- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1211

Some Shareholders Feeling Restless Over Saudi Arabian Mining Company (Ma'aden)'s (TADAWUL:1211) P/S Ratio

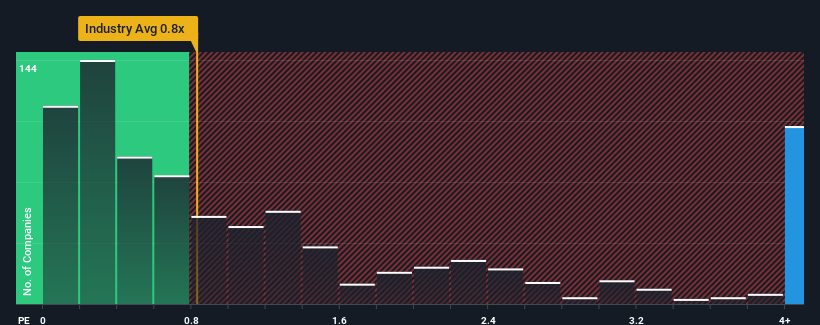

Saudi Arabian Mining Company (Ma'aden)'s (TADAWUL:1211) price-to-sales (or "P/S") ratio of 6.5x may look like a poor investment opportunity when you consider close to half the companies in the Metals and Mining industry in Saudi Arabia have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Saudi Arabian Mining Company (Ma'aden)

How Saudi Arabian Mining Company (Ma'aden) Has Been Performing

With revenue that's retreating more than the industry's average of late, Saudi Arabian Mining Company (Ma'aden) has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Saudi Arabian Mining Company (Ma'aden) will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Saudi Arabian Mining Company (Ma'aden)'s is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 58% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 6.4% per annum over the next three years. That's shaping up to be similar to the 7.4% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Saudi Arabian Mining Company (Ma'aden)'s P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Saudi Arabian Mining Company (Ma'aden)'s future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Saudi Arabian Mining Company (Ma'aden) is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Saudi Arabian Mining Company (Ma'aden)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1211

Saudi Arabian Mining Company (Ma'aden)

Operates as a mining and metals company in the Kingdom of Saudi Arabia, Indian Subcontinent, Japan, the United States, Europe, Australia, Brazil, Africa, GCC, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives