- Saudi Arabia

- /

- Chemicals

- /

- SASE:2310

Sahara International Petrochemical Company (TADAWUL:2310) Not Lagging Industry On Growth Or Pricing

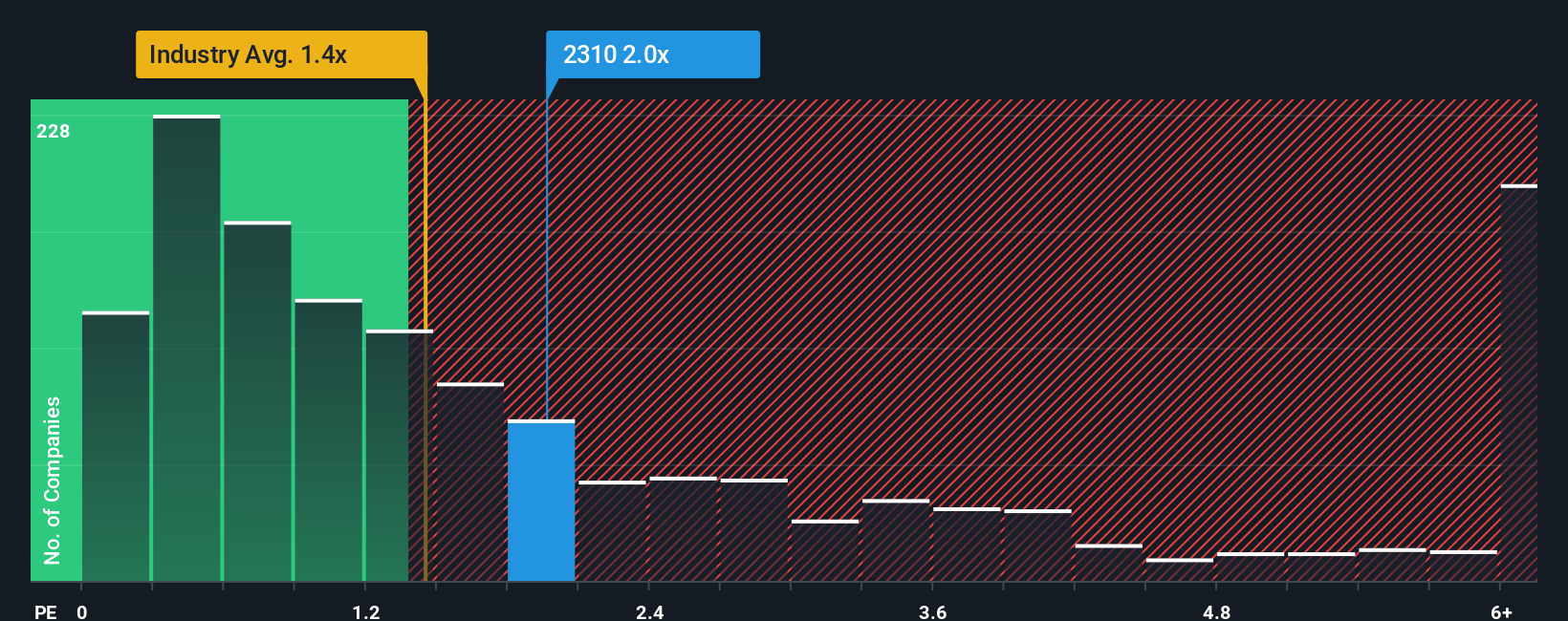

There wouldn't be many who think Sahara International Petrochemical Company's (TADAWUL:2310) price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S for the Chemicals industry in Saudi Arabia is similar at about 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Sahara International Petrochemical

How Has Sahara International Petrochemical Performed Recently?

While the industry has experienced revenue growth lately, Sahara International Petrochemical's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sahara International Petrochemical.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sahara International Petrochemical's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.8%. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.2% each year during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 3.0% growth each year, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Sahara International Petrochemical's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Sahara International Petrochemical's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Sahara International Petrochemical's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Sahara International Petrochemical (1 shouldn't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2310

Sahara International Petrochemical

Owns, establishes, operates, and manages industrial projects related to chemical and petrochemical industries in the Kingdom of Saudi Arabia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives