- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:4280

Kingdom Holding (TADAWUL:4280) Will Pay A Dividend Of SAR0.07

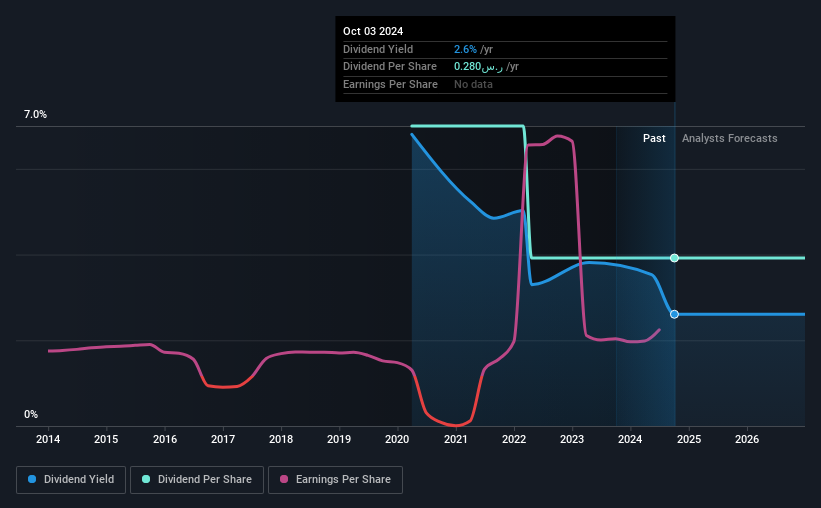

Kingdom Holding Company (TADAWUL:4280) will pay a dividend of SAR0.07 on the 1st of January. This makes the dividend yield 2.6%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Kingdom Holding's stock price has increased by 57% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Kingdom Holding

Kingdom Holding's Payment Could Potentially Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, Kingdom Holding's dividend was making up a very large proportion of earnings and perhaps more concerning was that it was 217% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS is forecast to expand by 33.7%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 55% which would be quite comfortable going to take the dividend forward.

Kingdom Holding's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. This suggests that the dividend might not be the most reliable. Since 2019, the annual payment back then was SAR0.50, compared to the most recent full-year payment of SAR0.28. This works out to a decline of approximately 44% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Kingdom Holding Might Find It Hard To Grow Its Dividend

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. We are encouraged to see that Kingdom Holding has grown earnings per share at 18% per year over the past five years. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We don't think Kingdom Holding is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Kingdom Holding (1 is a bit concerning!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4280

Kingdom Holding

A private equity firm specializing in making investments in banking and financial services, real estate, luxury hotels and hotel management, digital services, e-commerce, investment funds, hospitality, aviation, hotel real estate, petrochemicals, ride sharing, media and publishing, entertainment, healthcare including healthcare provision and healthcare management and consultancy, education, energy, manufacturing, consumer and retail, agriculture, social media, technology and industrial sectors.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives