- Saudi Arabia

- /

- Insurance

- /

- SASE:8050

A Piece Of The Puzzle Missing From Salama Cooperative Insurance Company's (TADAWUL:8050) 27% Share Price Climb

The Salama Cooperative Insurance Company (TADAWUL:8050) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 80%.

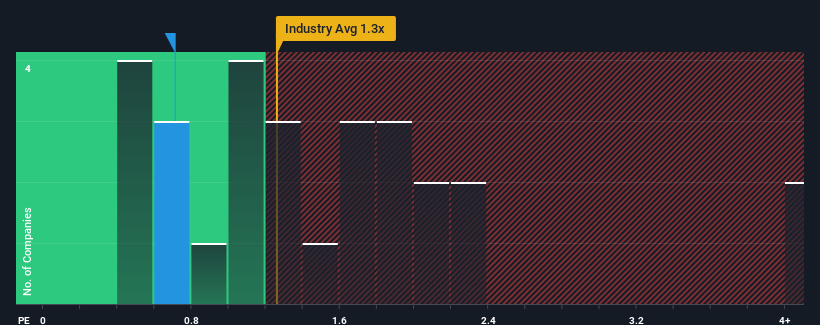

Although its price has surged higher, given about half the companies operating in Saudi Arabia's Insurance industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Salama Cooperative Insurance as an attractive investment with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Salama Cooperative Insurance

How Has Salama Cooperative Insurance Performed Recently?

Salama Cooperative Insurance certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Salama Cooperative Insurance, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Salama Cooperative Insurance's Revenue Growth Trending?

Salama Cooperative Insurance's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 44% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 75% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 1.1% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Salama Cooperative Insurance's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Salama Cooperative Insurance's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at the figures, it's surprising to see Salama Cooperative Insurance currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Having said that, be aware Salama Cooperative Insurance is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Salama Cooperative Insurance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Salama Cooperative Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8050

Salama Cooperative Insurance

Provides insurance products and services in the Kingdom of Saudi Arabia, the United Arab Emirates, Bahrain, Alegria, Senegal, Malaysia, and Egypt.

Flawless balance sheet and good value.

Market Insights

Community Narratives