- Saudi Arabia

- /

- Consumer Services

- /

- SASE:4291

What You Need To Know About National Company for Learning and Education's (TADAWUL:4291) Investor Composition

The big shareholder groups in National Company for Learning and Education (TADAWUL:4291) have power over the company. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Companies that used to be publicly owned tend to have lower insider ownership.

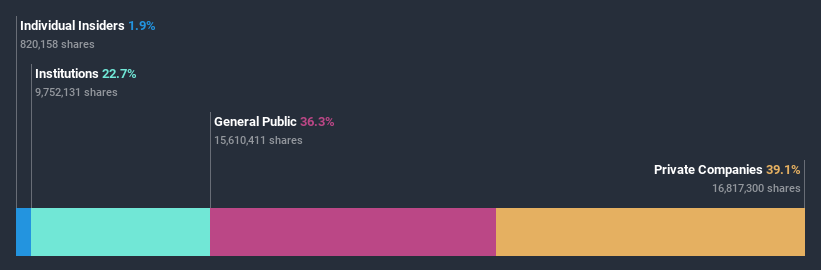

National Company for Learning and Education is not a large company by global standards. It has a market capitalization of ر.س2.2b, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutional investors have bought into the company. We can zoom in on the different ownership groups, to learn more about National Company for Learning and Education.

See our latest analysis for National Company for Learning and Education

What Does The Institutional Ownership Tell Us About National Company for Learning and Education?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

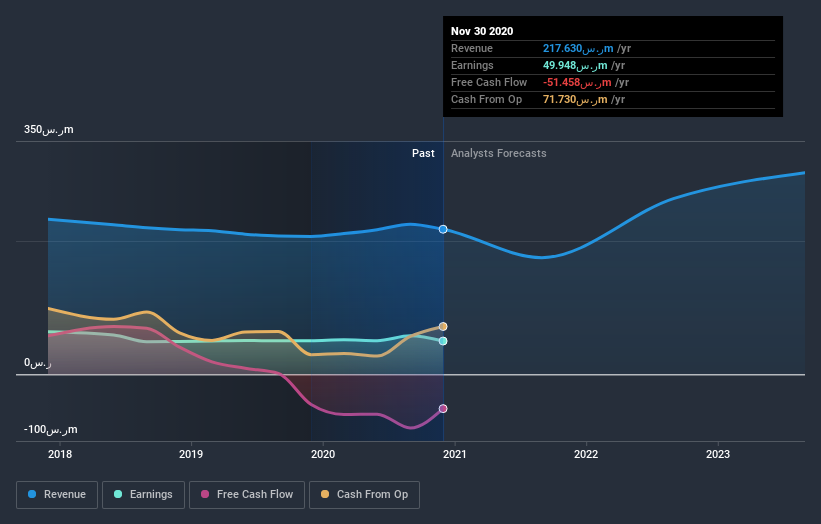

We can see that National Company for Learning and Education does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at National Company for Learning and Education's earnings history below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in National Company for Learning and Education. Our data shows that Mohammed Al Khudair Real Estate Development Company is the largest shareholder with 39% of shares outstanding. Mohammed Ibrahim Al-Khudair Waqf Foundation., Endowment Arm is the second largest shareholder owning 22% of common stock, and Khaled Bin Mohammed Bin Ibrahim Al Khudair holds about 0.7% of the company stock. Khaled Bin Mohammed Bin Ibrahim Al Khudair, who is the third-largest shareholder, also happens to hold the title of Chairman of the Board.

To make our study more interesting, we found that the top 2 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of National Company for Learning and Education

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

We can see that insiders own shares in National Company for Learning and Education. As individuals, the insiders collectively own ر.س42m worth of the ر.س2.2b company. It is good to see some investment by insiders, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public holds a 36% stake in National Company for Learning and Education. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 39%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand National Company for Learning and Education better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for National Company for Learning and Education you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade National Company for Learning and Education, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Company for Learning and Education might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4291

National Company for Learning and Education

Owns, establishes, manages, and operates kindergarten, primary, middle, and secondary schools in the Kingdom of Saudi Arabia.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives