- Saudi Arabia

- /

- Food

- /

- SASE:6060

Ash-Sharqiyah Development (TADAWUL:6060) pulls back 12% this week, but still delivers shareholders notable 9.2% CAGR over 3 years

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Ash-Sharqiyah Development Co. (TADAWUL:6060) shareholders have had that experience, with the share price dropping 81% in three years, versus a market return of about 28%. The falls have accelerated recently, with the share price down 29% in the last three months. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Ash-Sharqiyah Development

With zero revenue generated over twelve months, we don't think that Ash-Sharqiyah Development has proved its business plan yet. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Ash-Sharqiyah Development can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). It certainly is a dangerous place to invest, as Ash-Sharqiyah Development investors might realise.

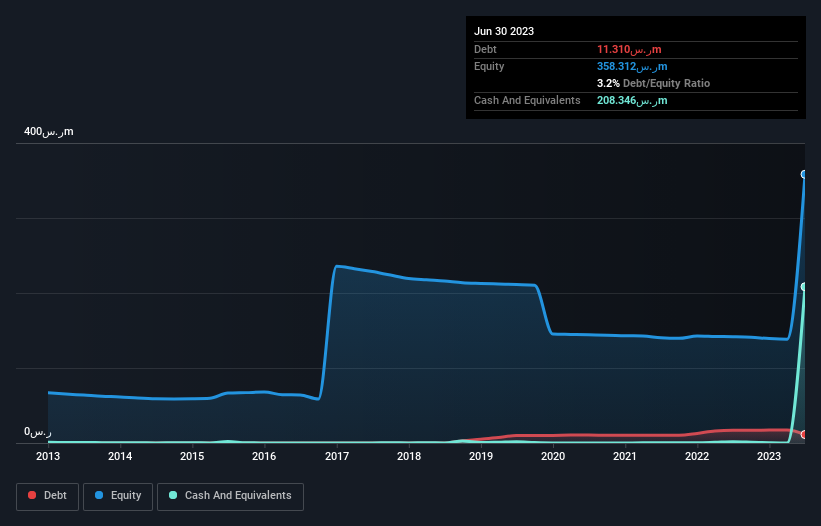

When it last reported its balance sheet in June 2023, Ash-Sharqiyah Development could boast a strong position, with cash in excess of all liabilities of ر.س173m. That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 22% per year, over 3 years , it seems like the market might have been over-excited previously. You can click on the image below to see (in greater detail) how Ash-Sharqiyah Development's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Ash-Sharqiyah Development's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Ash-Sharqiyah Development hasn't been paying dividends, but its TSR of 30% exceeds its share price return of -81%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Ash-Sharqiyah Development has rewarded shareholders with a total shareholder return of 64% in the last twelve months. That gain is better than the annual TSR over five years, which is 21%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Ash-Sharqiyah Development that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:6060

Ash-Sharqiyah Development

Produces and markets agricultural greenfeed in Saudi Arabia.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives