- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:4280

Earnings Not Telling The Story For Kingdom Holding Company (TADAWUL:4280) After Shares Rise 30%

The Kingdom Holding Company (TADAWUL:4280) share price has done very well over the last month, posting an excellent gain of 30%. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

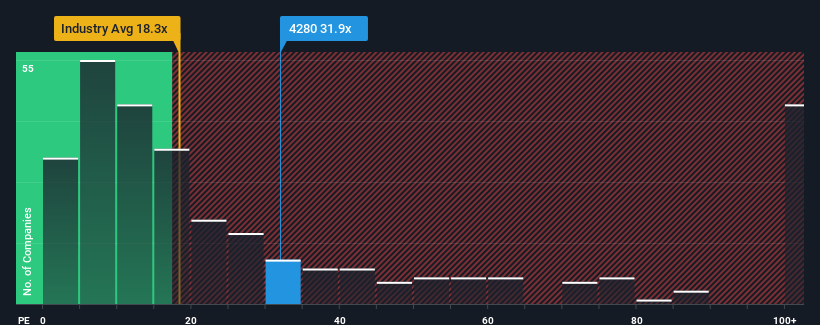

After such a large jump in price, Kingdom Holding may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 31.9x, since almost half of all companies in Saudi Arabia have P/E ratios under 26x and even P/E's lower than 17x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Kingdom Holding could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Kingdom Holding

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Kingdom Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 5.3% per year during the coming three years according to the sole analyst following the company. With the market predicted to deliver 15% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Kingdom Holding is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Kingdom Holding's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kingdom Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Kingdom Holding (1 is significant!) that you need to take into consideration.

You might be able to find a better investment than Kingdom Holding. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4280

Kingdom Holding

A private equity firm specializing in making investments in banking and financial services, real estate, luxury hotels and hotel management, digital services, e-commerce, investment funds, hospitality, aviation, hotel real estate, petrochemicals, ride sharing, media and publishing, entertainment, healthcare including healthcare provision and healthcare management and consultancy, education, energy, manufacturing, consumer and retail, agriculture, social media, technology and industrial sectors.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives