- Saudi Arabia

- /

- Chemicals

- /

- SASE:2060

National Industrialization (TADAWUL:2060) Shareholders Have Enjoyed A 60% Share Price Gain

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term National Industrialization Company (TADAWUL:2060) shareholders have enjoyed a 60% share price rise over the last half decade, well in excess of the market return of around 47% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 22%.

See our latest analysis for National Industrialization

Because National Industrialization made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years National Industrialization saw its revenue shrink by 35% per year. Despite the lack of revenue growth, the stock has returned a respectable 10%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

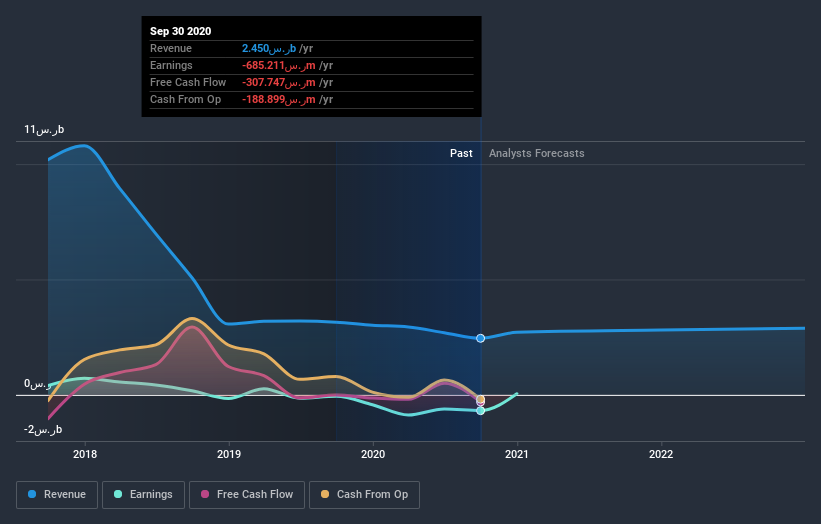

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at National Industrialization's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that National Industrialization shareholders have received a total shareholder return of 22% over one year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand National Industrialization better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with National Industrialization , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade National Industrialization, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Industrialization might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2060

National Industrialization

Operates in the petrochemicals, chemicals, plastics, and metals sectors in the Kingdom of Saudi Arabia, rest of the Middle East, Asia, Africa, Europe, and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives