- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1321

East Pipes Integrated Company for Industry (TADAWUL:1321) Stock Rockets 40% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, East Pipes Integrated Company for Industry (TADAWUL:1321) shares have been powering on, with a gain of 40% in the last thirty days. The last month tops off a massive increase of 152% in the last year.

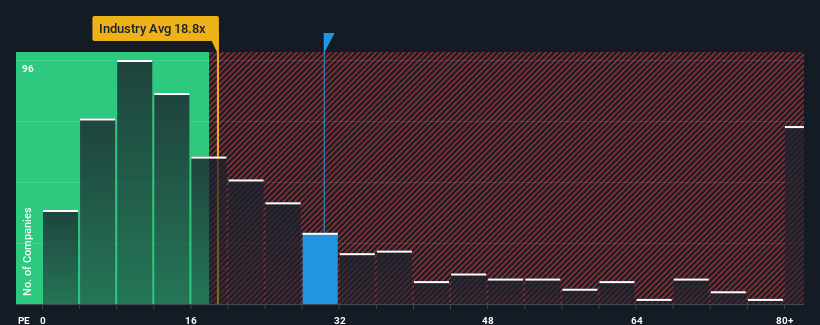

Although its price has surged higher, there still wouldn't be many who think East Pipes Integrated Company for Industry's price-to-earnings (or "P/E") ratio of 30.3x is worth a mention when the median P/E in Saudi Arabia is similar at about 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for East Pipes Integrated Company for Industry as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for East Pipes Integrated Company for Industry

What Are Growth Metrics Telling Us About The P/E?

East Pipes Integrated Company for Industry's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 124% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 59% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's an unpleasant look.

With this information, we find it concerning that East Pipes Integrated Company for Industry is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now East Pipes Integrated Company for Industry's P/E is also back up to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of East Pipes Integrated Company for Industry revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for East Pipes Integrated Company for Industry (2 are concerning!) that you need to be mindful of.

If you're unsure about the strength of East Pipes Integrated Company for Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if East Pipes Integrated Company for Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1321

East Pipes Integrated Company for Industry

Manufactures and sells pipes, tubes, and hollow shapes from iron and steel in the Kingdom of Saudi Arabia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives