- Saudi Arabia

- /

- Chemicals

- /

- SASE:2350

Market Still Lacking Some Conviction On Saudi Kayan Petrochemical Company (TADAWUL:2350)

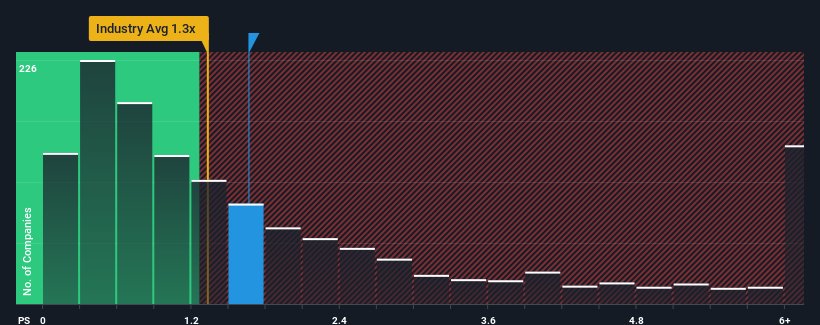

It's not a stretch to say that Saudi Kayan Petrochemical Company's (TADAWUL:2350) price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Saudi Arabia, where the median P/S ratio is around 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Saudi Kayan Petrochemical

How Has Saudi Kayan Petrochemical Performed Recently?

There hasn't been much to differentiate Saudi Kayan Petrochemical's and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to continue matching the industry, which has kept the P/S in line with expectations. You'd much rather the company improve its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Saudi Kayan Petrochemical.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Saudi Kayan Petrochemical's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 9.6% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.1% per annum, which is noticeably less attractive.

In light of this, it's curious that Saudi Kayan Petrochemical's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Saudi Kayan Petrochemical's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Saudi Kayan Petrochemical currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Saudi Kayan Petrochemical with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2350

Saudi Kayan Petrochemical

Manufactures and sells chemicals, polymers, and specialty products.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives