- Saudi Arabia

- /

- Insurance

- /

- SASE:8280

A Look At Al Alamiya for Cooperative Insurance's (TADAWUL:8280) Share Price Returns

It is doubtless a positive to see that the Al Alamiya for Cooperative Insurance Company (TADAWUL:8280) share price has gained some 32% in the last three months. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 59% after a long stretch. So we're hesitant to put much weight behind the short term increase. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

See our latest analysis for Al Alamiya for Cooperative Insurance

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

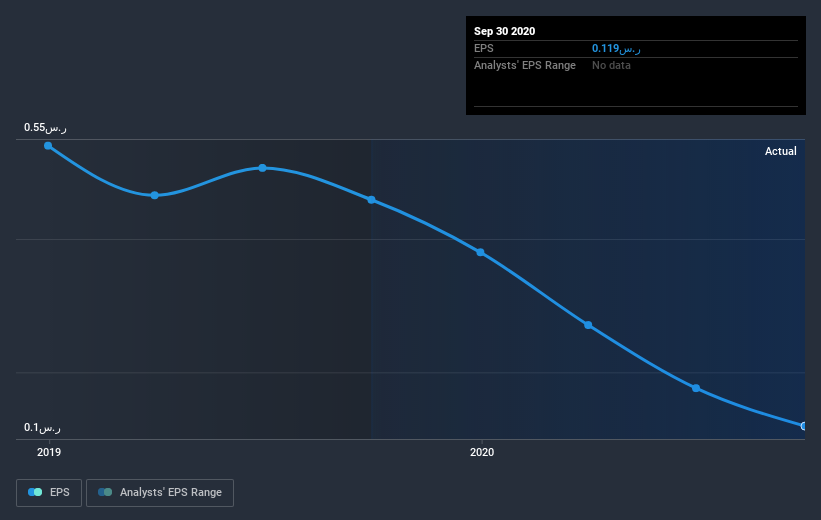

During the five years over which the share price declined, Al Alamiya for Cooperative Insurance's earnings per share (EPS) dropped by 28% each year. This fall in the EPS is worse than the 16% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around. The high P/E ratio of 214.90 suggests that shareholders believe earnings will grow in the years ahead.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Al Alamiya for Cooperative Insurance's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Al Alamiya for Cooperative Insurance has rewarded shareholders with a total shareholder return of 50% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Al Alamiya for Cooperative Insurance (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Al Alamiya for Cooperative Insurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:8280

Liva Insurance

Engages in the insurance and reinsurance businesses primarily in the Kingdom of Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives