- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4013

Here's Why Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Dr. Sulaiman Al Habib Medical Services Group with the means to add long-term value to shareholders.

See our latest analysis for Dr. Sulaiman Al Habib Medical Services Group

How Quickly Is Dr. Sulaiman Al Habib Medical Services Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Dr. Sulaiman Al Habib Medical Services Group's EPS has grown 27% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

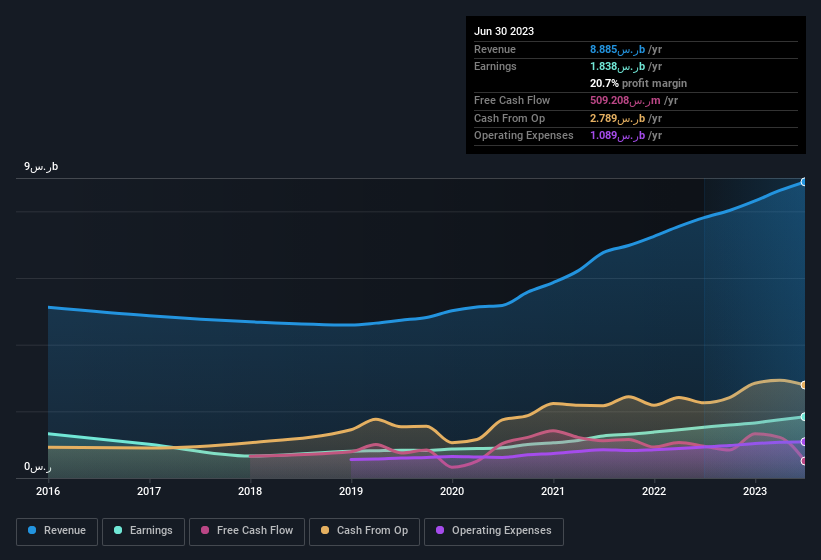

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Dr. Sulaiman Al Habib Medical Services Group maintained stable EBIT margins over the last year, all while growing revenue 14% to ر.س8.9b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Dr. Sulaiman Al Habib Medical Services Group.

Are Dr. Sulaiman Al Habib Medical Services Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Dr. Sulaiman Al Habib Medical Services Group insiders own a meaningful share of the business. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. ر.س34b That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to Dr. Sulaiman Al Habib Medical Services Group, with market caps over ر.س30b, is around ر.س3.2m.

Dr. Sulaiman Al Habib Medical Services Group's CEO took home a total compensation package of ر.س230k in the year prior to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Dr. Sulaiman Al Habib Medical Services Group Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Dr. Sulaiman Al Habib Medical Services Group's strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. This may only be a fast rundown, but the key takeaway is that Dr. Sulaiman Al Habib Medical Services Group is worth keeping an eye on. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Dr. Sulaiman Al Habib Medical Services Group that you should be aware of.

Although Dr. Sulaiman Al Habib Medical Services Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4013

Dr. Sulaiman Al Habib Medical Services Group

Dr. Sulaiman Al Habib Medical Services Group Company establishes, manages, and operates hospitals, general and specialized medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally.

Reasonable growth potential with acceptable track record.