- Turkey

- /

- Electric Utilities

- /

- IBSE:IZENR

Middle East Hidden Treasures Three Promising Stocks To Watch

Reviewed by Simply Wall St

The Middle East stock markets have been experiencing mixed performances, influenced by optimism surrounding potential U.S. Federal Reserve rate cuts and fluctuating oil prices. In this dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can navigate the current economic landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| C. Mer Industries | 76.92% | 13.56% | 68.93% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

IZDEMIR Enerji Elektrik Uretim (IBSE:IZENR)

Simply Wall St Value Rating: ★★★★★☆

Overview: IZDEMIR Enerji Elektrik Uretim A.S. is engaged in the production and sale of electricity generated from coal, with a market capitalization of TRY23.73 billion.

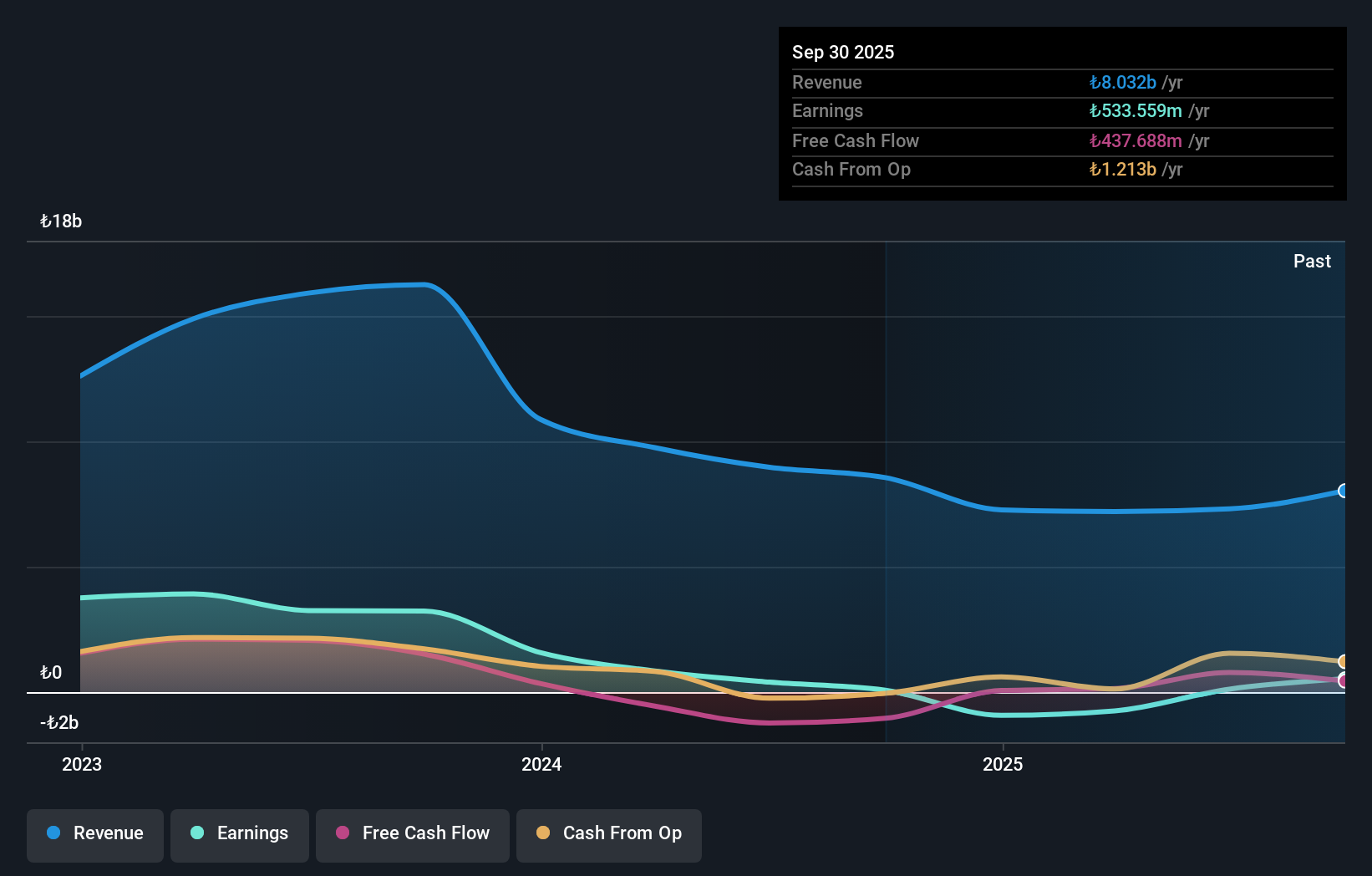

Operations: IZDEMIR Enerji generates revenue primarily from its non-regulated utility segment, amounting to TRY7.08 billion. The company's financial performance is influenced by its ability to manage costs effectively within this segment.

IZENR's recent performance paints an intriguing picture, with earnings surging by 3183.8% over the past year, significantly outpacing the Electric Utilities industry growth of 15%. Despite a TRY239.2 million one-off loss impacting its financials, net income for the third quarter reached TRY548.85 million compared to TRY154.71 million last year. The company's net debt to equity ratio stands at a satisfactory 3.8%, and interest payments are well covered with EBIT at 32.7 times coverage, indicating solid financial health amidst fluctuating sales figures and strategic capital expenditures like those seen in September's TRY735.9 million outlay.

Thob Al Aseel (SASE:4012)

Simply Wall St Value Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market capitalization of SAR1.33 billion.

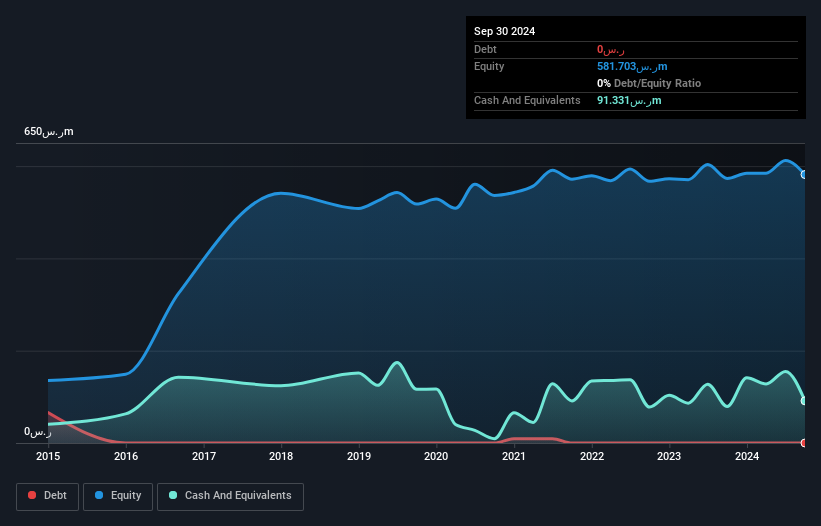

Operations: The company's revenue primarily stems from the Thobs segment, generating SAR369.43 million, followed by the Fabrics segment at SAR129.35 million.

Thob Al Aseel, a nimble player in the luxury sector, reported third-quarter sales of SAR 81 million, slightly up from SAR 78.56 million last year, with net income rising to SAR 5.99 million from SAR 5.59 million. Over nine months, sales reached SAR 393.84 million against last year’s SAR 406.16 million; however, net income improved to SAR 78.24 million from SAR 72.31 million previously noted for its robust earnings growth of 7%, surpassing industry averages and trading at an attractive value below estimated fair value by about half its worth while remaining debt-free with high-quality earnings and positive cash flow contributing to its stable financial health.

Gad-Dairies (Marketing 1992) (TASE:GAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gad-Dairies (Marketing 1992) Ltd. focuses on producing packaged food with a specialization in dairy products, and it has a market cap of ₪1.22 billion.

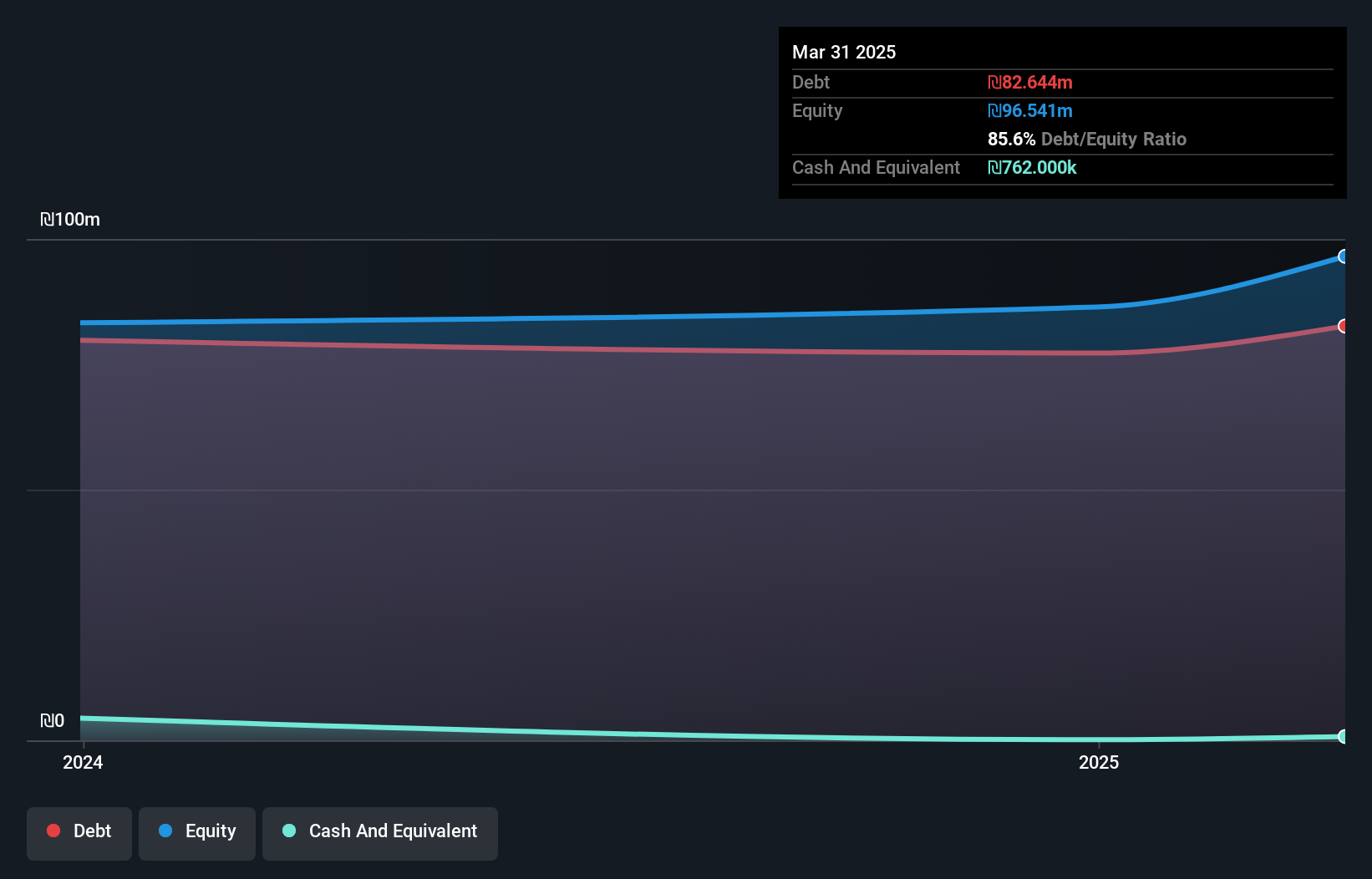

Operations: Gad-Dairies generates revenue primarily from the retail sector and the professional field, with sales of ₪403.73 million and ₪285.74 million, respectively.

Gad-Dairies, a prominent player in Israel's dairy sector, has shown robust earnings growth of 53% over the past year, outpacing the food industry's average. Despite its high net debt to equity ratio of 84.8%, interest payments are comfortably covered by EBIT at 27 times. The company recently completed an IPO raising ILS 280 million and announced a dividend of ILS 0.16 per share for December. Collaborating with Remilk, Gad is launching "The New Milk," tapping into innovative dairy alternatives that meet kosher dietary needs while maintaining traditional taste and texture, signaling potential market expansion opportunities.

- Take a closer look at Gad-Dairies (Marketing 1992)'s potential here in our health report.

Gain insights into Gad-Dairies (Marketing 1992)'s past trends and performance with our Past report.

Make It Happen

- Access the full spectrum of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IZENR

IZDEMIR Enerji Elektrik Uretim

Produces and sells electricity through coal.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026