- Saudi Arabia

- /

- Chemicals

- /

- SASE:2001

Investors Appear Satisfied With Methanol Chemicals Company's (TADAWUL:2001) Prospects

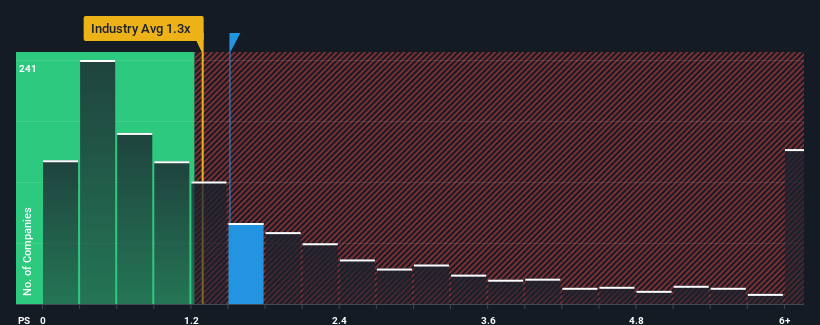

There wouldn't be many who think Methanol Chemicals Company's (TADAWUL:2001) price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S for the Chemicals industry in Saudi Arabia is similar at about 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Methanol Chemicals

What Does Methanol Chemicals' Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Methanol Chemicals has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Methanol Chemicals will help you uncover what's on the horizon.How Is Methanol Chemicals' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Methanol Chemicals' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. Even so, admirably revenue has lifted 86% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.5% as estimated by the lone analyst watching the company. With the rest of the industry predicted to shrink by 4.3%, it's set to post a similar result.

With this information, it's not too hard to see why Methanol Chemicals is trading at a fairly similar P/S in comparison. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Methanol Chemicals' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Methanol Chemicals' analyst forecasts revealed that its equally shaky outlook against the industry is keeping its P/S in line with the industry too. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to justify a high or low P/S ratio. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Methanol Chemicals with six simple checks.

If these risks are making you reconsider your opinion on Methanol Chemicals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2001

Methanol Chemicals

Manufactures and sells methanol derivatives, formaldehyde derivatives, superplasticizers, and amino resins in the Middle East and North Africa region.

Adequate balance sheet and overvalued.