As Gulf markets continue to show resilience, with key indices like Saudi Arabia's benchmark and Dubai's main share index posting gains, investors are increasingly attentive to the region's economic dynamics and geopolitical developments. In this environment, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and potential for growth amidst shifting market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

YAMAMA Cement (SASE:3020)

Simply Wall St Value Rating: ★★★★★☆

Overview: YAMAMA Cement Company is involved in the manufacture, production, and trading of cement within Saudi Arabia and has a market capitalization of SAR7.41 billion.

Operations: The primary revenue stream for YAMAMA Cement comes from its cement industry operations, generating SAR1.17 billion. The company's financial performance is highlighted by a net profit margin trend that can be examined for insights into profitability.

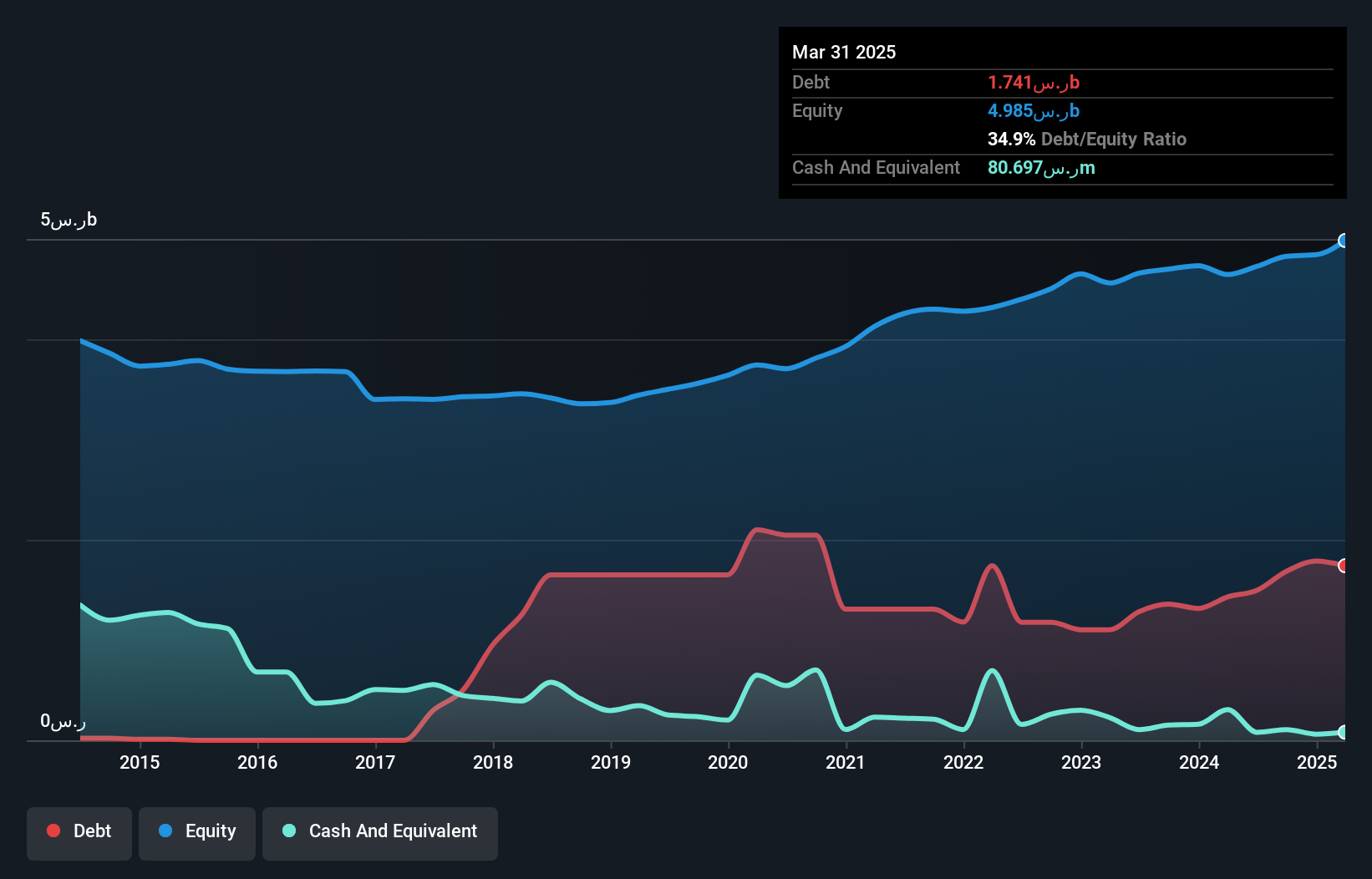

YAMAMA Cement, a smaller player in the Middle East market, has shown robust financial health with a net debt to equity ratio of 35.7%, indicating prudent debt management. The company reported impressive earnings growth of 38% over the past year, outpacing the Basic Materials industry average of 31%. With sales reaching SAR 1.17 billion and net income at SAR 420.71 million for the full year ending December 2024, YAMAMA's performance underscores its potential value. Additionally, trading at approximately 71% below estimated fair value suggests an opportunity for investors seeking undervalued stocks in this region.

- Take a closer look at YAMAMA Cement's potential here in our health report.

Examine YAMAMA Cement's past performance report to understand how it has performed in the past.

Plasson Industries (TASE:PLSN)

Simply Wall St Value Rating: ★★★★★★

Overview: Plasson Industries Ltd is a company that develops, manufactures, and markets technical products across various global regions with a market capitalization of ₪1.91 billion.

Operations: Plasson Industries generates revenue primarily from three segments: connection accessories for plumbing (₪883.29 million), products for animals (₪564.07 million), and other activities (₪259.52 million).

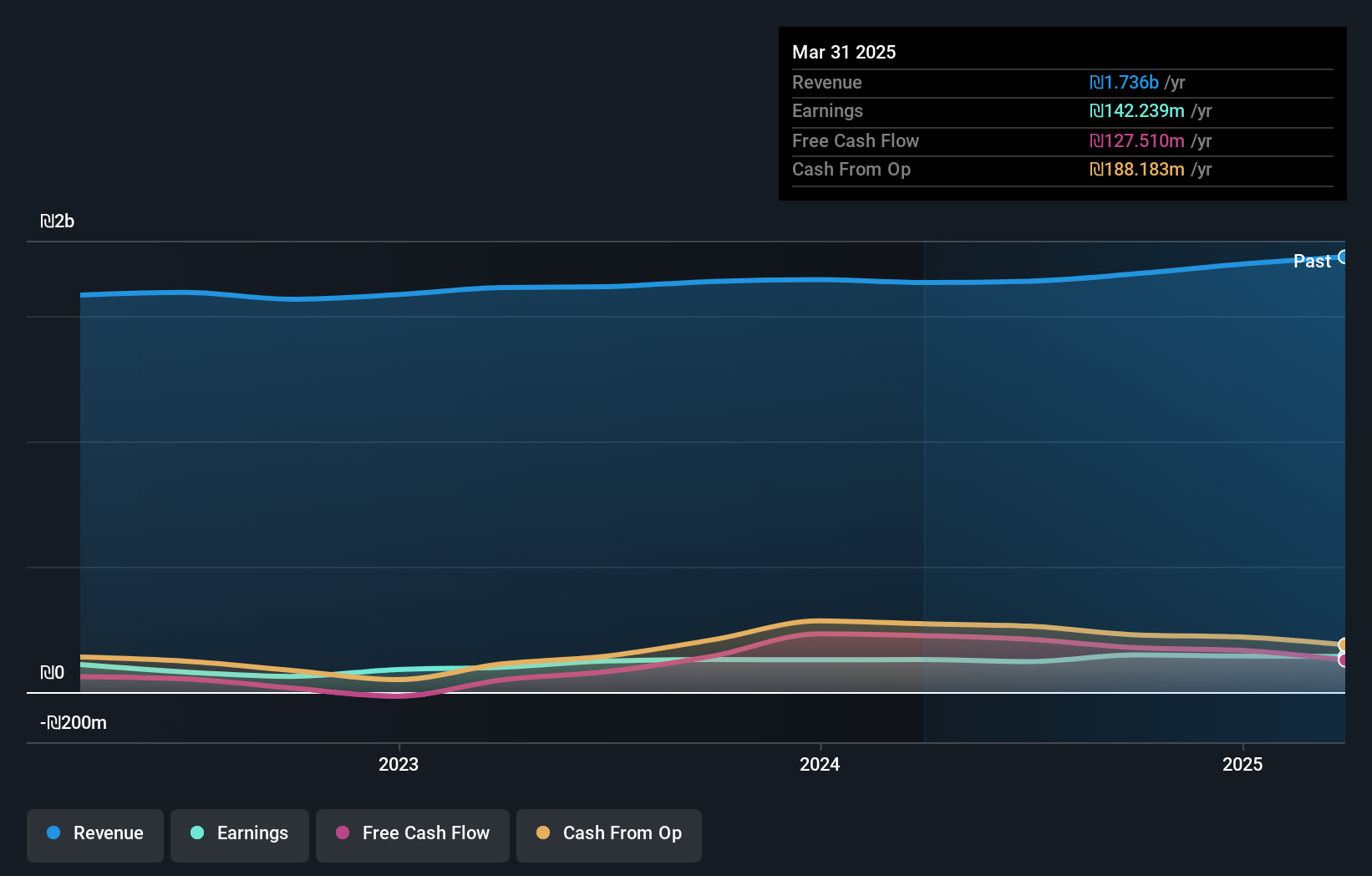

Plasson Industries, a compact player in the machinery sector, has demonstrated robust earnings growth of 11.4% over the past year, outpacing the industry average of 6.8%. The company reported sales of ILS 1.71 billion for 2024, up from ILS 1.64 billion in the previous year, with net income increasing to ILS 143.79 million from ILS 129.11 million. Its price-to-earnings ratio at 13.3x sits below the IL market's average of 13.7x, suggesting good value potential for investors seeking quality earnings and satisfactory debt management with a net debt to equity ratio at just under 14%.

- Unlock comprehensive insights into our analysis of Plasson Industries stock in this health report.

Gain insights into Plasson Industries' past trends and performance with our Past report.

Telsys (TASE:TLSY)

Simply Wall St Value Rating: ★★★★★★

Overview: Telsys Ltd. is engaged in marketing and distributing electronic components within Israel, with a market capitalization of ₪1.60 billion.

Operations: Telsys Ltd. generates revenue primarily from its SOM sector and distribution segments, with the SOM sector contributing ₪280.67 million and distribution adding ₪113.93 million. The company's cost structure and profitability are influenced by these revenue streams, impacting its financial performance overall.

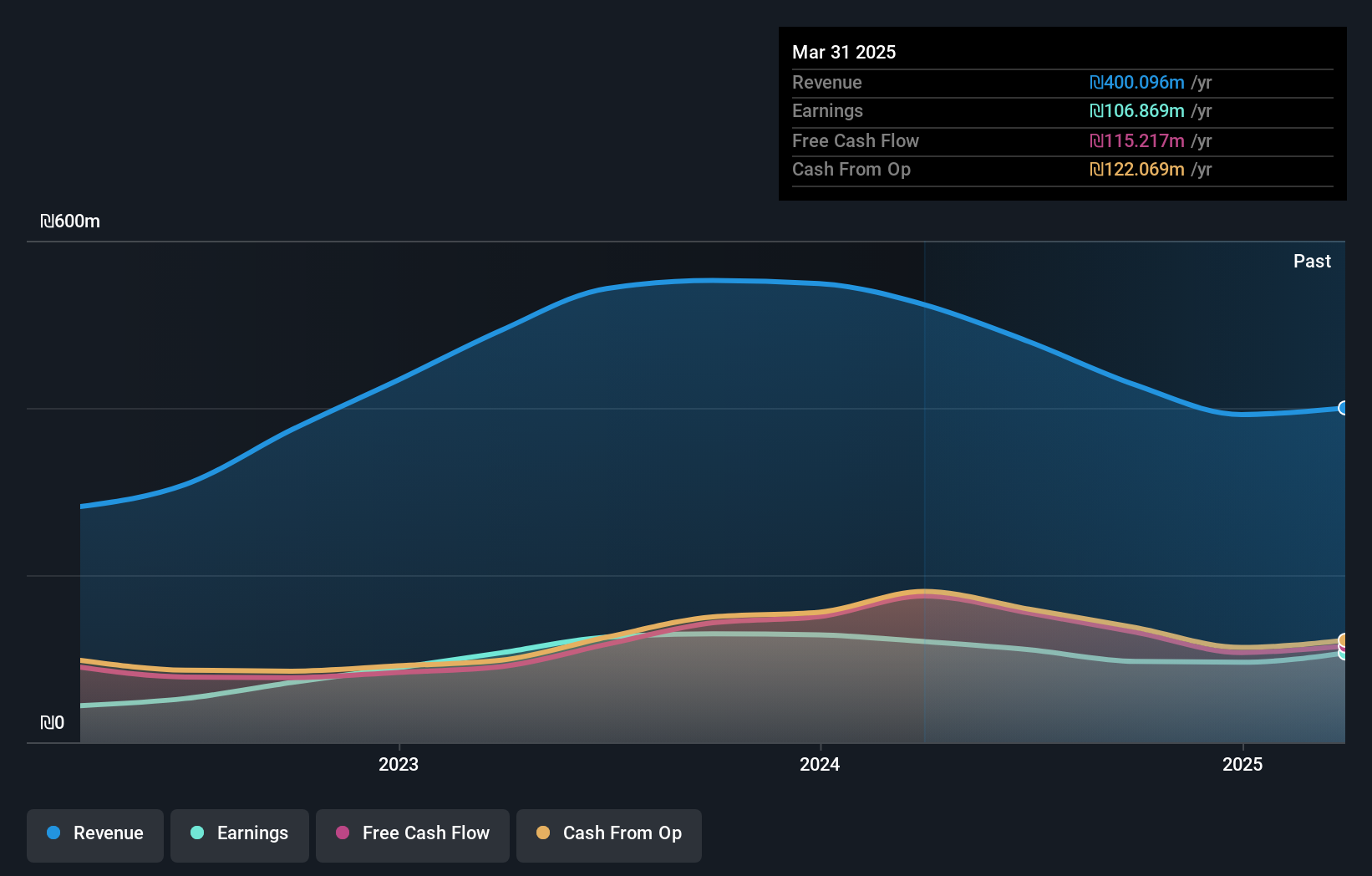

Telsys, a promising player in the electronics sector, has seen its debt to equity ratio improve from 9.6% to 8.8% over five years, indicating prudent financial management. Despite a challenging year with earnings dropping by 25.5%, contrasting sharply with the industry average of 10.7%, Telsys remains profitable and boasts high-quality past earnings. The company reported sales of ILS 392 million for the full year ending December 2024, down from ILS 548 million previously; net income also decreased to ILS 95.68 million from ILS 128.42 million last year, reflecting market pressures yet highlighting resilience amidst volatility in share price movements recently observed.

- Get an in-depth perspective on Telsys' performance by reading our health report here.

Assess Telsys' past performance with our detailed historical performance reports.

Next Steps

- Click through to start exploring the rest of the 243 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLSN

Plasson Industries

Develops, manufactures, and markets technical products in Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and rest of the Americas.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives