- Saudi Arabia

- /

- Hospitality

- /

- SASE:1810

Why Investors Shouldn't Be Surprised By Seera Holding Group's (TADAWUL:1810) P/S

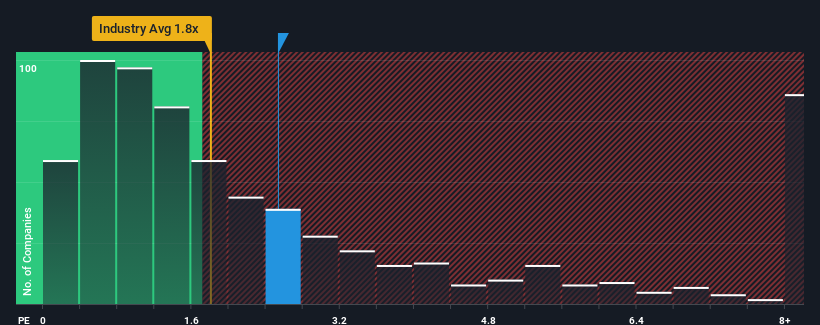

With a median price-to-sales (or "P/S") ratio of close to 2.4x in the Hospitality industry in Saudi Arabia, you could be forgiven for feeling indifferent about Seera Holding Group's (TADAWUL:1810) P/S ratio of 2.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Seera Holding Group

What Does Seera Holding Group's Recent Performance Look Like?

Recent times have been advantageous for Seera Holding Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Seera Holding Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Seera Holding Group's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 54% last year. Pleasingly, revenue has also lifted 140% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the five analysts watching the company. That's shaping up to be similar to the 16% each year growth forecast for the broader industry.

With this information, we can see why Seera Holding Group is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Seera Holding Group's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Seera Holding Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You always need to take note of risks, for example - Seera Holding Group has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Seera Holding Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1810

Seera Holding Group

Provides travel and tourism services in the Kingdom of Saudi Arabia, the United Kingdom, Egypt, the United Arab Emirates, Spain, and Kuwait.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives