- Saudi Arabia

- /

- Hospitality

- /

- SASE:6016

What Shatirah House Restaurant Co.'s (TADAWUL:9520) 25% Share Price Gain Is Not Telling You

Shatirah House Restaurant Co. (TADAWUL:9520) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

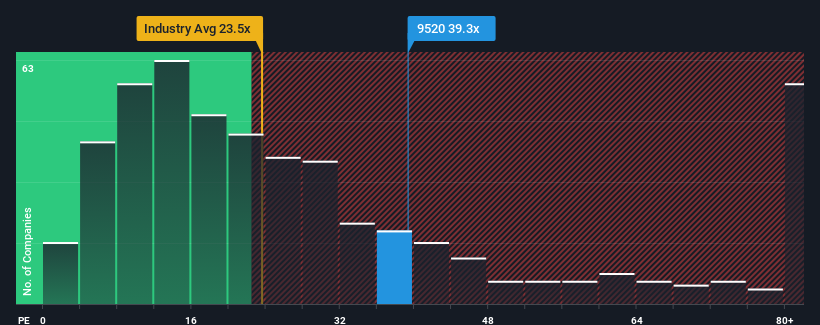

Following the firm bounce in price, given close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 25x, you may consider Shatirah House Restaurant as a stock to avoid entirely with its 39.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Shatirah House Restaurant as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shatirah House Restaurant

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Shatirah House Restaurant's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 356% last year. Still, incredibly EPS has fallen 35% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 18% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Shatirah House Restaurant's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Shares in Shatirah House Restaurant have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shatirah House Restaurant revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shatirah House Restaurant, and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Shatirah House Restaurant. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Shatirah House Restaurant, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:6016

Shatirah House Restaurant

Operates quick service restaurants under the Burgerizzr brand in Saudi Arabia.

Excellent balance sheet very low.

Market Insights

Community Narratives