventilation, air conditioning, and refrigeration industry.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives