As global markets experience a mix of record highs and inflationary pressures, investors are navigating a landscape marked by fluctuating interest rates and economic uncertainties. In such an environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.48 | US$36.92 | 49.9% |

| Hibino (TSE:2469) | ¥2770.00 | ¥5502.15 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$110.50 | NT$220.75 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$55.32 | US$110.32 | 49.9% |

| América Móvil. de (BMV:AMX B) | MX$14.90 | MX$29.71 | 49.9% |

| Com2uS (KOSDAQ:A078340) | ₩48250.00 | ₩96043.49 | 49.8% |

| F-Secure Oyj (HLSE:FSECURE) | €1.706 | €3.41 | 49.9% |

| AIMECHATEC (TSE:6227) | ¥3785.00 | ¥7563.15 | 50% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €3.285 | €6.57 | 50% |

Here's a peek at a few of the choices from the screener.

Seera Holding Group (SASE:1810)

Overview: Seera Holding Group, with a market cap of SAR6.59 billion, operates in the travel and tourism sector across Saudi Arabia, the UK, Egypt, the UAE, Spain, and Kuwait through its subsidiaries.

Operations: Seera Holding Group's revenue segments include Tourism at SAR1.63 billion, Ticketing at SAR661.91 million, Hospitality at SAR141.66 million, Transportation at SAR1.48 billion, and Property Rentals (Excl. Hospitality) at SAR93.87 million.

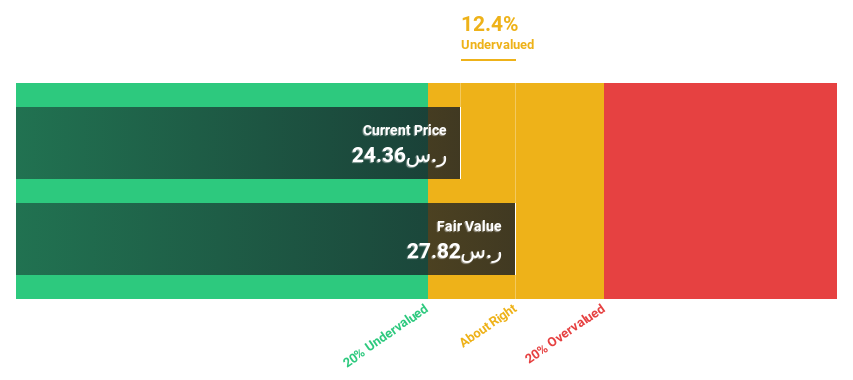

Estimated Discount To Fair Value: 10.4%

Seera Holding Group is trading at SAR24.46, slightly below its estimated fair value of SAR27.29, suggesting it may be undervalued based on cash flows. Despite large one-off items affecting financial results, the company's earnings are expected to grow significantly at 25.5% annually, outpacing the SA market's 5.9%. However, revenue growth is slower than significant thresholds and return on equity remains low at a forecasted 4.8% in three years.

- The analysis detailed in our Seera Holding Group growth report hints at robust future financial performance.

- Dive into the specifics of Seera Holding Group here with our thorough financial health report.

Suzhou Shihua New Material Technology (SHSE:688093)

Overview: Suzhou Shihua New Material Technology Co., Ltd. (SHSE:688093) specializes in the development and production of advanced materials, with a market cap of CN¥5.40 billion.

Operations: The company's revenue segments are not provided in the text.

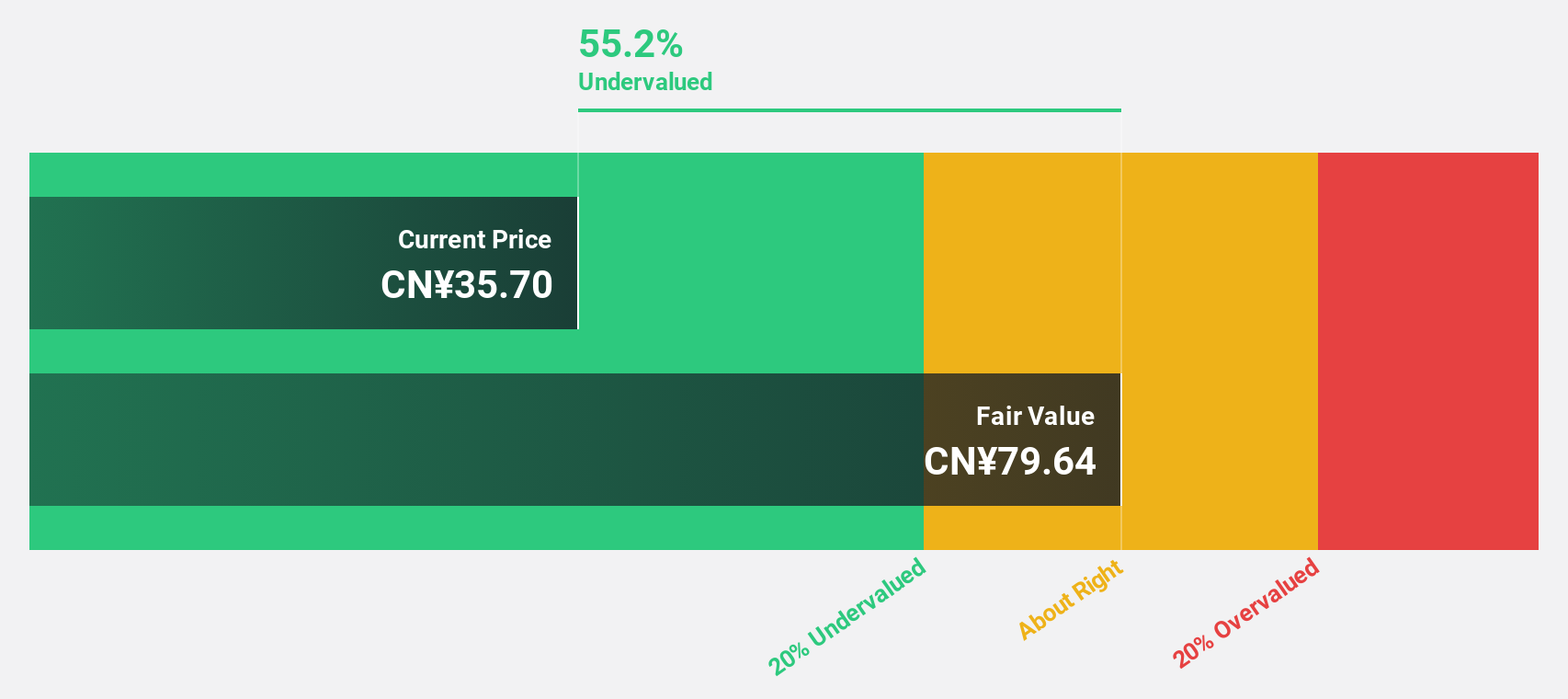

Estimated Discount To Fair Value: 23.8%

Suzhou Shihua New Material Technology is trading at CN¥21.49, below its estimated fair value of CN¥28.22, indicating undervaluation based on cash flows. The company's revenue and earnings are forecast to grow at 35% and 25.3% annually, respectively, both outpacing the broader Chinese market growth rates. However, its dividend yield of 1.68% is not well covered by free cash flows, and return on equity is expected to be modest at 15.5%.

- Insights from our recent growth report point to a promising forecast for Suzhou Shihua New Material Technology's business outlook.

- Navigate through the intricacies of Suzhou Shihua New Material Technology with our comprehensive financial health report here.

Shinko Electric Industries (TSE:6967)

Overview: Shinko Electric Industries Co., Ltd. develops, produces, and sells various semiconductor packages in Japan with a market cap of ¥797.46 billion.

Operations: The company's revenue segments include Metal Package at ¥81.89 billion and Plastic Package at ¥123.26 billion.

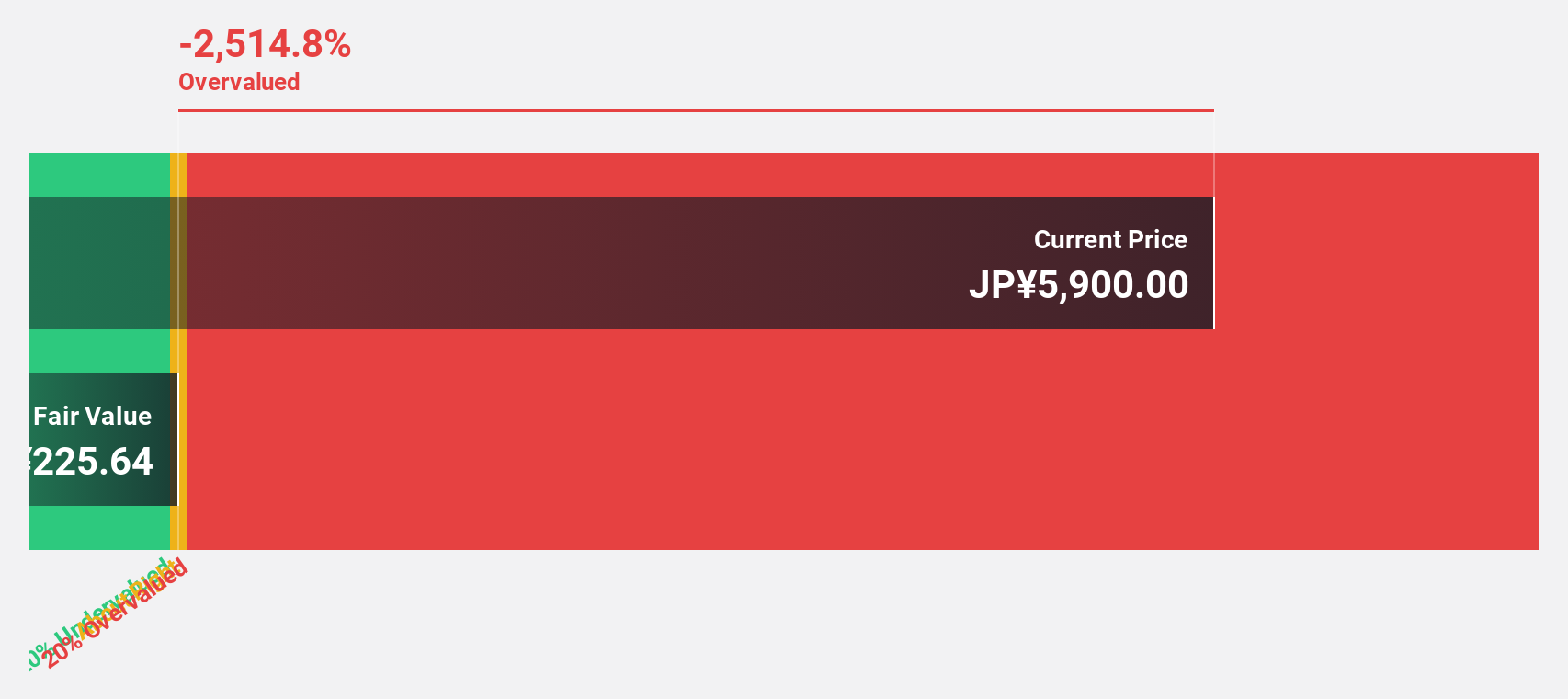

Estimated Discount To Fair Value: 46.3%

Shinko Electric Industries is trading at ¥5,902, significantly below its estimated fair value of ¥10,982.25. The company's earnings are forecast to grow 23.4% annually, outpacing the Japanese market's 8% growth rate. However, revenue growth is expected at a slower pace of 8.3% per year compared to its earnings trajectory and the broader market's revenue growth of 4.2%. Return on equity is projected to be modest at 12.2%.

- Our earnings growth report unveils the potential for significant increases in Shinko Electric Industries' future results.

- Get an in-depth perspective on Shinko Electric Industries' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Explore the 918 names from our Undervalued Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688093

Suzhou Shihua New Material Technology

Suzhou Shihua New Material Technology Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives