- Saudi Arabia

- /

- Insurance

- /

- SASE:8313

Almarai And 2 More Promising Middle Eastern Small Caps To Explore

Reviewed by Simply Wall St

The Middle East markets have recently experienced a retreat, with Gulf indices edging lower due to regional interest rate cuts and cautious investor sentiment following the U.S. Federal Reserve's policy outlook. Despite this volatility, strong economic fundamentals and strategic IPOs in the region offer potential opportunities for investors seeking promising small-cap stocks. Identifying a good stock often involves looking at companies with robust growth potential and resilience amidst fluctuating market conditions, making Almarai and two other small caps worth exploring in this dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Rimoni Industries | NA | 1.42% | -1.24% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| C. Mer Industries | 96.50% | 13.91% | 71.62% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Europen Endustri Insaat Sanayi ve Ticaret (IBSE:EUREN)

Simply Wall St Value Rating: ★★★★★★

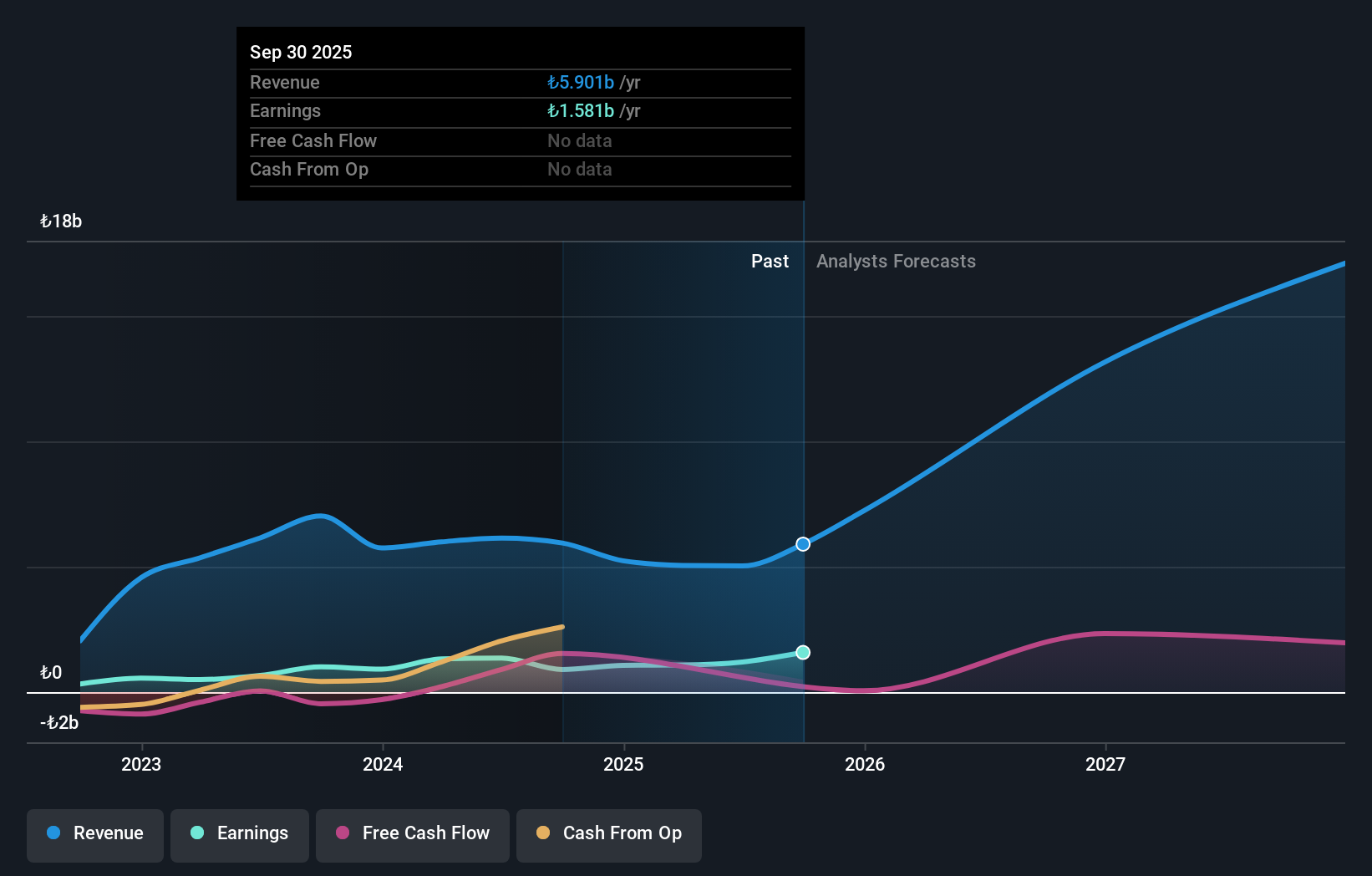

Overview: Europen Endustri Insaat Sanayi ve Ticaret A.S. operates in the manufacturing sector, focusing on glass, PVC profiles, and door and window products, with a market cap of TRY21.13 billion.

Operations: Revenue primarily stems from door and window products, including heat glass, at TRY2.48 billion, followed by glass at TRY2.15 billion, and PVC profiles contributing TRY450.83 million. The company's net profit margin reveals notable insights into its profitability trends over time.

Europen Endustri Insaat Sanayi ve Ticaret, a smaller player in the Middle East market, reported a net income of TRY 414 million for Q2 2025, up from TRY 293 million the previous year. Despite sales dipping slightly to TRY 1.56 billion from TRY 1.58 billion, earnings per share rose to TRY 0.1972 from TRY 0.1393. The company's debt management is commendable with a net debt to equity ratio at a satisfactory level of 8.7%, down significantly over five years from 44.8% to just above fifteen percent now, indicating prudent financial strategies amidst challenging industry conditions.

National Company for Learning and Education (SASE:4291)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Company for Learning and Education operates a network of educational institutions across various levels in the Kingdom of Saudi Arabia, with a market capitalization of SAR 6.54 billion.

Operations: The company generates revenue primarily through its various school operations, with Al-Rayan Schools and Al Qairwan Schools being the largest contributors at SAR 96.96 million and SAR 91.19 million, respectively. The net profit margin trends provide insight into the company's profitability dynamics over time.

In the Middle East's educational sector, National Company for Learning and Education stands out with an impressive earnings growth of 71.9% over the past year, significantly surpassing the industry average of 13.5%. The company also boasts a robust debt management strategy, having reduced its debt-to-equity ratio from 8.2 to 4 over five years. With interest payments well-covered by EBIT at a multiple of 12 times, financial stability seems assured. Despite these strengths, future revenue growth is projected at a moderate pace of about 9.48% annually, suggesting steady but cautious optimism in its expansion plans.

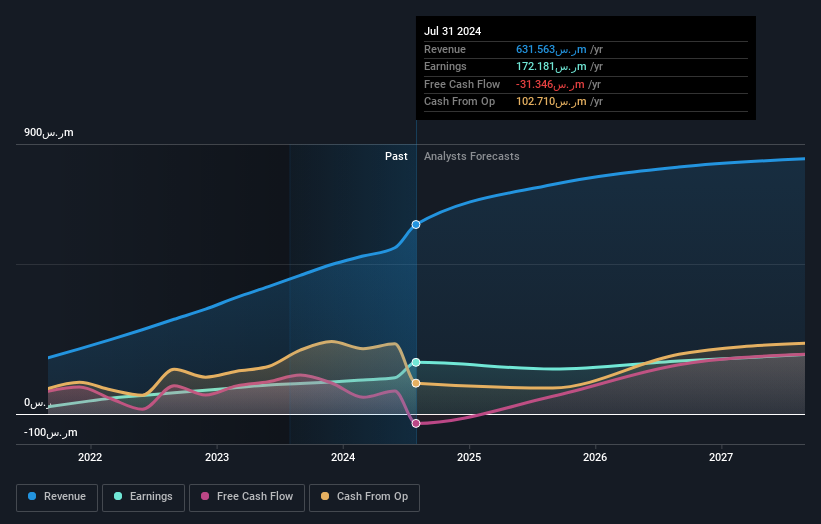

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR7.40 billion.

Operations: Rasan generates revenue primarily from its Tameeni - Motors and Leasing segments, with SAR242.41 million and SAR163.27 million respectively. The Tameeni - Health segment contributes SAR60.20 million to the overall revenue stream.

Rasan Information Technology has shown impressive growth, with earnings surging by 167% over the past year, outperforming the insurance industry. The company is debt-free, which eliminates concerns about interest coverage and positions it well for future opportunities. Recent financial results highlight a significant increase in sales to SAR 124 million for Q2 2025 from SAR 64 million a year ago, while net income jumped to SAR 45 million from SAR 9 million. Additionally, Rasan's subsidiary Tameeni signed an agreement with Saudi National Bank to provide insurance services, likely boosting revenue further as projected growth stands at approximately 19% annually.

Make It Happen

- Discover the full array of 206 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8313

Rasan Information Technology

A financial technology company, provides insurance and financial services in the Kingdom of Saudi Arabia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives