- Saudi Arabia

- /

- Construction

- /

- SASE:2320

Middle Eastern Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As Middle Eastern equities experience a rise amid bargain hunting, with Saudi Arabia nearing a two-year low and Qatar's benchmark index gaining traction, investors are keenly observing the region's market dynamics. In such an environment, dividend stocks can offer stability and potential income, making them an appealing choice for those looking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.18% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.90% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.49% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.74% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.38% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.27% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.92% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.68% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.86% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.13% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

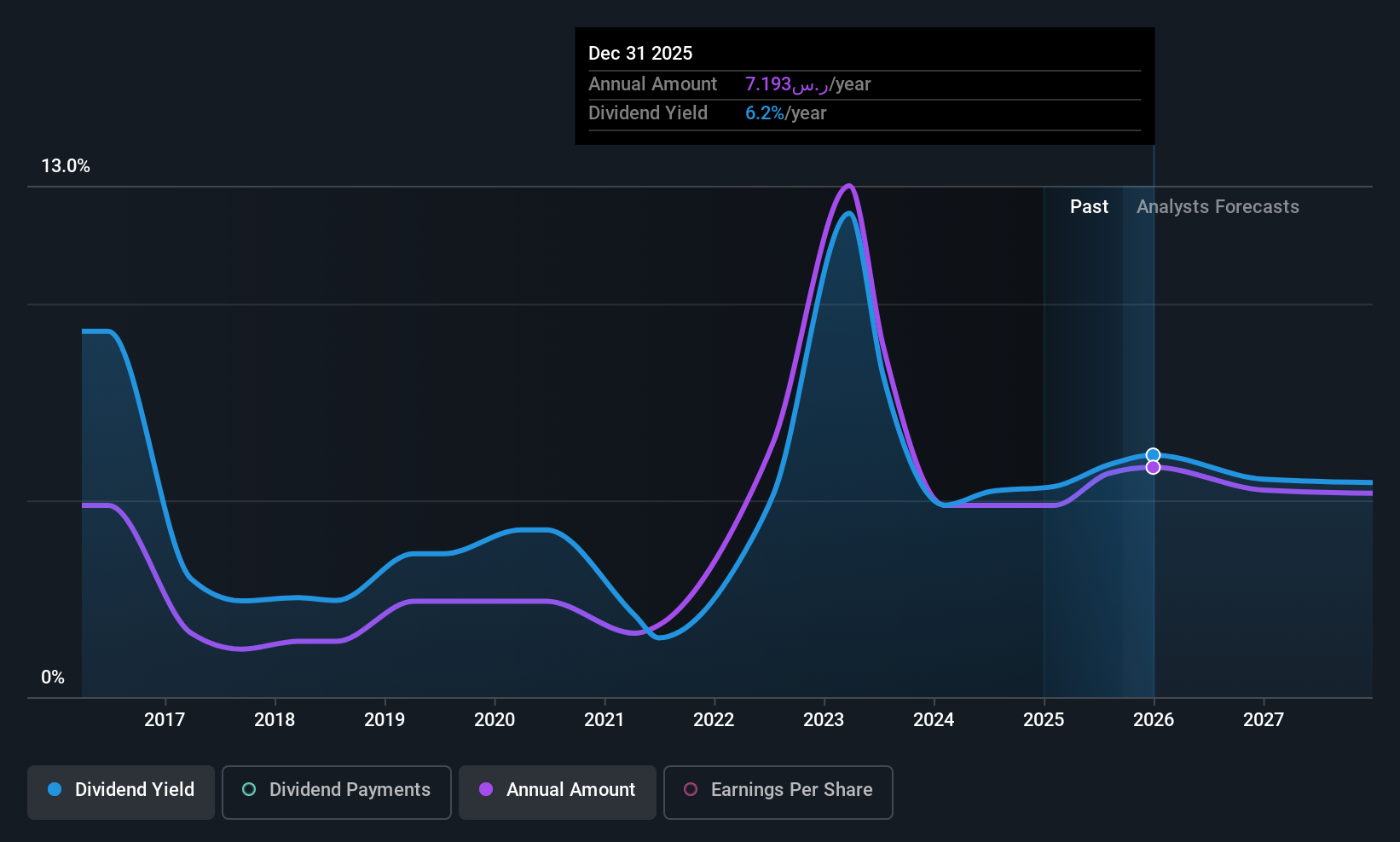

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SABIC Agri-Nutrients Company is involved in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across several countries including Singapore, the United States, India, and Saudi Arabia, with a market cap of SAR54.46 billion.

Operations: SABIC Agri-Nutrients Company's revenue primarily comes from its Agri-Nutrients segment, generating SAR11.72 billion, with an additional contribution of SAR506.94 million from Petrochemicals.

Dividend Yield: 6.1%

SABIC Agri-Nutrients has recently increased its interim cash dividend to SAR 3.5 per share for the first half of 2025, reflecting a commitment to returning value to shareholders despite past volatility in dividends. The company's earnings have grown, with Q2 net income reaching SAR 1.06 billion, up from SAR 705.34 million last year. However, the high cash payout ratio and reliance on earnings rather than free cash flow raise sustainability concerns for future dividends.

- Get an in-depth perspective on SABIC Agri-Nutrients' performance by reading our dividend report here.

- Our valuation report unveils the possibility SABIC Agri-Nutrients' shares may be trading at a discount.

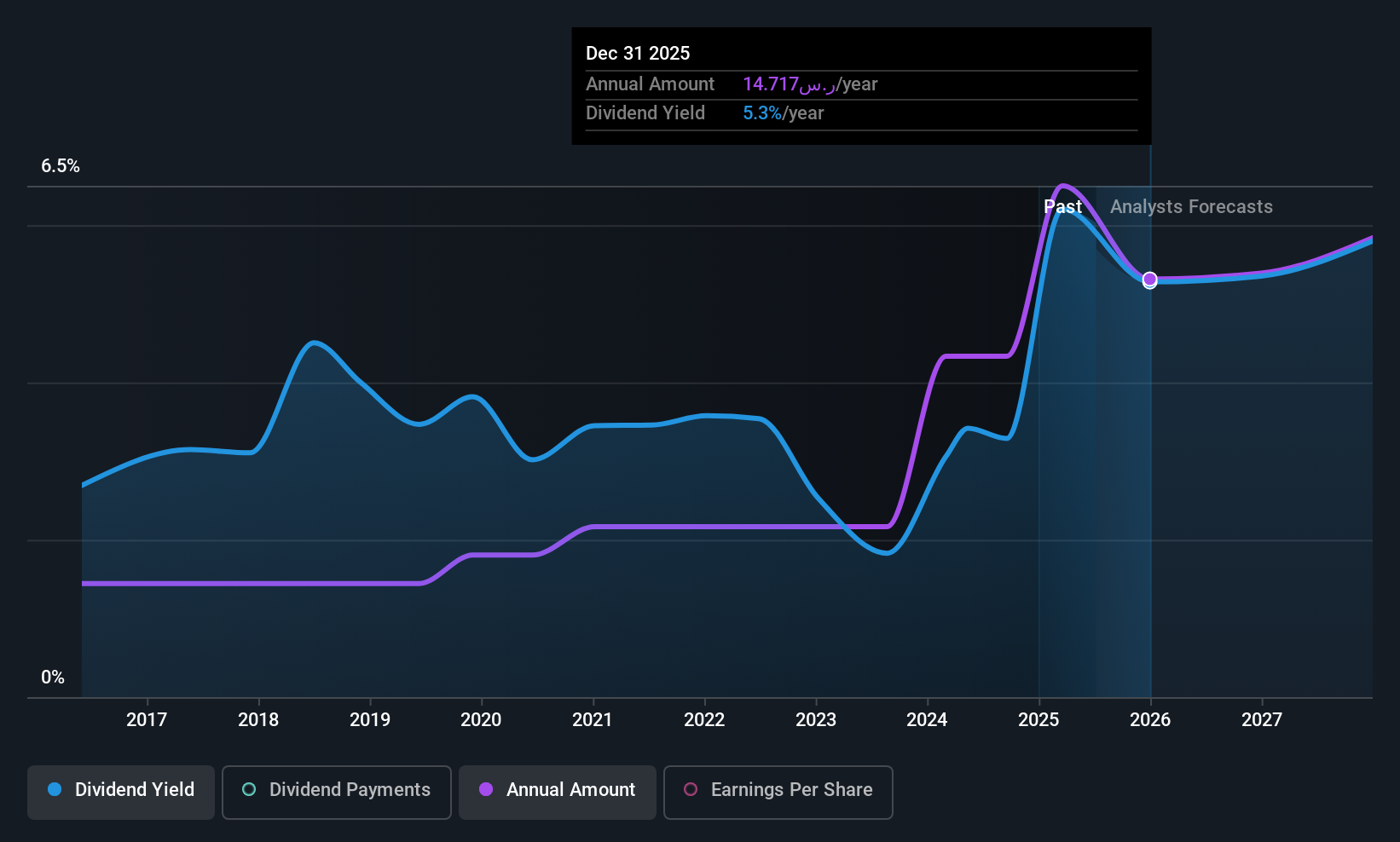

Saudia Dairy & Foodstuff (SASE:2270)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudia Dairy & Foodstuff Company, along with its subsidiaries, is engaged in the production and distribution of dairy products, beverages, and various foodstuffs across the Kingdom of Saudi Arabia, Poland, and other Gulf and Arab countries with a market cap of SAR8.23 billion.

Operations: Saudia Dairy & Foodstuff Company's revenue is derived from two primary segments: Beverages, which generated SAR1.66 billion, and Non-Beverages, contributing SAR1.50 billion.

Dividend Yield: 6.9%

Saudia Dairy & Foodstuff offers a dividend yield of 6.92%, placing it in the top 25% of Saudi Arabian dividend payers. Despite stable and reliable dividends over the past decade, sustainability concerns arise as dividends are not well covered by free cash flows, evidenced by a high cash payout ratio of 119%. Recent earnings show a decline in net income, which may impact future dividend stability despite an attractive price-to-earnings ratio of 17.6x.

- Take a closer look at Saudia Dairy & Foodstuff's potential here in our dividend report.

- Our valuation report here indicates Saudia Dairy & Foodstuff may be overvalued.

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles, power transmission towers, and accessories across the United Arab Emirates, Saudi Arabia, and Egypt with a market cap of SAR3.47 billion.

Operations: Al-Babtain Power and Telecommunications Company generates revenue through four main segments: Towers and Metal Structures Sector (SAR1.26 billion), Solar Energy Sector (SAR595.90 million), Columns and Lighting (SAR534.91 million), and Design, Supply, and Installation (SAR394.57 million).

Dividend Yield: 3.7%

Al-Babtain Power and Telecommunications' dividend yield of 3.71% is below the top tier in Saudi Arabia, but dividends are well covered by earnings (40.6% payout ratio) and cash flows (23.6% cash payout ratio). Despite recent earnings growth, with net income rising to SAR 97.75 million for Q2 2025, the dividend history has been volatile over the past decade. The stock trades at a favorable price-to-earnings ratio of 10.9x compared to the market average of 20.2x, suggesting good value relative to peers.

- Click to explore a detailed breakdown of our findings in Al-Babtain Power and Telecommunications' dividend report.

- The valuation report we've compiled suggests that Al-Babtain Power and Telecommunications' current price could be quite moderate.

Taking Advantage

- Navigate through the entire inventory of 67 Top Middle Eastern Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers, accessories, and communication towers in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives