- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4162

Almunajem Foods' (TADAWUL:4162) Dividend Will Be SAR1.25

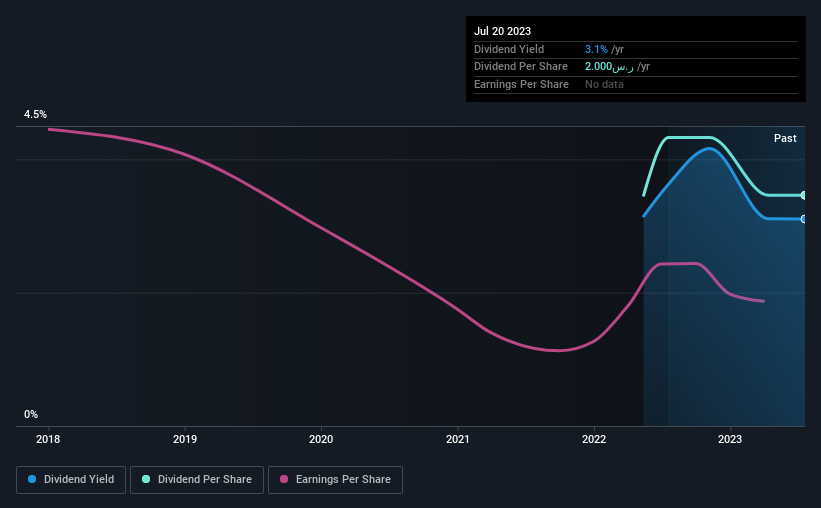

The board of Almunajem Foods Company (TADAWUL:4162) has announced that it will pay a dividend of SAR1.25 per share on the 22nd of August. This means that the annual payment will be 3.1% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for Almunajem Foods

Almunajem Foods' Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, Almunajem Foods' dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Unless the company can turn things around, EPS could fall by 15.9% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 14%, which is definitely feasible to continue.

Almunajem Foods Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Earnings per share has been sinking by 16% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Almunajem Foods' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Almunajem Foods is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Almunajem Foods that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4162

Almunajem Foods

Engages in the wholesale and retail trade of fruits, vegetables, cold and frozen poultry and meat, caned, and other food products in Saudi Arabia.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives