What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. So after we looked into Halwani Bros (TADAWUL:6001), the trends above didn't look too great.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Halwani Bros is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.043 = ر.س20m ÷ (ر.س949m - ر.س479m) (Based on the trailing twelve months to March 2023).

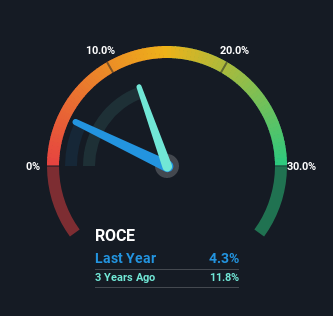

Thus, Halwani Bros has an ROCE of 4.3%. Ultimately, that's a low return and it under-performs the Food industry average of 10%.

View our latest analysis for Halwani Bros

In the above chart we have measured Halwani Bros' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Halwani Bros.

SWOT Analysis for Halwani Bros

- No major strengths identified for 6001.

- Interest payments on debt are not well covered.

- Dividend is low compared to the top 25% of dividend payers in the Food market.

- Expensive based on P/S ratio and estimated fair value.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Debt is not well covered by operating cash flow.

- Dividends are not covered by earnings.

What Can We Tell From Halwani Bros' ROCE Trend?

In terms of Halwani Bros' historical ROCE trend, it isn't fantastic. The company used to generate 17% on its capital five years ago but it has since fallen noticeably. In addition to that, Halwani Bros is now employing 23% less capital than it was five years ago. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

Another thing to note, Halwani Bros has a high ratio of current liabilities to total assets of 51%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

What We Can Learn From Halwani Bros' ROCE

To see Halwani Bros reducing the capital employed in the business in tandem with diminishing returns, is concerning. However the stock has delivered a 64% return to shareholders over the last five years, so investors might be expecting the trends to turn around. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

One more thing, we've spotted 2 warning signs facing Halwani Bros that you might find interesting.

While Halwani Bros isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you're looking to trade Halwani Bros, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Halwani Bros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:6001

Halwani Bros

Manufactures, packages, wholesales, and retails food products in the Kingdom of Saudi Arabia, Arab Republic of Egypt, and internationally.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives