- Saudi Arabia

- /

- Consumer Services

- /

- SASE:4291

Do National Company for Learning and Education's (TADAWUL:4291) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like National Company for Learning and Education (TADAWUL:4291). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

National Company for Learning and Education's Improving Profits

In the last three years National Company for Learning and Education's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, National Company for Learning and Education's EPS catapulted from ر.س2.33 to ر.س4.00, over the last year. Year on year growth of 72% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that, last year, National Company for Learning and Education's revenue from operations was lower than its revenue, so that could distort our analysis of its margins. The music to the ears of National Company for Learning and Education shareholders is that EBIT margins have grown from 24% to 31% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

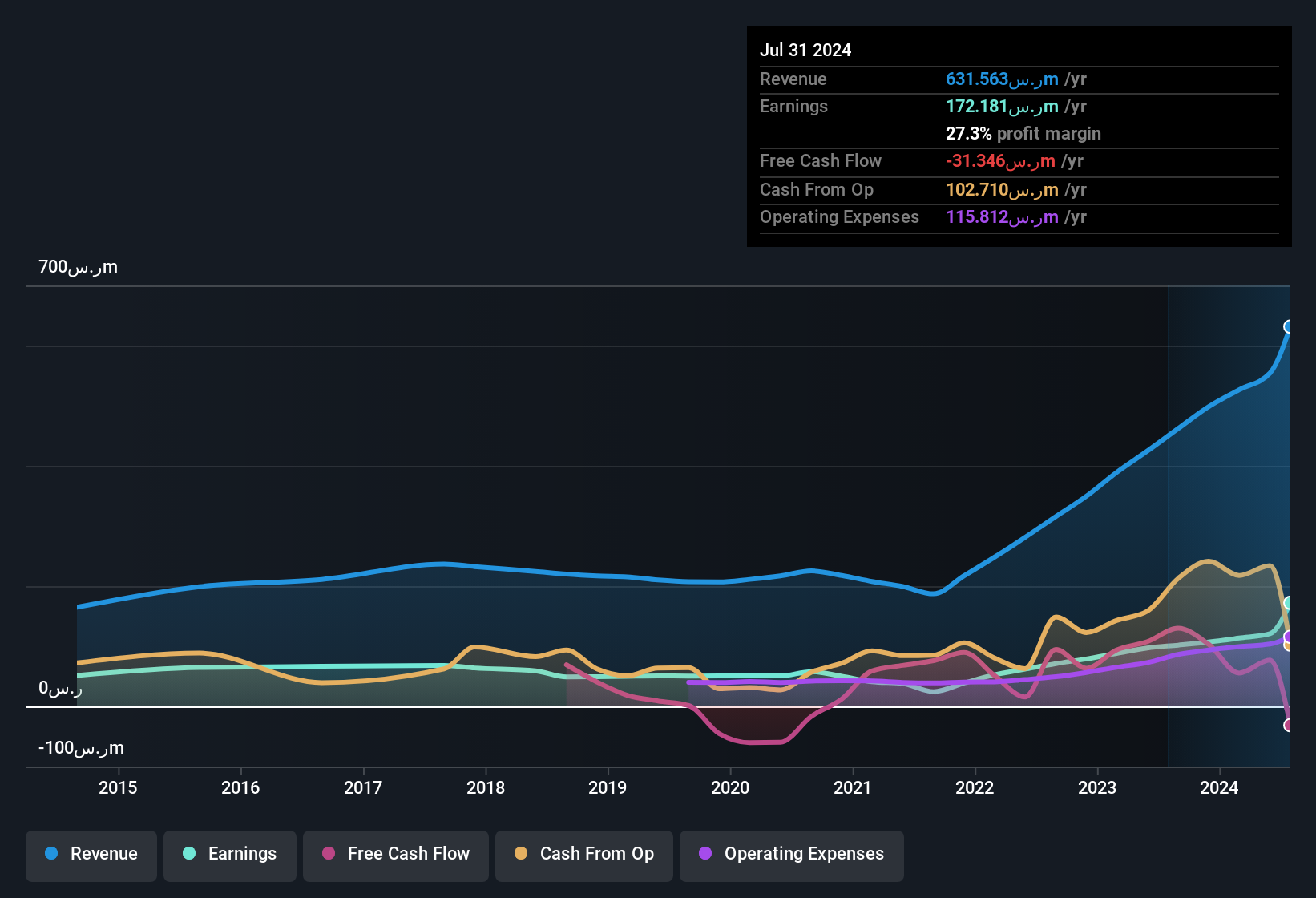

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for National Company for Learning and Education

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for National Company for Learning and Education?

Are National Company for Learning and Education Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that National Company for Learning and Education insiders have a significant amount of capital invested in the stock. We note that their impressive stake in the company is worth ر.س1.6b. Coming in at 22% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does National Company for Learning and Education Deserve A Spot On Your Watchlist?

National Company for Learning and Education's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching National Company for Learning and Education very closely. We don't want to rain on the parade too much, but we did also find 1 warning sign for National Company for Learning and Education that you need to be mindful of.

Although National Company for Learning and Education certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Saudi companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Company for Learning and Education might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4291

National Company for Learning and Education

Owns, establishes, manages, and operates kindergarten, primary, middle, and secondary schools in the Kingdom of Saudi Arabia.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives