- Saudi Arabia

- /

- Hospitality

- /

- SASE:1820

Abdulmohsen Al-Hokair Group for Tourism and Development Company (TADAWUL:1820) Stock Catapults 28% Though Its Price And Business Still Lag The Industry

Despite an already strong run, Abdulmohsen Al-Hokair Group for Tourism and Development Company (TADAWUL:1820) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 44%.

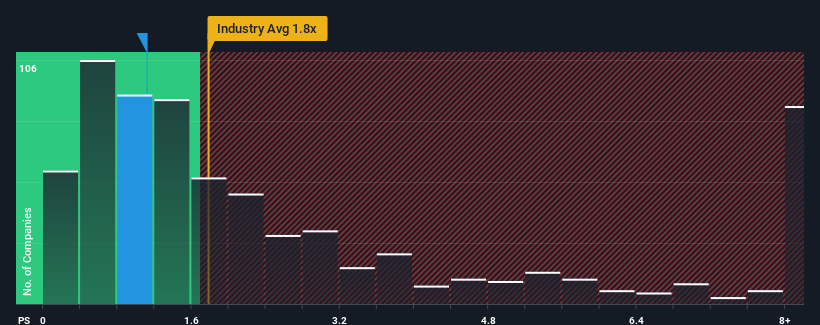

Even after such a large jump in price, Abdulmohsen Al-Hokair Group for Tourism and Development may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Hospitality industry in Saudi Arabia have P/S ratios greater than 2.5x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Abdulmohsen Al-Hokair Group for Tourism and Development

What Does Abdulmohsen Al-Hokair Group for Tourism and Development's Recent Performance Look Like?

Abdulmohsen Al-Hokair Group for Tourism and Development could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Abdulmohsen Al-Hokair Group for Tourism and Development's future stacks up against the industry? In that case, our free report is a great place to start.How Is Abdulmohsen Al-Hokair Group for Tourism and Development's Revenue Growth Trending?

Abdulmohsen Al-Hokair Group for Tourism and Development's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 8.9% gain to the company's revenues. The latest three year period has also seen a 9.2% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 7.6% over the next year. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

In light of this, it's understandable that Abdulmohsen Al-Hokair Group for Tourism and Development's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Abdulmohsen Al-Hokair Group for Tourism and Development's P/S Mean For Investors?

Despite Abdulmohsen Al-Hokair Group for Tourism and Development's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Abdulmohsen Al-Hokair Group for Tourism and Development's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Abdulmohsen Al-Hokair Group for Tourism and Development (1 makes us a bit uncomfortable!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BAAN Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1820

BAAN Holding Group

BAAN Holding Group Company for Tourism and Development Company provides hospitality and entertainment services in the Kingdom of Saudi Arabia, the United Arab Emirates, and Egypt.

Reasonable growth potential and fair value.

Market Insights

Community Narratives