- Saudi Arabia

- /

- Hospitality

- /

- SASE:1810

Seera Holding Group's(TADAWUL:1810) Share Price Is Down 51% Over The Past Five Years.

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Seera Holding Group (TADAWUL:1810), since the last five years saw the share price fall 51%.

Check out our latest analysis for Seera Holding Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

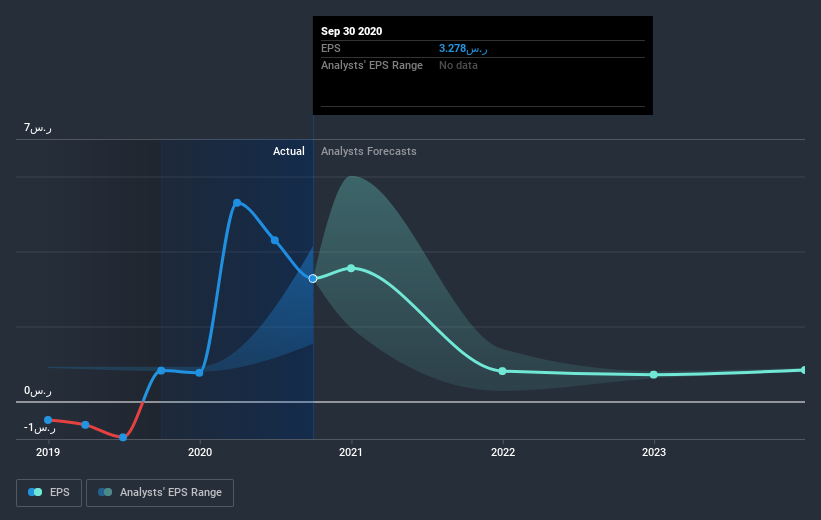

During the five years over which the share price declined, Seera Holding Group's earnings per share (EPS) dropped by 4.9% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 13% per year, over the period. So it seems the market was too confident about the business, in the past. The low P/E ratio of 5.77 further reflects this reticence.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Seera Holding Group has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Investors in Seera Holding Group had a tough year, with a total loss of 9.8%, against a market gain of about 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Seera Holding Group better, we need to consider many other factors. For instance, we've identified 2 warning signs for Seera Holding Group that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you’re looking to trade Seera Holding Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:1810

Seera Holding Group

Provides travel and tourism services in the Kingdom of Saudi Arabia, the United Kingdom, Egypt, the United Arab Emirates, Spain, and Kuwait.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives