- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3040

Exploring Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In the wake of recent market dynamics, where major indices like the Russell 2000 have shown significant movement following political shifts and economic policy changes, small-cap stocks are capturing investor interest due to their potential for growth in a changing regulatory and fiscal environment. As we explore three undiscovered gems with promising potential, it's essential to consider how these companies might capitalize on current market conditions, such as favorable tax policies and regulatory adjustments, which can provide a fertile ground for innovative businesses poised for expansion.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Qassim Cement (SASE:3040)

Simply Wall St Value Rating: ★★★★★★

Overview: Qassim Cement Company is involved in the production and sale of cement within Saudi Arabia, with a market capitalization of SAR5.93 billion.

Operations: Qassim Cement generates revenue primarily from its operating segment, amounting to SAR672.02 million. The company's financial performance is influenced by its cost structure and market dynamics within Saudi Arabia's cement industry.

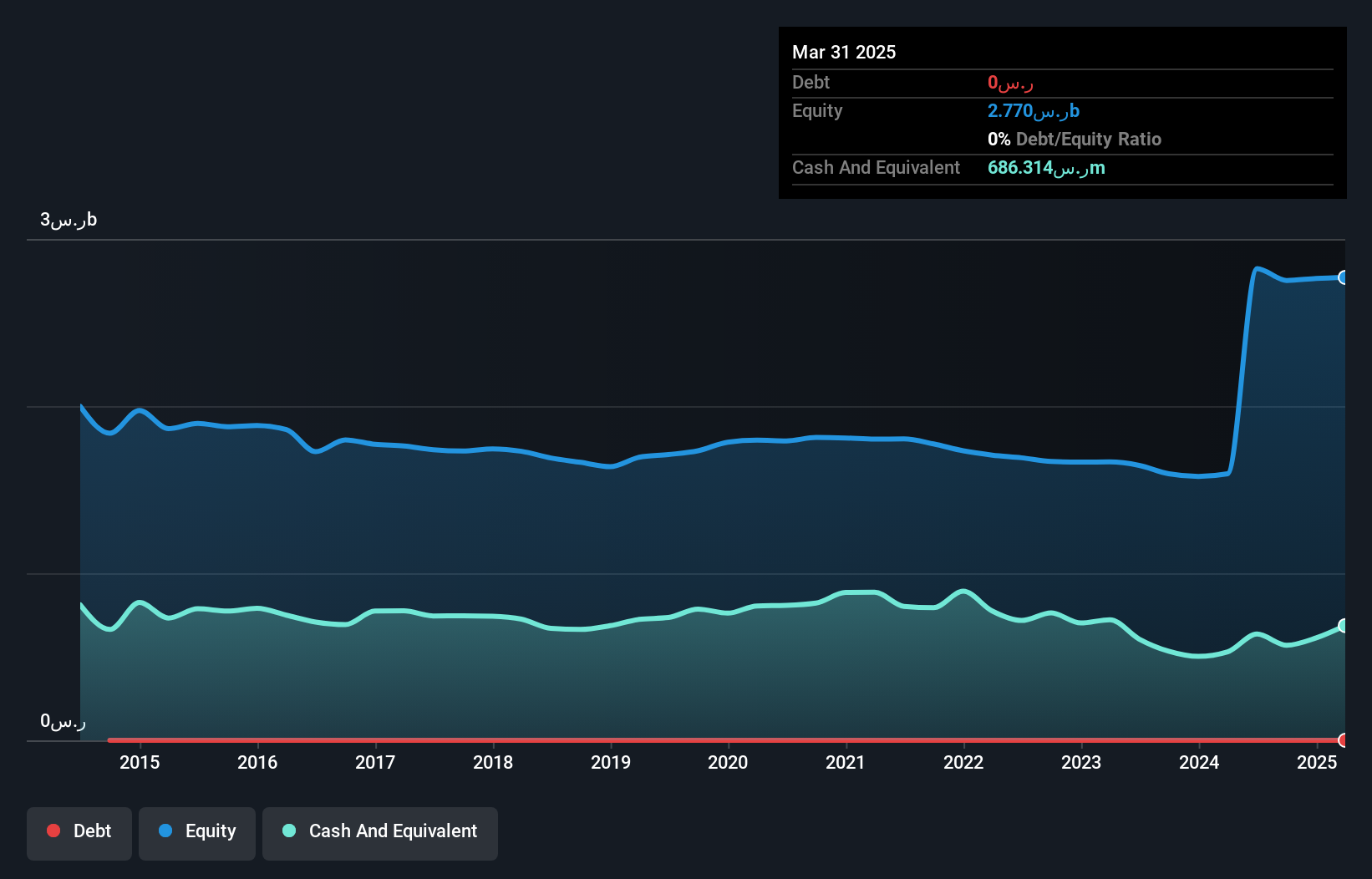

Qassim Cement, a smaller player in the cement industry, has shown robust financial health with no debt over the past five years, making interest coverage a non-issue. Recent earnings growth of 15.7% outpaces the Basic Materials industry's -2.5%, indicating strong performance relative to peers. The company reported sales of SAR 203 million for Q2 2024, up from SAR 137 million last year, while net income rose to SAR 72.89 million from SAR 38.1 million. Trading at approximately 17% below estimated fair value suggests potential undervaluation in its current market position.

- Delve into the full analysis health report here for a deeper understanding of Qassim Cement.

Assess Qassim Cement's past performance with our detailed historical performance reports.

Shenzhen Xinyichang Technology (SHSE:688383)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Xinyichang Technology Co., Ltd. specializes in the research, development, production, and sale of intelligent manufacturing equipment for industries such as LED, capacitor, semiconductor, and lithium battery in China with a market cap of CN¥5.72 billion.

Operations: Xinyichang Technology's revenue is primarily derived from the sale of intelligent manufacturing equipment across various industries, including LED and semiconductors. The company focuses on optimizing its cost structure to enhance profitability, with a notable trend observed in its gross profit margin over recent periods.

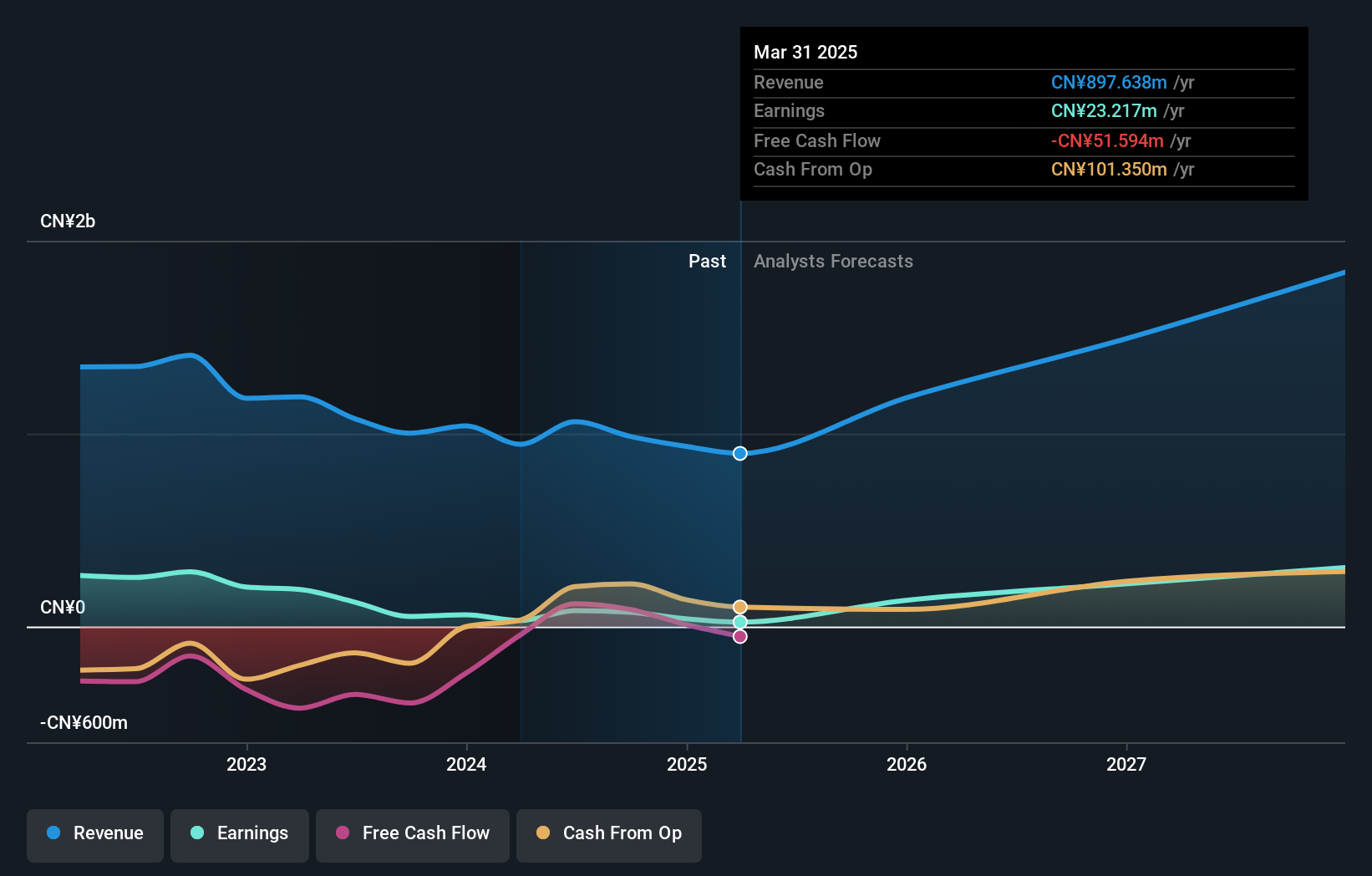

Shenzhen Xinyichang Technology, a smaller player in the tech scene, has shown robust earnings growth of 40.2% over the past year, outpacing its industry peers. Despite a high net debt to equity ratio of 40.1%, interest payments are well covered by EBIT at 11.9 times, indicating solid financial management. Trading slightly below its estimated fair value adds to its appeal for potential investors looking for undervalued opportunities. Recent earnings reports reveal an increase in net income to CNY 69.47 million from CNY 56.17 million last year, alongside strategic share repurchases totaling CNY 16.99 million this year, reflecting confidence in future prospects.

Solar Applied Materials Technology (TPEX:1785)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Solar Applied Materials Technology Corporation engages in the manufacturing, processing, recycling, refining, and trading of sputtering targets for thin film applications as well as precious metal materials and specialty chemicals for the automotive industry across Taiwan, China, and international markets with a market cap of NT$39.35 billion.

Operations: The company generates revenue primarily from the sale of sputtering targets, precious metal materials, and specialty chemicals. Its financial performance is highlighted by a market capitalization of NT$39.35 billion.

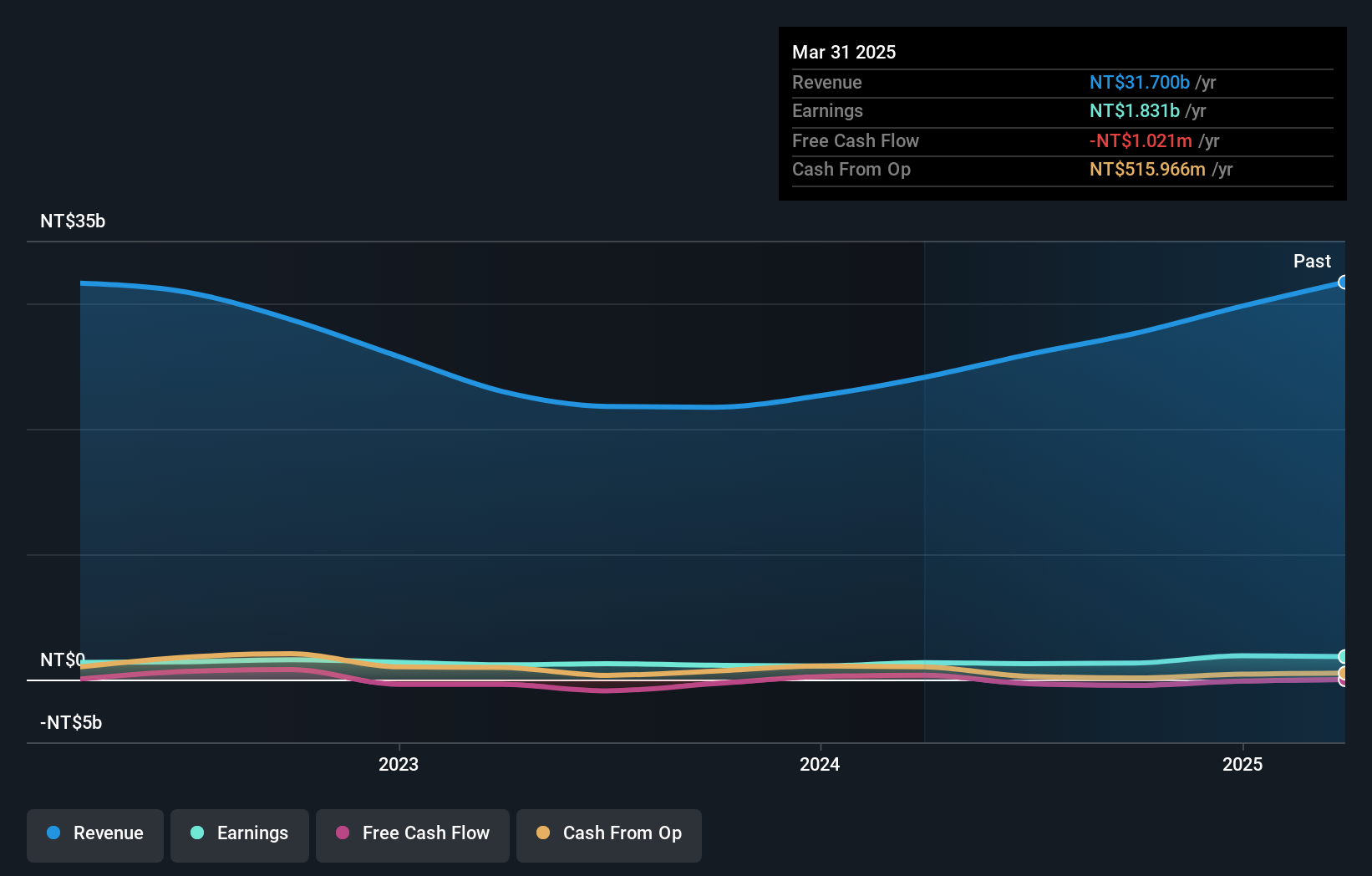

Solar Applied Materials Technology, a smaller player in the industry, recently reported impressive financials. For Q3 2024, sales reached TWD 7.62 billion compared to TWD 5.95 billion last year, with net income rising to TWD 458 million from TWD 408 million. Earnings per share improved to TWD 0.77 from TWD 0.69 previously. Over the past year, earnings grew by an impressive 14%, outpacing the Chemicals industry average of around 13%. Despite a high net debt-to-equity ratio of approximately 59%, interest payments are well covered by EBIT at over ten times coverage, indicating robust financial health despite some leverage concerns.

- Navigate through the intricacies of Solar Applied Materials Technology with our comprehensive health report here.

Understand Solar Applied Materials Technology's track record by examining our Past report.

Summing It All Up

- Unlock our comprehensive list of 4673 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qassim Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3040

Qassim Cement

Engages in the manufacture and selling of cement in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives