- China

- /

- Electrical

- /

- SHSE:603312

Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by economic uncertainty and inflation concerns, small-cap stocks have faced notable challenges, with the Russell 2000 Index slipping into correction territory. Amid this volatile backdrop, identifying promising small-cap companies requires a keen focus on those with robust fundamentals and growth potential that can withstand market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Riyadh Cement (SASE:3092)

Simply Wall St Value Rating: ★★★★★★

Overview: Riyadh Cement Company engages in the production and sale of cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman, with a market capitalization of SAR3.74 billion.

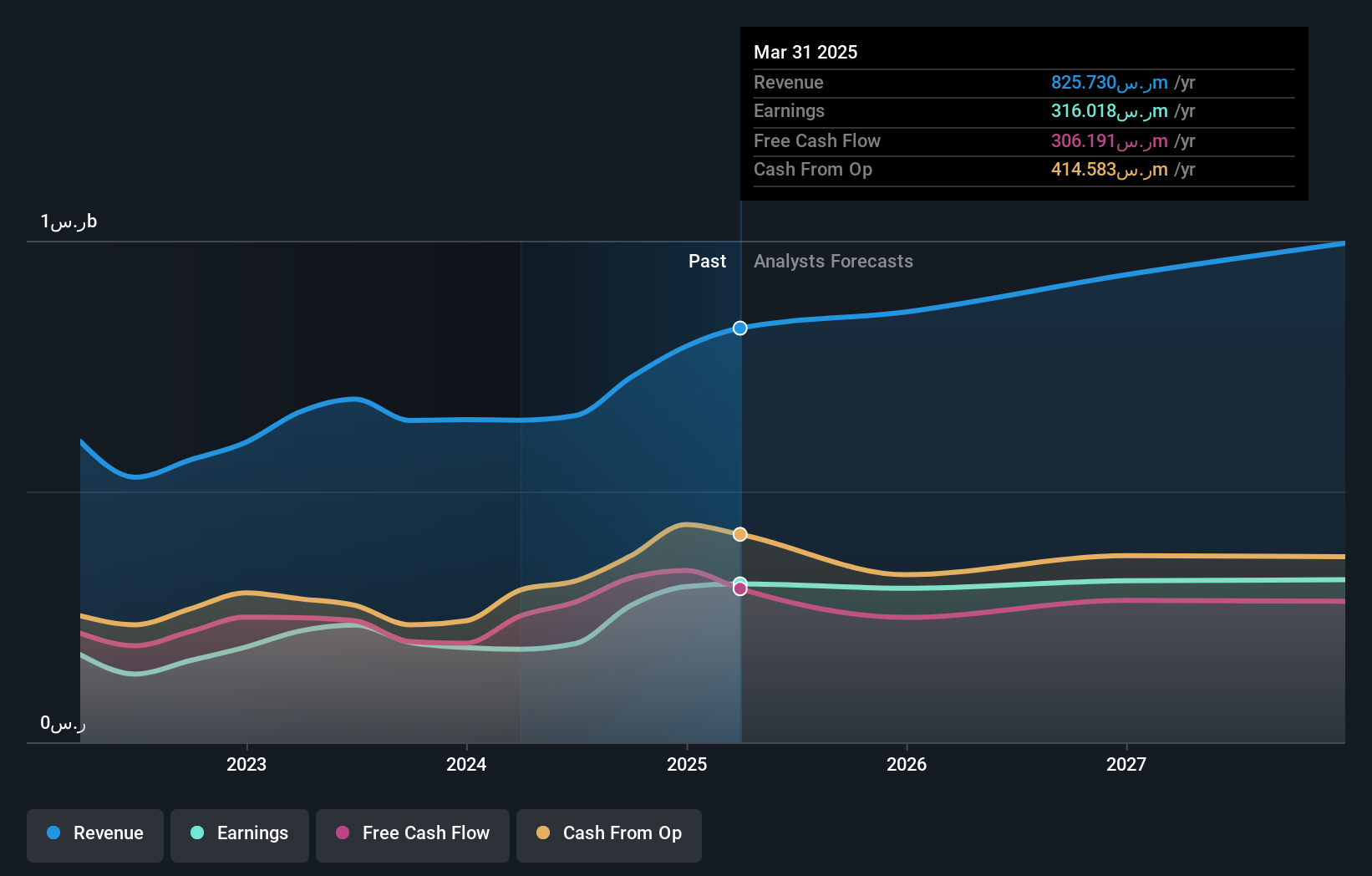

Operations: The primary revenue stream for Riyadh Cement comes from cement manufacturing, generating SAR727.03 million. The company's financial performance can be assessed by examining its gross profit margin or net profit margin trends over time.

Riyadh Cement, a smaller player in the industry, has shown robust financial performance recently. With zero debt on its books compared to a 5% debt-to-equity ratio five years ago, the company is financially sound. In the third quarter of 2024, sales reached SAR 203 million from SAR 127 million last year, while net income soared to SAR 94.58 million from SAR 18.71 million. Despite high-quality earnings and a significant earnings growth of 37% last year surpassing industry growth of 12%, future earnings are projected to decrease by an average of 10% annually over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of Riyadh Cement.

Gain insights into Riyadh Cement's historical performance by reviewing our past performance report.

Wanguo Gold Group (SEHK:3939)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People’s Republic of China and Solomon Islands, with a market capitalization of HK$12.79 billion.

Operations: The company's revenue is primarily derived from two projects: Yifeng, contributing CN¥749.25 million, and Solomon, contributing CN¥912.63 million.

Wanguo Gold Group, a smaller player in the mining sector, has shown impressive growth with earnings surging 89.9% over the past year, outpacing the industry average of 22.8%. Despite a rise in its debt-to-equity ratio from 13.9% to 16.3% over five years, it maintains more cash than total debt and enjoys strong interest coverage at 91.7 times EBIT. Recent board changes saw Ms. Gao Jinzhu rejoin as an executive director, bringing extensive industry experience. The company raised HKD 1.38 billion through a follow-on equity offering, indicating strategic financial maneuvers to support future endeavors.

Suzhou West Deane New Power ElectricLtd (SHSE:603312)

Simply Wall St Value Rating: ★★★★★☆

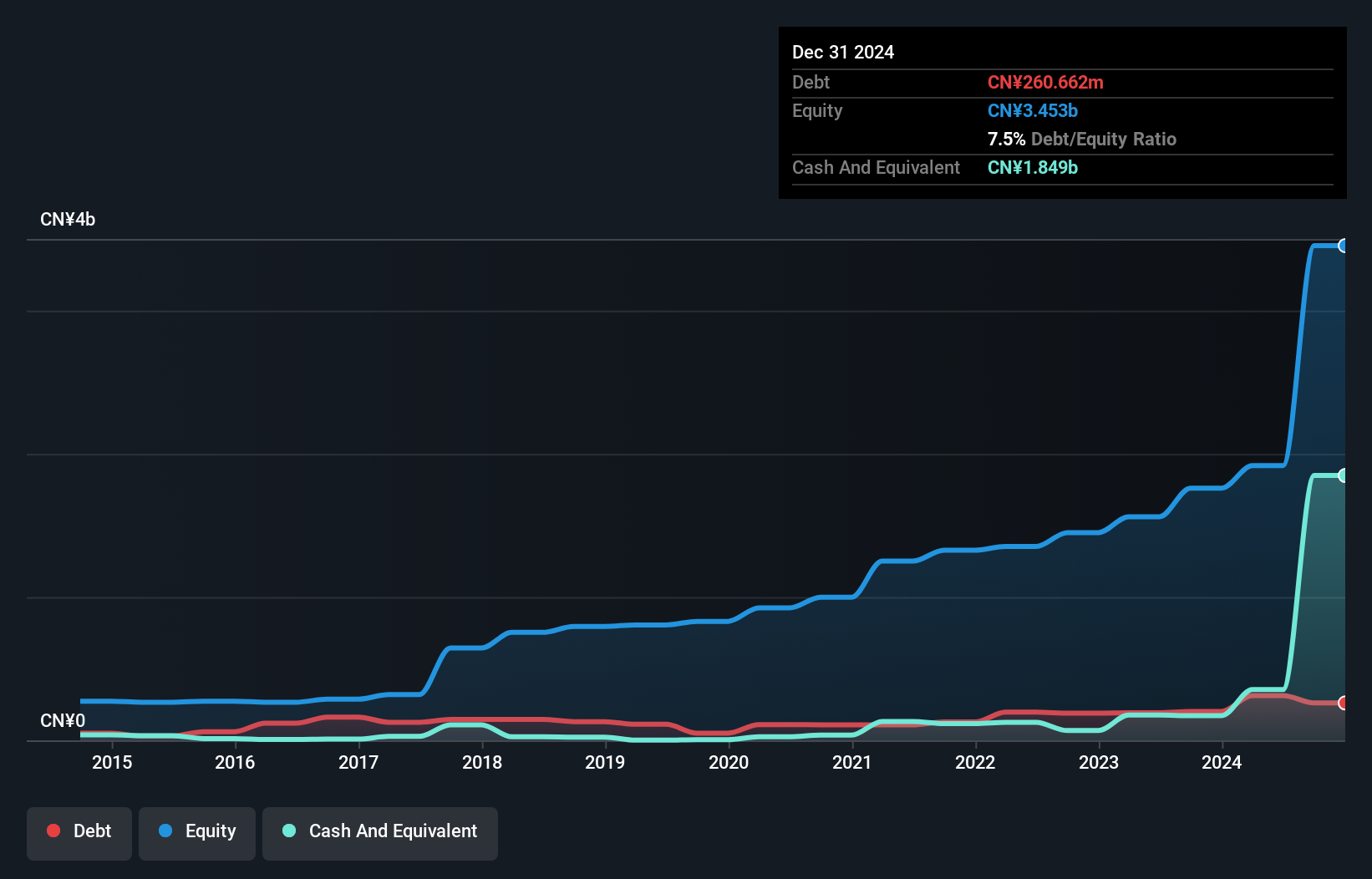

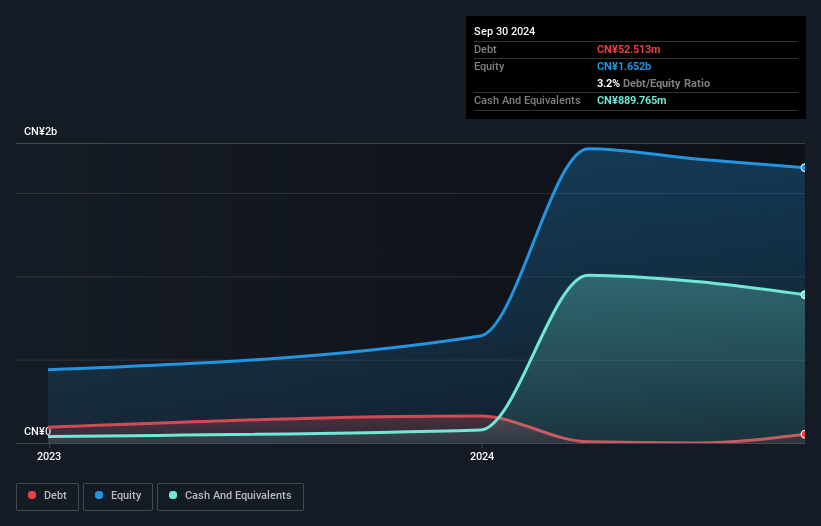

Overview: Suzhou West Deane New Power Electric Co., Ltd. is an engineering and manufacturing company that offers laminated bus bar products globally, with a market capitalization of CN¥4.99 billion.

Operations: West Deane generates revenue primarily from its Electrical Machinery and Equipment Manufacturing segment, amounting to CN¥1.90 billion.

Suzhou West Deane New Power Electric Ltd. seems to be an intriguing prospect, trading at 73.2% below its fair value estimate, offering significant potential for investors seeking undervalued opportunities. Over the past year, earnings grew by 11.5%, outpacing the Electrical industry average of 1.1%, indicating robust performance in a competitive sector. Despite a dip in basic earnings per share from CNY 1.18 to CNY 0.95 over nine months ending September 2024, net income rose slightly to CNY 147.89 million from CNY 143.37 million last year, reflecting resilience amidst market challenges and highlighting its high-quality earnings profile.

Seize The Opportunity

- Access the full spectrum of 4562 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603312

Suzhou West Deane New Power ElectricLtd

An engineering and manufacturing company, provides laminated bus bar (LBB) products worldwide.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives