- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3090

Investors Still Waiting For A Pull Back In Tabuk Cement Company (TADAWUL:3090)

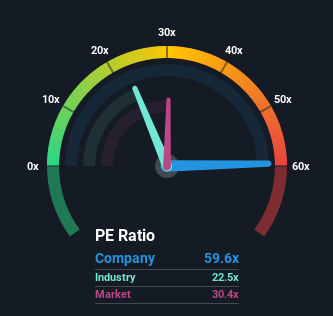

Tabuk Cement Company's (TADAWUL:3090) price-to-earnings (or "P/E") ratio of 59.6x might make it look like a strong sell right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios below 30x and even P/E's below 22x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Tabuk Cement's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Tabuk Cement

Is There Enough Growth For Tabuk Cement?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Tabuk Cement's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 88% during the coming year according to the sole analyst following the company. With the market only predicted to deliver 14%, the company is positioned for a stronger earnings result.

With this information, we can see why Tabuk Cement is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Tabuk Cement's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Tabuk Cement you should know about.

Of course, you might also be able to find a better stock than Tabuk Cement. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tabuk Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:3090

Tabuk Cement

Manufactures and sells cement in the Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives