- Israel

- /

- Capital Markets

- /

- TASE:ATRY

Thob Al Aseel And 2 Other Undiscovered Gems In The Middle East Market

Reviewed by Simply Wall St

As Middle East markets navigate a complex landscape of regional tensions and global economic shifts, recent optimism surrounding potential U.S. Federal Reserve rate cuts has provided some relief to investors. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, as demonstrated by Thob Al Aseel and two other promising companies that stand out in the region's dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

We'll examine a selection from our screener results.

Thob Al Aseel (SASE:4012)

Simply Wall St Value Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.43 billion.

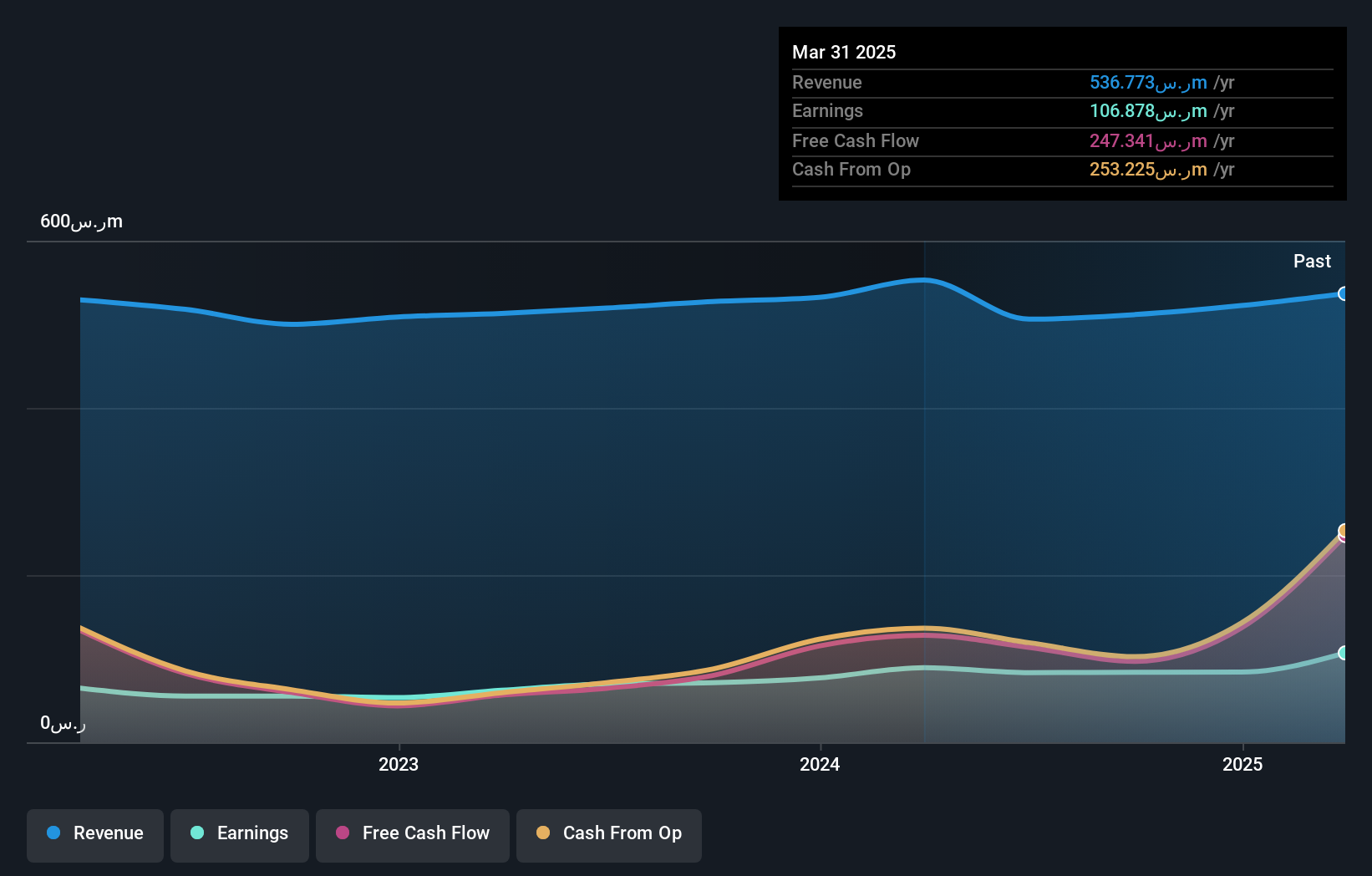

Operations: Thob Al Aseel generates revenue primarily from Thobs and Fabrics, with Thobs contributing SAR 374.05 million and Fabrics adding SAR 125.39 million. The company's financial performance is influenced by these segments, which form the core of its revenue streams.

Thob Al Aseel, a notable player in the Middle East's luxury sector, reported a 7.3% earnings growth over the past year, surpassing the industry's 4.6%. Trading at 80.2% below its estimated fair value, it presents an intriguing opportunity despite recent challenges such as second-quarter sales dropping to SAR 87 million from SAR 116 million last year and net income falling to SAR 9 million from SAR 27 million. The company is debt-free with high-quality earnings and has appointed Khaled Abdullah Al-Omar as CEO, who brings over two decades of experience to steer future growth initiatives.

- Unlock comprehensive insights into our analysis of Thob Al Aseel stock in this health report.

Assess Thob Al Aseel's past performance with our detailed historical performance reports.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

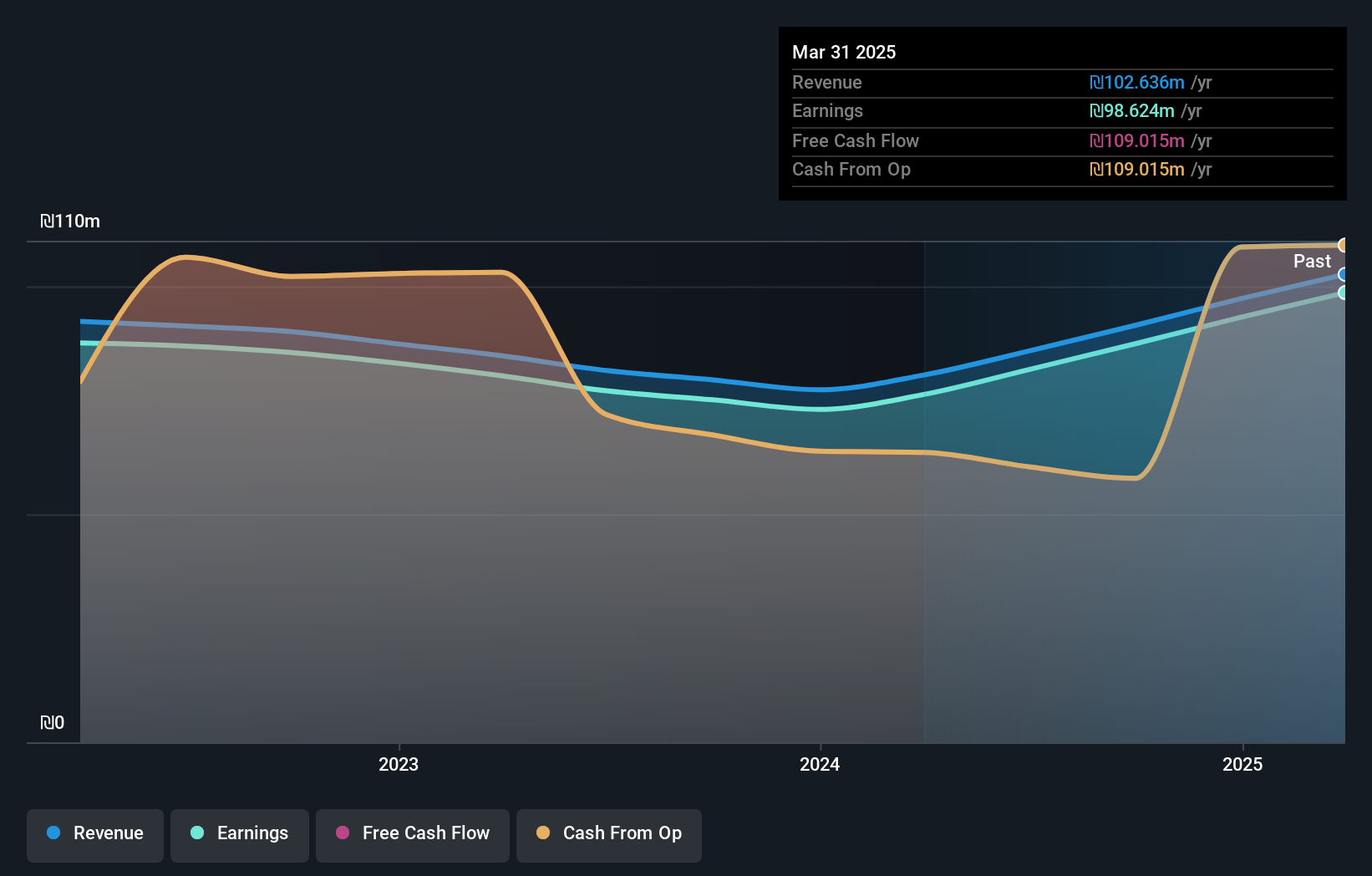

Overview: Atreyu Capital Markets Ltd, with a market cap of ₪1.18 billion, operates in Israel through its subsidiaries by offering investment management services.

Operations: Atreyu Capital Markets generates revenue primarily through its investment management services in Israel. The company has a market cap of ₪1.18 billion, reflecting its financial standing in the sector.

Atreyu Capital Markets, a nimble player in the financial sector, showcases its strength with no debt on its books and a solid cash runway. Over the past five years, earnings have increased by 3.4% annually, highlighting steady growth. The firm's recent performance shines with second-quarter net income climbing to ILS 26.36 million from ILS 23.64 million year-on-year, while revenue reached ILS 27.54 million compared to ILS 24.65 million previously. With a price-to-earnings ratio of 11.6x below the IL market average of 15.5x and high-quality earnings reported, Atreyu seems well-positioned in its industry landscape despite slower growth than peers last year at only 24%.

One Software Technologies (TASE:ONE)

Simply Wall St Value Rating: ★★★★★★

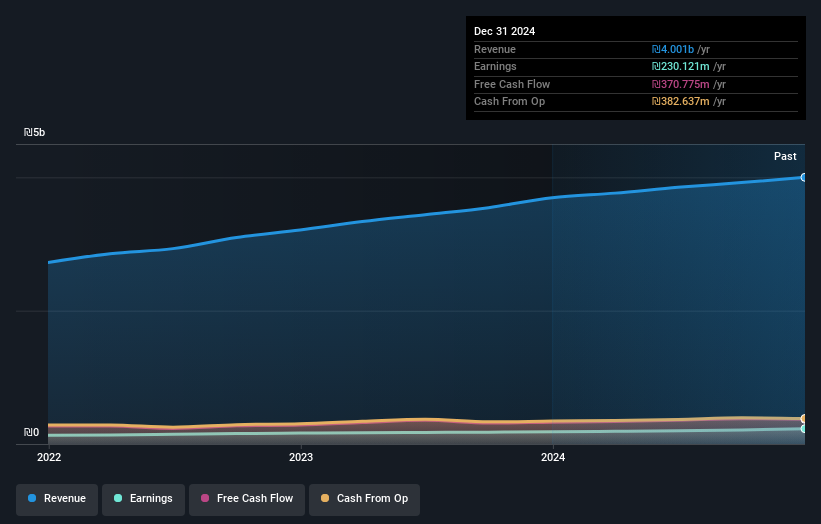

Overview: One Software Technologies Ltd offers a range of software, hardware, and integration services with a market capitalization of ₪5.82 billion.

Operations: Revenue streams for One Software Technologies Ltd include Infrastructure and Computing Solutions at ₪1.28 billion, Outsourcing of Business Processes and Technological Support Centers at ₪365.75 million, and Technological Solutions and Services, Management Consulting, and Value-Added Services at ₪2.68 billion.

One Software Technologies, a nimble player in the IT sector, has shown impressive earnings growth of 26.6% over the past year, outpacing the industry average of 26.3%. The company’s price-to-earnings ratio stands at 23.1x, which is notably below the IT industry average of 26.7x, suggesting it could be undervalued relative to peers. With a debt-to-equity ratio reduced from 47.7% to 27.7% over five years and interest payments well-covered by EBIT at a robust 71.5x coverage, financial stability seems solid. Recent earnings reveal net income rose to ILS 66.87 million for Q2 compared to ILS 53.04 million last year, reflecting strong operational performance.

Seize The Opportunity

- Get an in-depth perspective on all 201 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ATRY

Atreyu Capital Markets

Through its subsidiaries, provides investment management services in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives