- Saudi Arabia

- /

- Food

- /

- SASE:6010

National Agricultural Development's (TADAWUL:6010) earnings growth rate lags the 14% CAGR delivered to shareholders

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the National Agricultural Development share price has climbed 97% in five years, easily topping the market return of 27% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 64% in the last year.

Although National Agricultural Development has shed ر.س300m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for National Agricultural Development

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, National Agricultural Development moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

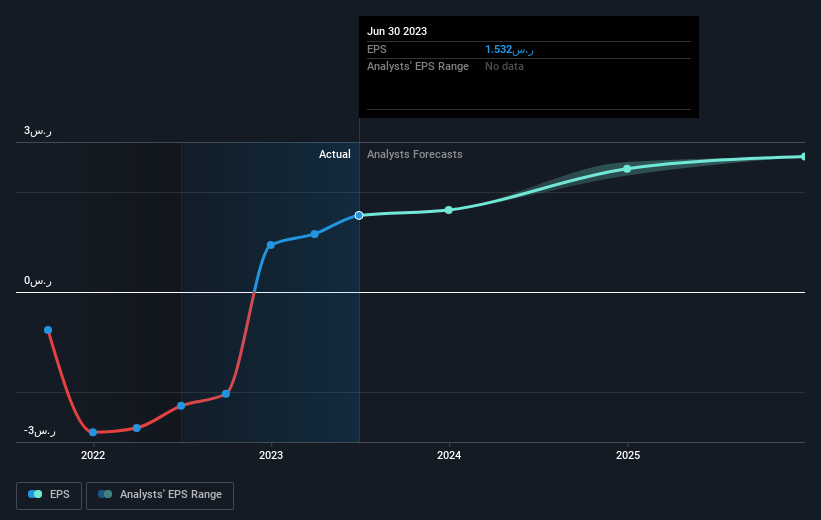

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that National Agricultural Development has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's nice to see that National Agricultural Development shareholders have received a total shareholder return of 64% over the last year. That's better than the annualised return of 14% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand National Agricultural Development better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with National Agricultural Development , and understanding them should be part of your investment process.

But note: National Agricultural Development may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if National Agricultural Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:6010

National Agricultural Development

Engages in production of agricultural and livestock products in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet with solid track record.