- Israel

- /

- Food and Staples Retail

- /

- TASE:DIPL

Al-Jouf Agricultural Development Leads 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced mixed outcomes, influenced by falling oil prices and weaker-than-expected U.S. economic data, which have impacted investor sentiment across the Gulf region. Despite these fluctuations, the search for undiscovered gems with strong potential remains a key focus for investors navigating these dynamic conditions, with companies like Al-Jouf Agricultural Development emerging as noteworthy contenders.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Al-Jouf Agricultural Development (SASE:6070)

Simply Wall St Value Rating: ★★★★★☆

Overview: Al-Jouf Agricultural Development Co. is involved in the production, sale, and marketing of agricultural products within Saudi Arabia and has a market capitalization of SAR1.43 billion.

Operations: Al-Jouf Agricultural generates revenue primarily from its agricultural activity manufacturing segment, which contributes SAR499.60 million, significantly overshadowing the SAR83.19 million from agricultural activity plants.

Al-Jouf Agricultural Development, a notable player in the Middle East's agricultural sector, showcases robust financial health with its interest payments well-covered by EBIT at 11 times. Its net debt to equity ratio stands at 29.8%, deemed satisfactory, and earnings growth of 21.5% last year outpaced the food industry average of 14.2%. The company's net income rose to SAR 75 million from SAR 69 million previously, reflecting high-quality past earnings and a price-to-earnings ratio of 18.9x below the SA market average. Recent dividends affirmations further highlight shareholder value focus with SAR 15 million distributed for fiscal year-end.

Diplomat Holdings (TASE:DIPL)

Simply Wall St Value Rating: ★★★★★★

Overview: Diplomat Holdings Ltd. is a sales and distribution company in the fast-moving consumer goods sector with a market cap of ₪1.15 billion.

Operations: Diplomat Holdings generates revenue through its sales and distribution activities in the fast-moving consumer goods sector. The company's financial performance is highlighted by a net profit margin of 3.5%.

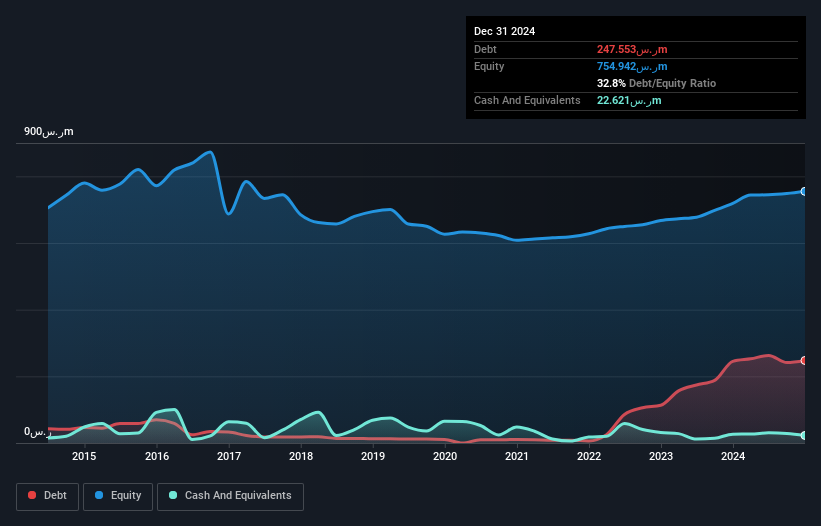

Diplomat Holdings, a small-cap player in the Middle East, showcases promising financial health with its debt to equity ratio dropping from 97.6% to 42.3% over five years and a net debt to equity standing at 20.8%, which is satisfactory. The company reported earnings growth of 53% last year, outpacing the industry average of 51%. Despite this growth, it's trading at a significant discount—75% below its estimated fair value. A notable one-off gain of ₪34.9M impacted recent results; however, earnings per share jumped from ILS 2.66 to ILS 4.07 year-over-year, indicating robust performance amidst market dynamics.

- Unlock comprehensive insights into our analysis of Diplomat Holdings stock in this health report.

Gain insights into Diplomat Holdings' past trends and performance with our Past report.

I.E.S Holdings (TASE:IES)

Simply Wall St Value Rating: ★★★★★★

Overview: I.E.S Holdings Ltd focuses on real estate investment operations in Israel with a market capitalization of ₪1.23 billion.

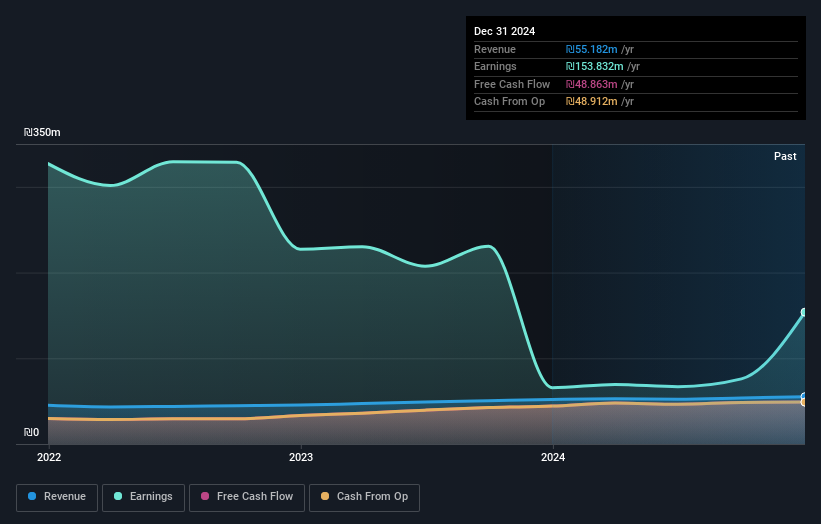

Operations: The company generates revenue primarily through its investment in real estate, with reported revenues of ₪55.18 million.

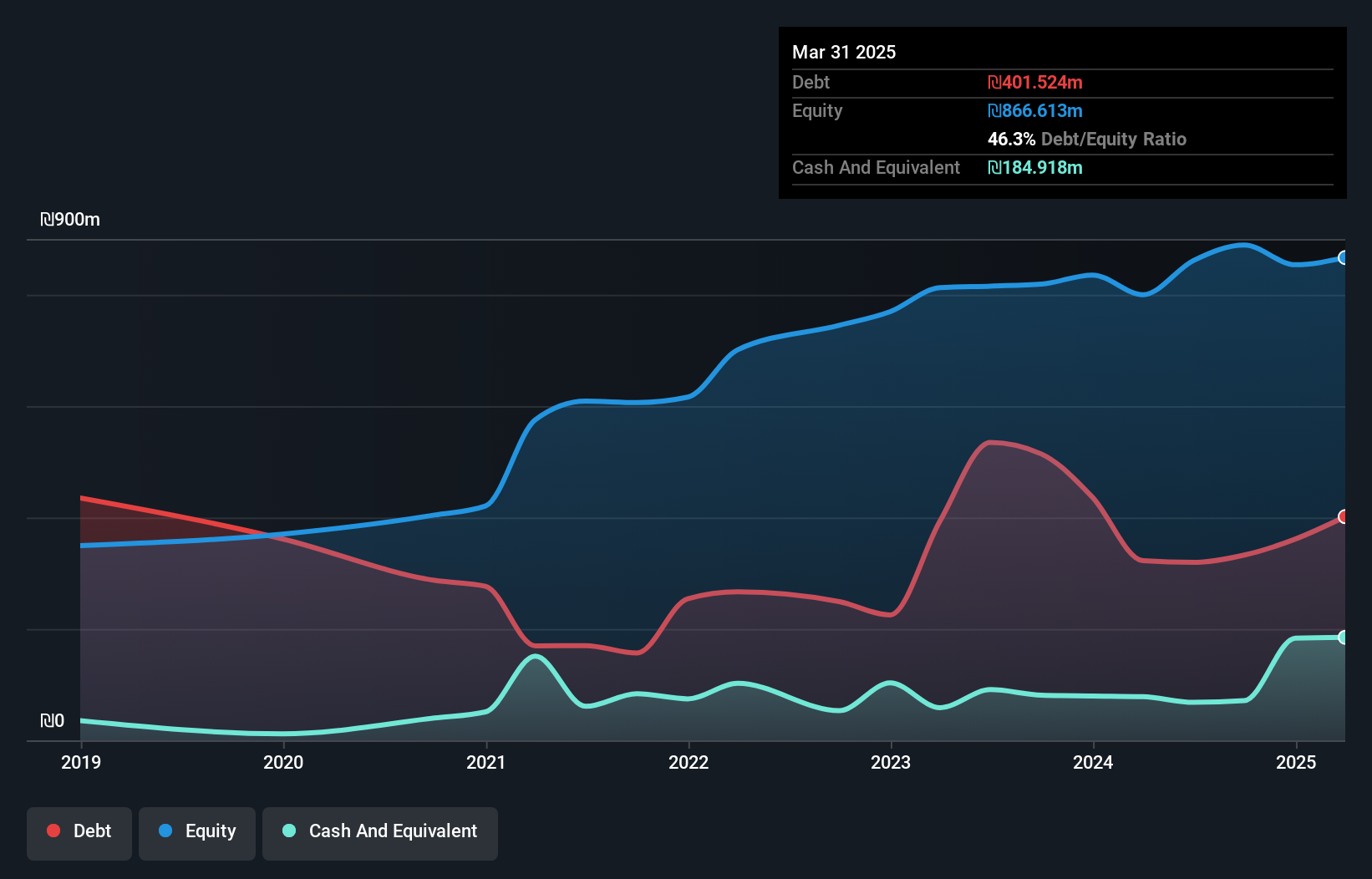

I.E.S Holdings, a small player in the Middle East market, shows promising financial health with earnings soaring by 134% last year, outpacing the real estate sector's 34.6% growth. This surge was partly due to a significant one-off gain of ₪140.7M impacting its results for 2024. The company boasts a solid balance sheet with more cash than total debt and has successfully reduced its debt-to-equity ratio from 0.7% to 0.1% over five years. Its price-to-earnings ratio of 8x suggests good value compared to the IL market average of 13.8x, making it an intriguing prospect for investors seeking potential growth opportunities in this region.

- Delve into the full analysis health report here for a deeper understanding of I.E.S Holdings.

Examine I.E.S Holdings' past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 243 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DIPL

Diplomat Holdings

Operates as a sales and distribution company in the fast-moving consumer goods sector.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives