- Saudi Arabia

- /

- Food

- /

- SASE:6090

Does Jazan Energy and Development Co.'s (TADAWUL:6090) Weak Fundamentals Mean That The Market Could Correct Its Share Price?

Most readers would already be aware that Jazan Energy and Development's (TADAWUL:6090) stock increased significantly by 13% over the past three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. Specifically, we decided to study Jazan Energy and Development's ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Jazan Energy and Development

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Jazan Energy and Development is:

1.7% = ر.س9.3m ÷ ر.س531m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every SAR1 worth of equity, the company was able to earn SAR0.02 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Jazan Energy and Development's Earnings Growth And 1.7% ROE

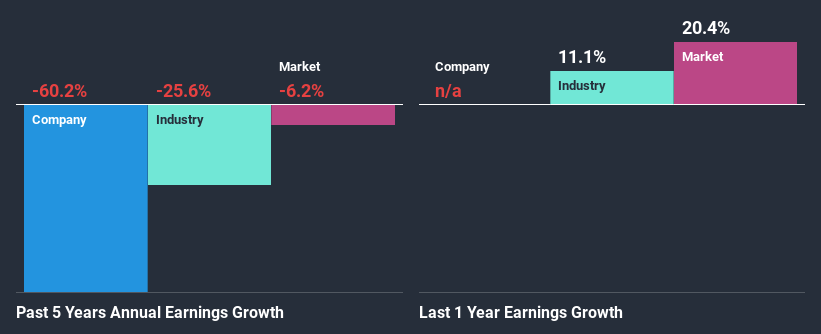

It is quite clear that Jazan Energy and Development's ROE is rather low. Not just that, even compared to the industry average of 12%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 60% seen by Jazan Energy and Development over the last five years is not surprising. We reckon that there could also be other factors at play here. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

Furthermore, even when compared to the industry, which has been shrinking its earnings at a rate 26% in the same period, we found that Jazan Energy and Development's performance is pretty disappointing, as it suggests that the company has been shrunk its earnings at a rate faster than the industry.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Jazan Energy and Development fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Jazan Energy and Development Using Its Retained Earnings Effectively?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Conclusion

Overall, we would be extremely cautious before making any decision on Jazan Energy and Development. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Jazan Energy and Development's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading Jazan Energy and Development or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Jazan Development and Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:6090

Jazan Development and Investment

Engages in the aquaculture, agricultural, manufacturing, industrial, real estate, and other businesses in Saudi Arabia and Russia.

Mediocre balance sheet very low.

Market Insights

Community Narratives