None Riyadh Cement And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In a market environment where U.S. stock indexes are climbing toward record highs and small-cap stocks are trailing behind larger indices, investors may be seeking opportunities that offer potential for growth despite current economic challenges such as rising inflation and volatile interest rates. Identifying undiscovered gems—stocks with solid fundamentals and unique market positions—can be particularly rewarding, especially when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AOKI Holdings | 27.05% | 3.74% | 52.54% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Shenzhen Farben Information TechnologyLtd | 7.69% | 21.56% | 3.60% | ★★★★★★ |

| 3B Blackbio Dx | 0.31% | -9.96% | -9.16% | ★★★★★★ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Vinacomin - Power Holding | 42.01% | -0.84% | 34.75% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

| Sanstar | 9.90% | 23.18% | 36.19% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Riyadh Cement (SASE:3092)

Simply Wall St Value Rating: ★★★★★★

Overview: Riyadh Cement Company is engaged in the production and sale of cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman, with a market capitalization of SAR4.39 billion.

Operations: Riyadh Cement's revenue primarily comes from its cement manufacturing segment, amounting to SAR727.03 million. The company's net profit margin reflects its profitability dynamics within this sector.

Riyadh Cement, a smaller player in the industry, has shown impressive earnings growth of 37% over the past year, outpacing the Basic Materials sector's 12.1%. With a Price-To-Earnings ratio of 16.1x, it appears attractively valued compared to the SA market's 24.1x. The company is debt-free now, contrasting with its debt-to-equity ratio of 5% five years ago. Riyadh Cement seems well-positioned given its high-quality earnings and forecasted revenue growth of 9.32% annually. Its positive free cash flow further underscores financial health and potential for continued performance in a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of Riyadh Cement.

Understand Riyadh Cement's track record by examining our Past report.

Guodian Nanjing Automation (SHSE:600268)

Simply Wall St Value Rating: ★★★★★★

Overview: Guodian Nanjing Automation Co., Ltd. is involved in the manufacture and sale of industrial power automation equipment both in China and internationally, with a market capitalization of approximately CN¥7.54 billion.

Operations: The company's primary revenue stream is derived from the industrial power automation equipment segment, generating approximately CN¥8.05 billion.

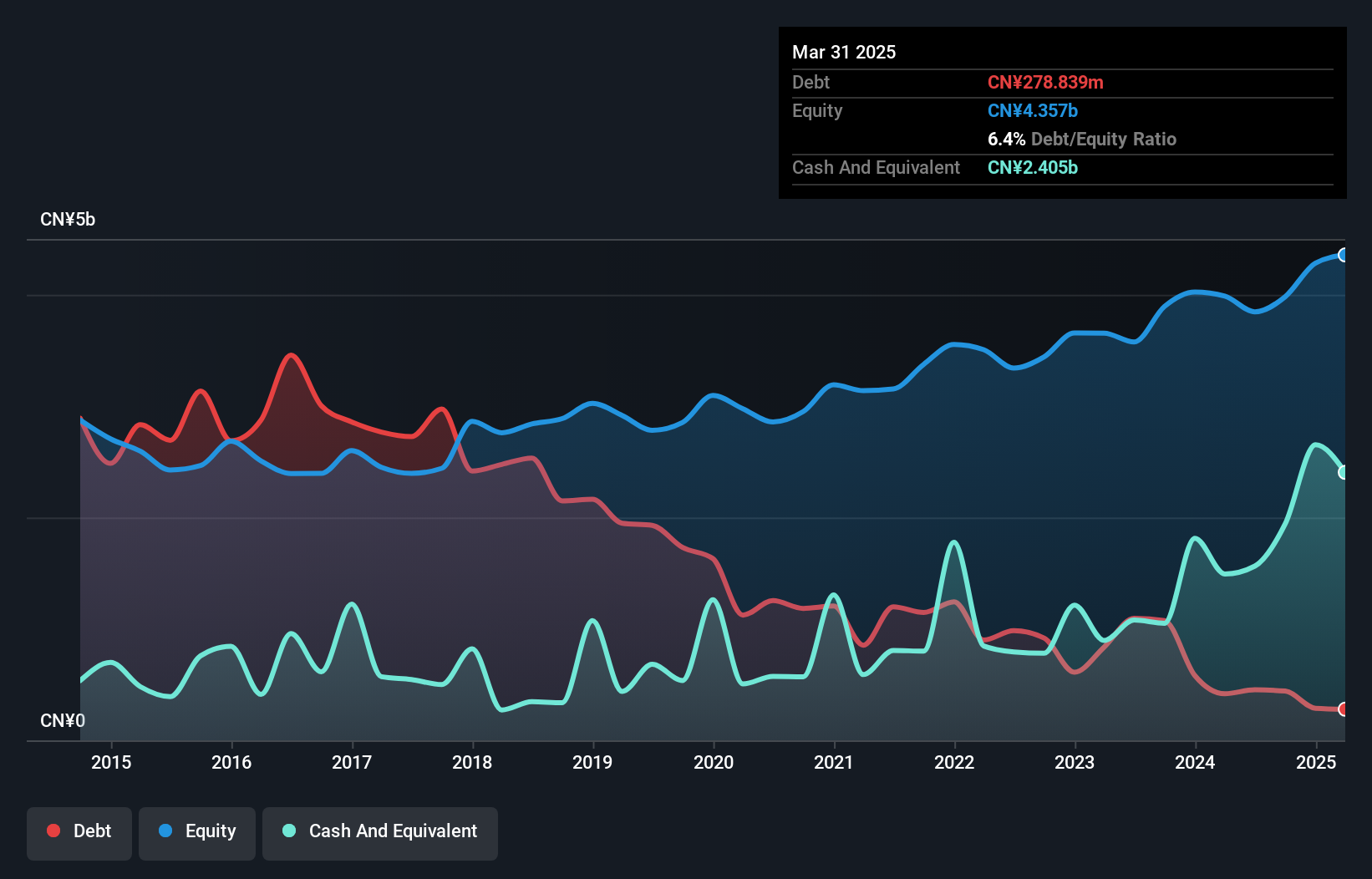

Guodian Nanjing Automation, a nimble player in the electrical sector, showcases robust financial health and promising growth metrics. Its earnings surged by 43% last year, outpacing the industry's modest 1% rise. The company's debt-to-equity ratio impressively shrank from 61% to just 11% over five years, reflecting prudent financial management. Additionally, it trades at nearly 90% below its estimated fair value, suggesting potential undervaluation. With an EBIT covering interest payments a staggering 240 times over and free cash flow remaining positive, Guodian appears well-positioned for sustained performance amidst industry peers.

- Click to explore a detailed breakdown of our findings in Guodian Nanjing Automation's health report.

Sijin Intelligent Forming Machinery (SZSE:003025)

Simply Wall St Value Rating: ★★★★★★

Overview: Sijin Intelligent Forming Machinery Co., Ltd. operates in the machinery industry, specializing in the production of intelligent forming equipment, with a market cap of CN¥3.76 billion.

Operations: Sijin Intelligent Forming Machinery generates revenue primarily from its intelligent forming equipment products. The company's cost structure includes expenses related to production and distribution, impacting its profitability.

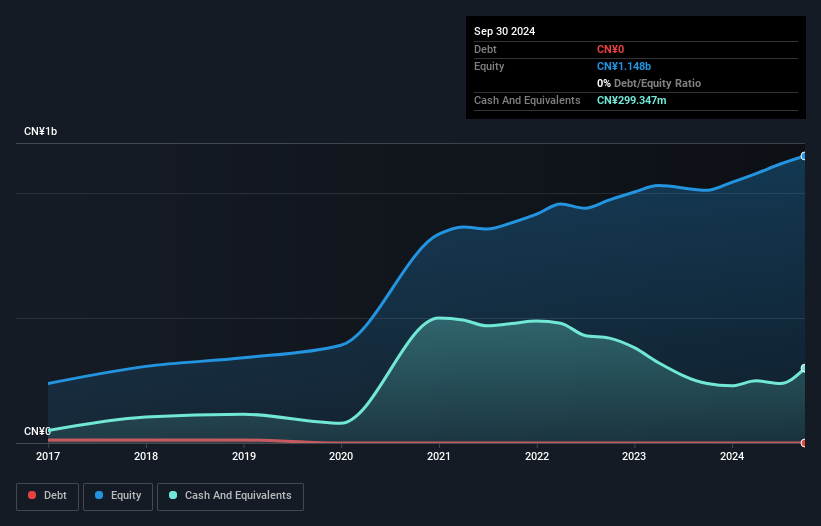

Sijin Intelligent Forming Machinery, a smaller player in its sector, has shown impressive earnings growth of 91% over the past year, significantly outpacing the broader machinery industry. The company is currently trading at 37.5% below its estimated fair value, suggesting potential undervaluation. Despite being debt-free now compared to a debt-to-equity ratio of 0.8 five years ago, recent financial results were skewed by a non-recurring gain of CN¥64.9M as of September 2024. While these factors highlight Sijin's potential appeal, investors should consider the impact of such one-off items on overall performance before making decisions.

Key Takeaways

- Investigate our full lineup of 4745 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003025

Sijin Intelligent Forming Machinery

Sijin Intelligent Forming Machinery Co., Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives