Future Care Trading And 2 Promising Small Caps With Solid Foundations

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced mixed results with small-cap stocks showing resilience compared to their larger counterparts. Amidst cautious sentiment driven by fluctuating job signals and ongoing manufacturing challenges, investors are increasingly seeking solid foundations in smaller companies that can weather economic uncertainties. In this context, identifying stocks with strong fundamentals becomes crucial as these attributes often provide stability and growth potential even when broader market conditions are volatile.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Future Care Trading (SASE:9544)

Simply Wall St Value Rating: ★★★★★★

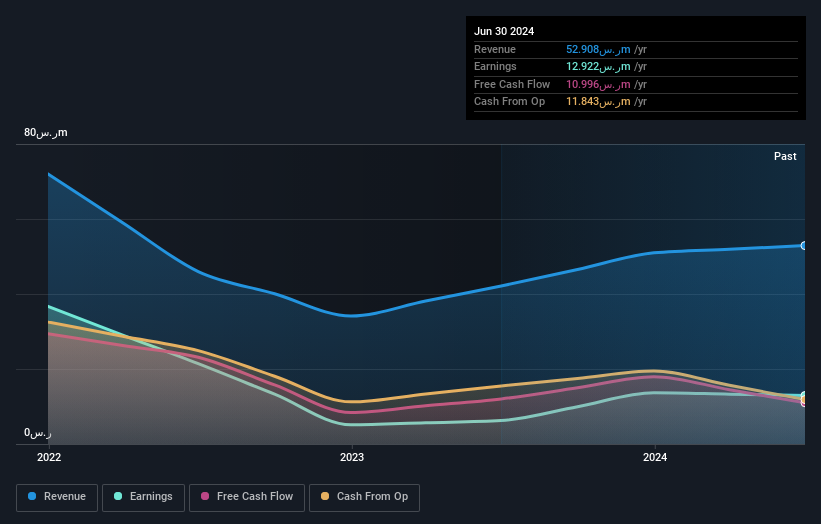

Overview: Future Care Trading Co. operates in the Kingdom of Saudi Arabia, offering a variety of home medical and laboratory services, with a market capitalization of SAR5.30 billion.

Operations: Future Care Trading Co. generates revenue primarily from its healthcare facilities and services segment, totaling SAR52.91 million.

Future Care Trading, a small cap entity in the healthcare sector, has shown impressive earnings growth of 106.9% over the past year, outpacing the industry average of 13.5%. Despite its volatile share price recently, it remains debt-free and boasts high-quality earnings. Over five years, however, earnings have decreased by an average of 40.4% annually. Recent financials indicate sales rose to SAR 24.96 million for the half-year ending June 2024 from SAR 23.04 million previously, although net income dipped slightly to SAR 5.15 million from SAR 5.89 million last year—highlighting both potential and challenges ahead.

Qingdao Foods (SZSE:001219)

Simply Wall St Value Rating: ★★★★★★

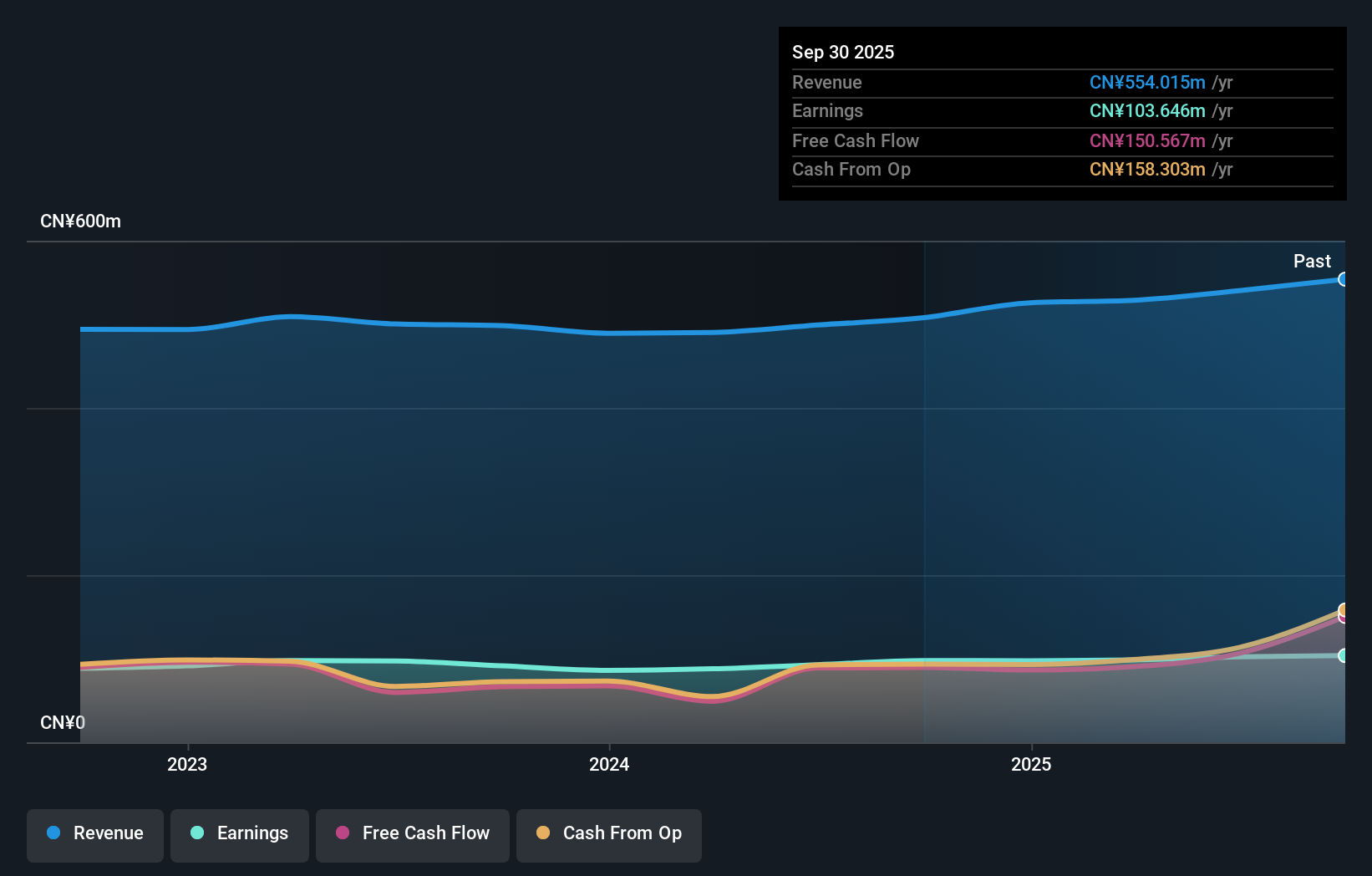

Overview: Qingdao Foods Co., Ltd. is a company focused on the production and sale of biscuits and other baked goods in China, with a market cap of CN¥2.68 billion.

Operations: Qingdao Foods generates revenue primarily from the sale of biscuits and baked goods. The company's cost structure includes expenses related to production, distribution, and marketing. A key financial indicator shows that its gross profit margin has shown variability across recent periods.

With a P/E ratio of 29.3x, Qingdao Foods stands out as a compelling option below the broader CN market's 35.4x. The company is debt-free, boasting high-quality earnings and positive free cash flow, which suggests financial robustness. Over the past year, earnings grew by 6.9%, outpacing the food industry's -5.8%. Recent reports highlight sales of CNY 395 million for nine months ending September 2024, up from CNY 377 million last year, with net income rising to CNY 86.6 million from CNY 74.87 million previously—indicative of strong operational performance in a challenging sector landscape.

- Unlock comprehensive insights into our analysis of Qingdao Foods stock in this health report.

Review our historical performance report to gain insights into Qingdao Foods''s past performance.

Systex (TWSE:6214)

Simply Wall St Value Rating: ★★★★★☆

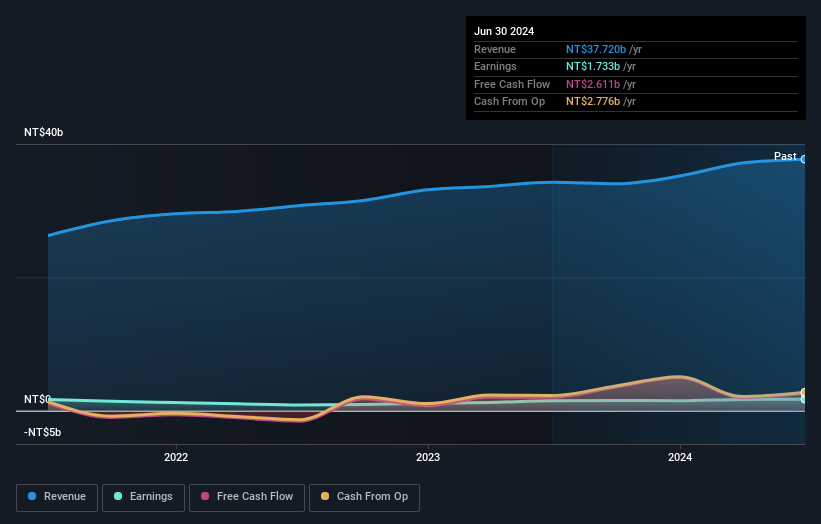

Overview: Systex Corporation offers a range of IT services to enterprise and government clients across Taiwan and Asia, with a market cap of NT$34.12 billion.

Operations: Systex Corporation generates revenue primarily from its Business Software Services Business at NT$13.15 billion and Digital Ecological Integration Business at NT$9.59 billion. The company also earns significant income from its China Headquarters and Financial Services segments, contributing NT$7.73 billion and NT$5.16 billion, respectively. Consumer Market Business adds another NT$6.56 billion to the revenue stream, while adjustments and eliminations account for a reduction of NT$4.48 billion in total revenues.

Systex, a smaller player in the IT sector, has been making waves with its recent performance. The company reported earnings growth of 15%, surpassing the industry's 11%. Despite a notable one-off gain of NT$588M affecting recent results, Systex's financial health appears robust with more cash than debt. Trading at 44% below fair value suggests potential undervaluation. Recent changes include Taiwan Mobile acquiring over 5% stake and board reshuffles due to regulatory compliance. With positive free cash flow and no concerns over interest coverage, Systex seems well-positioned for future opportunities amidst industry dynamics.

- Click to explore a detailed breakdown of our findings in Systex's health report.

Evaluate Systex's historical performance by accessing our past performance report.

Seize The Opportunity

- Dive into all 4718 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Systex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6214

Systex

Provides various IT services for enterprise and government clients in Taiwan and Asia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives