Middle Eastern Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As major Gulf markets navigate mixed signals from falling oil prices and hopes for a U.S. rate cut, investors are closely monitoring economic indicators that could influence the region's financial landscape. In this context, dividend stocks can offer a stable income stream, making them an attractive consideration for portfolios seeking resilience amid market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.53% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.23% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.65% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.49% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.12% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.66% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.43% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.32% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.26% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.43% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

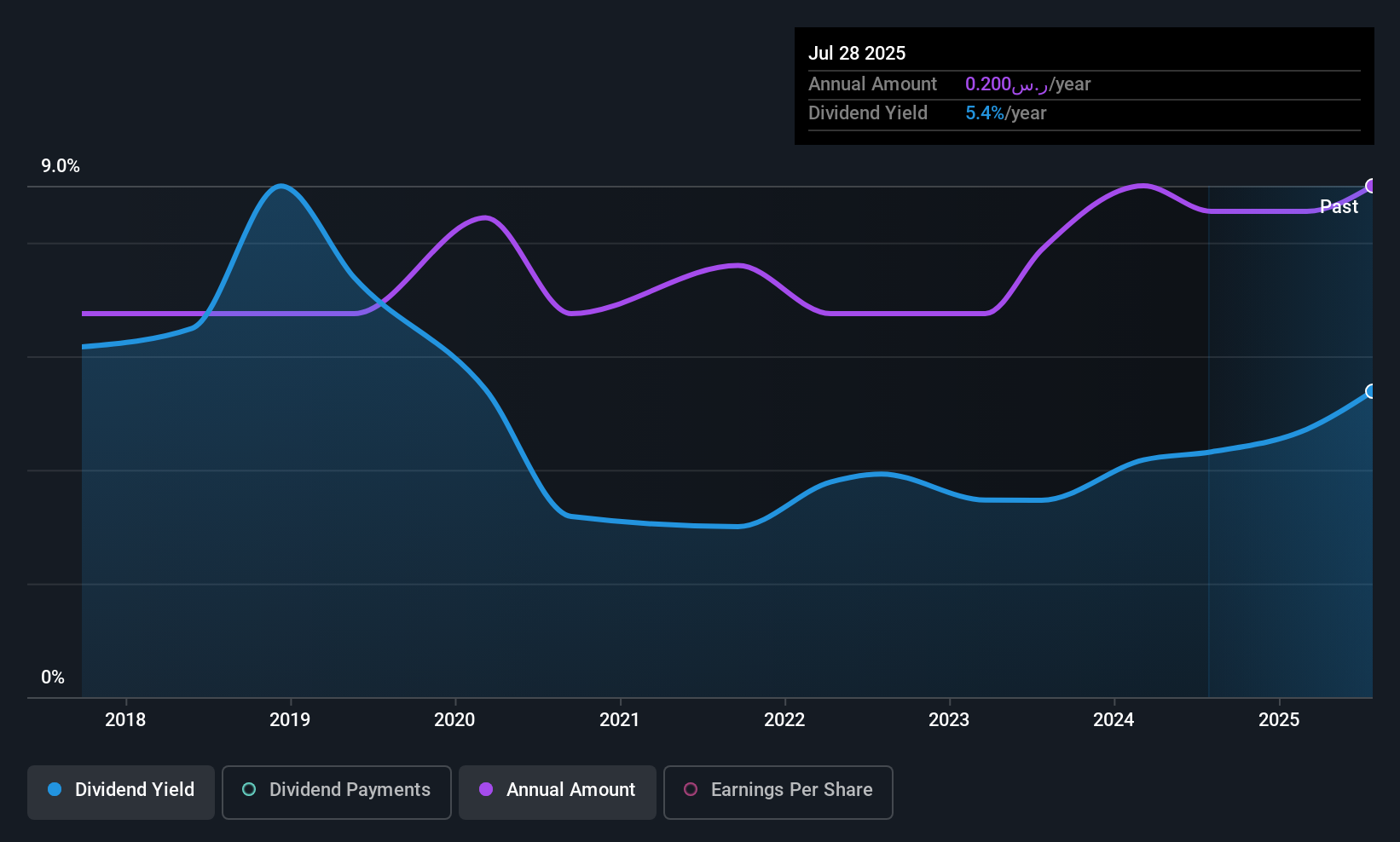

Thob Al Aseel (SASE:4012)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thob Al Aseel Company is involved in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.50 billion.

Operations: Thob Al Aseel's revenue is primarily derived from its Thobs segment, which generated SAR374.05 million, and its Fabrics segment, contributing SAR125.39 million.

Dividend Yield: 5.3%

Thob Al Aseel's dividend payments are covered by earnings with an 89.5% payout ratio and a 40.7% cash payout ratio, indicating strong cash flow support. However, its dividend track record is unstable, having been paid for only eight years with volatility over that period. Despite trading significantly below estimated fair value, recent earnings showed a decline in quarterly net income to SAR 9.23 million from SAR 26.67 million year-on-year, potentially impacting future dividends amidst leadership changes with the appointment of Khaled Abdullah Al-Omar as CEO.

- Get an in-depth perspective on Thob Al Aseel's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Thob Al Aseel is priced lower than what may be justified by its financials.

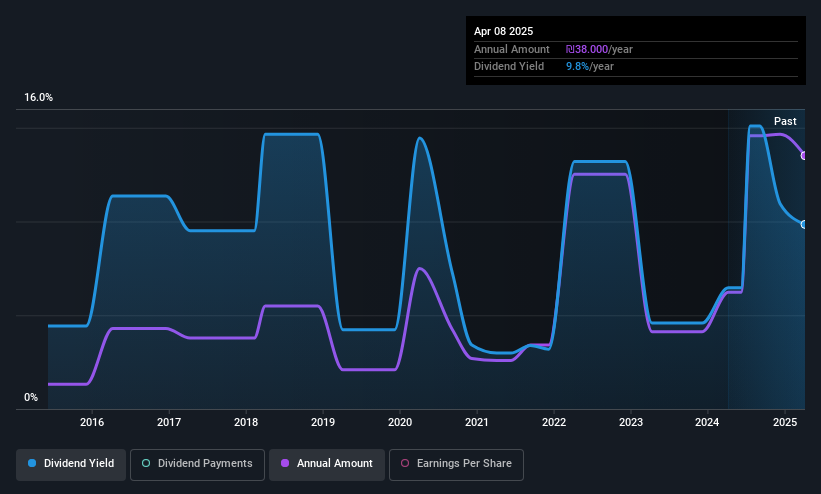

Computer Direct Group (TASE:CMDR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Computer Direct Group Ltd. operates in the computing and software sector in Israel with a market cap of ₪1.58 billion.

Operations: Computer Direct Group Ltd.'s revenue is primarily derived from three segments: Infrastructure and Computing (₪1.28 billion), Outsourcing of Business Processes and Technology Support Centers (₪365.75 million), and Technological Solutions and Services, Management Consulting and Value-Added Services (₪2.68 billion).

Dividend Yield: 8.3%

Computer Direct Group's dividend yield is among the top 25% in Israel, supported by a reasonable payout ratio of 59.5% and a low cash payout ratio of 32.3%, ensuring coverage by earnings and cash flows. However, the dividend track record has been volatile over the past decade despite recent increases. The company reported improved earnings for Q2 2025 with net income rising to ILS 25.07 million from ILS 19.45 million year-on-year, reflecting solid financial performance amidst an ex-dividend date on August 27, offering a ILS 4.50 cash dividend per share payable on September 4, contributing to its attractiveness for income-focused investors despite historical instability in payments.

- Take a closer look at Computer Direct Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Computer Direct Group is trading behind its estimated value.

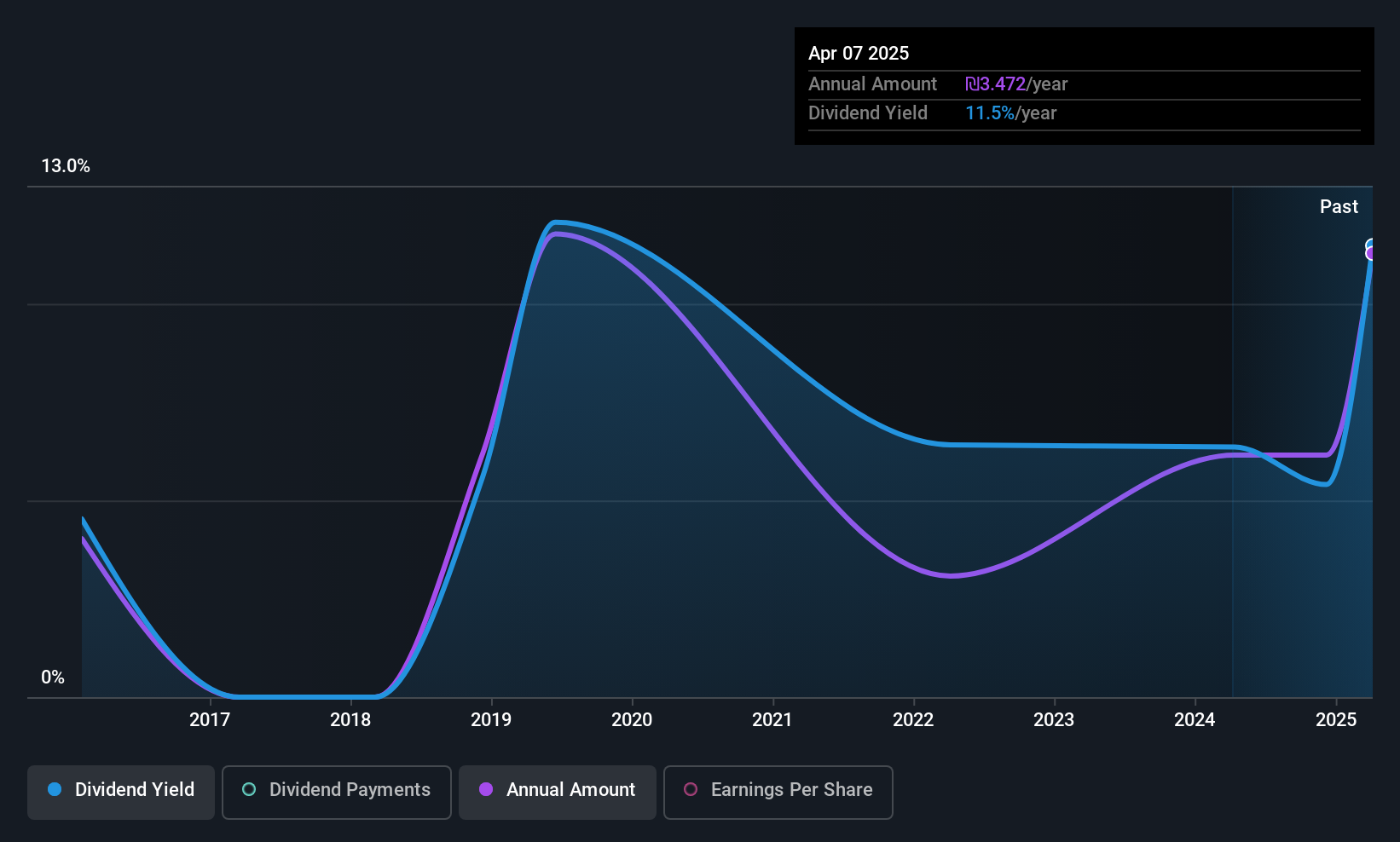

Gan Shmuel Foods (TASE:GSFI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gan Shmuel Foods Ltd. is an Israeli company that produces, markets, and sells citrus fruit, tomato, and other non-citrus fruit products with a market cap of ₪435.86 million.

Operations: Gan Shmuel Foods Ltd. generates revenue from two primary segments: Retailer, contributing $44.09 million, and Industrial, accounting for $242.34 million.

Dividend Yield: 10.4%

Gan Shmuel Foods offers a high dividend yield, ranking in the top 25% of Israeli dividend payers. Despite this, its dividends have been historically volatile and unreliable over the past decade. The company maintains a sustainable payout with a 44.2% earnings payout ratio and 71.4% cash flow coverage, indicating strong financial backing for its dividends. Recent Q2 results showed declining sales and net income, which may impact future payouts despite current coverage levels.

- Delve into the full analysis dividend report here for a deeper understanding of Gan Shmuel Foods.

- The valuation report we've compiled suggests that Gan Shmuel Foods' current price could be quite moderate.

Make It Happen

- Click this link to deep-dive into the 68 companies within our Top Middle Eastern Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:CMDR

Computer Direct Group

Engages in the computing and software business in Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives