- United Arab Emirates

- /

- Real Estate

- /

- ADX:KICO

December 2024's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Dow Jones Industrial Average and S&P 500 Index setting new intraday peaks, investors are keeping a keen eye on emerging opportunities. Penny stocks, though often considered speculative, remain an intriguing investment area due to their potential for growth and value. By focusing on companies with strong financials and clear growth trajectories, investors can uncover promising prospects within this sector.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £190.77M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$43.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.415 | £438.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,696 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Al Khaleej Investment P.J.S.C (ADX:KICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Khaleej Investment P.J.S.C. is a real estate and investment company based in the United Arab Emirates with a market capitalization of AED462 million.

Operations: The company's revenue is derived entirely from its real estate segment, amounting to AED17.43 million.

Market Cap: AED462M

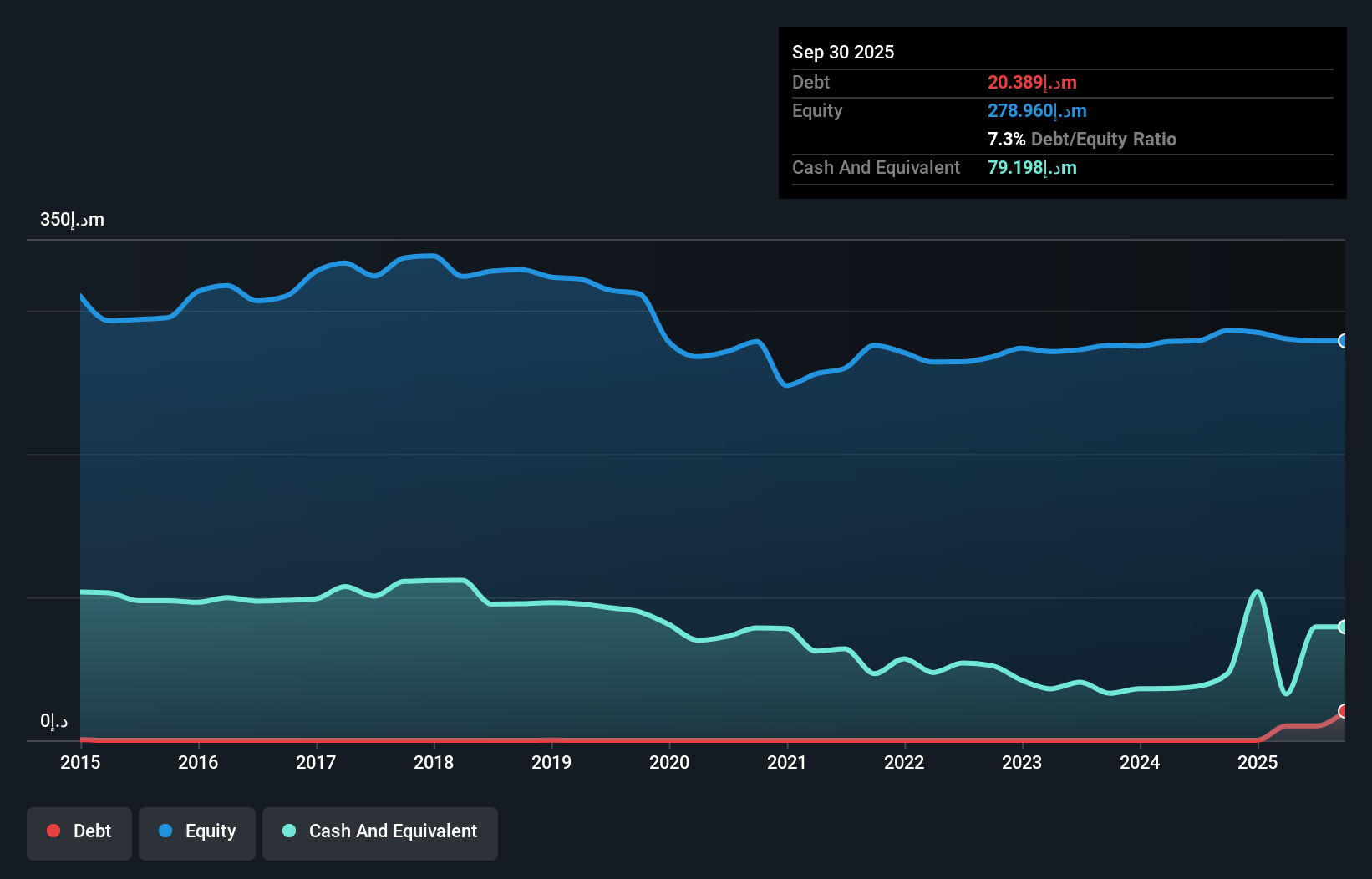

Al Khaleej Investment P.J.S.C. recently reported a significant increase in net income for the third quarter, reaching AED 6.88 million compared to AED 2.86 million the previous year, with earnings per share rising to AED 0.07 from AED 0.03. Despite its low revenue of AED17 million, the company benefits from being debt-free and having short-term assets of AED57.6 million that cover both short and long-term liabilities comfortably. However, volatility remains high at 10%, and a large one-off gain has impacted recent earnings quality, while Return on Equity is relatively low at 4.2%.

- Dive into the specifics of Al Khaleej Investment P.J.S.C here with our thorough balance sheet health report.

- Assess Al Khaleej Investment P.J.S.C's previous results with our detailed historical performance reports.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ForFarmers N.V. is a company that offers feed solutions for both conventional and organic livestock farming across several European countries and internationally, with a market capitalization of €291.19 million.

Operations: The company's revenue is primarily derived from its Food Processing segment, which generated €2.72 billion.

Market Cap: €291.19M

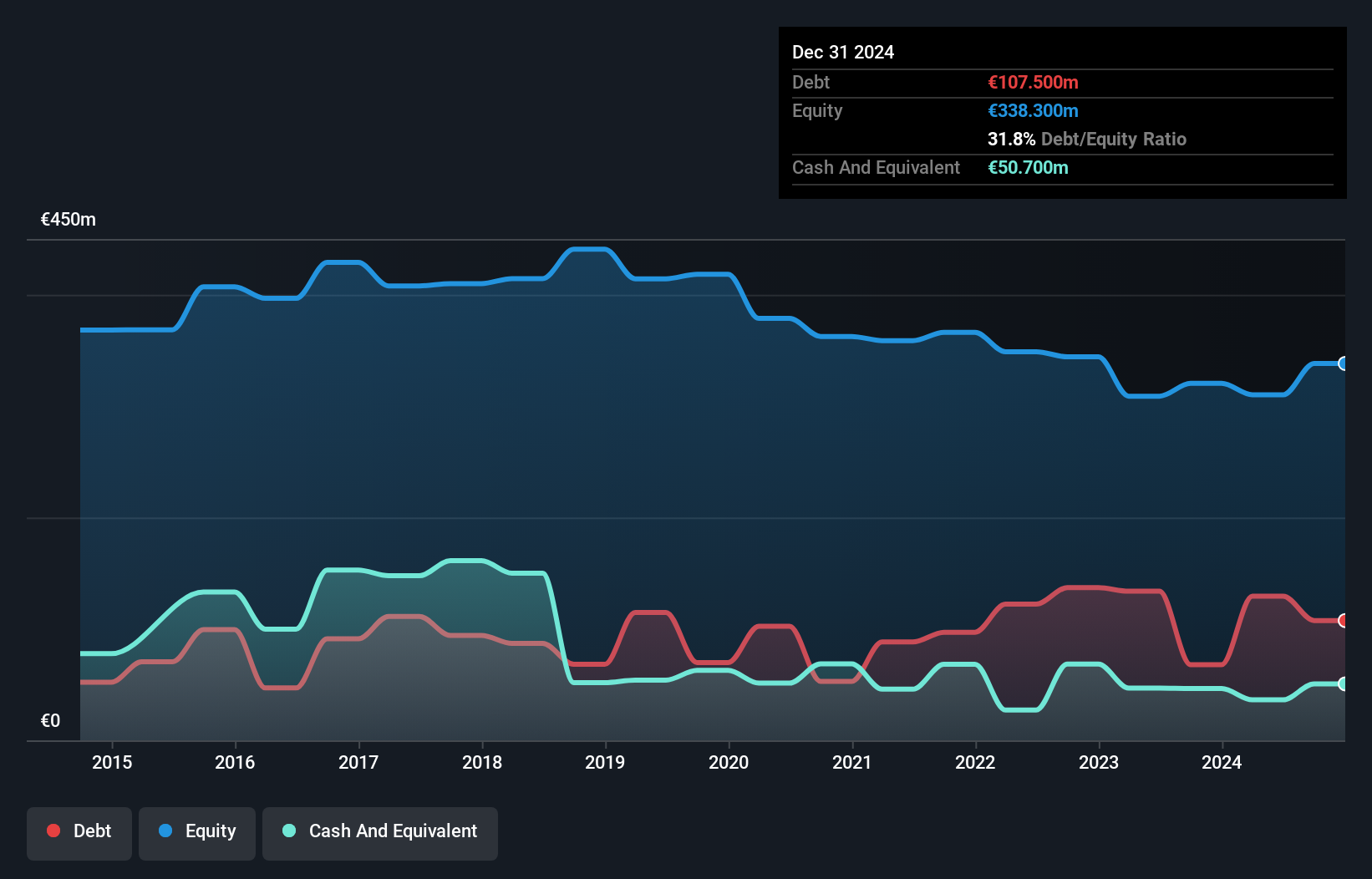

ForFarmers, with a market cap of €291.19 million, is trading significantly below its estimated fair value and has recently become profitable. The company's short-term assets comfortably cover both short and long-term liabilities, while its net debt to equity ratio remains satisfactory at 30%. However, the management team is relatively new with an average tenure of 1.5 years, and earnings have been impacted by a large one-off loss of €11.8 million. Despite these challenges, earnings are forecast to grow by over 21% annually, though interest coverage remains slightly below optimal levels at 2.9 times EBIT.

- Click to explore a detailed breakdown of our findings in ForFarmers' financial health report.

- Gain insights into ForFarmers' outlook and expected performance with our report on the company's earnings estimates.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in developing, importing, exporting, wholesaling, and retailing fabrics and readymade clothes, with a market cap of SAR1.73 billion.

Operations: The company generates revenue primarily from Thobs, amounting to SAR391.02 million, and Fabrics, contributing SAR120.65 million.

Market Cap: SAR1.73B

Thob Al Aseel, with a market cap of SAR1.73 billion, shows promising financial stability as its short-term assets significantly exceed both short and long-term liabilities. The company is debt-free, which eliminates concerns about interest coverage. Recent earnings growth of 17.7% surpasses the luxury industry average and marks an improvement from its five-year average decline. However, the dividend yield of 4.4% is not fully covered by earnings, raising sustainability questions. While trading below fair value suggests potential upside, the board's inexperience might pose governance challenges despite high-quality past earnings and improved profit margins year-on-year.

- Jump into the full analysis health report here for a deeper understanding of Thob Al Aseel.

- Review our historical performance report to gain insights into Thob Al Aseel's track record.

Where To Now?

- Click this link to deep-dive into the 5,696 companies within our Penny Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:KICO

Al Khaleej Investment P.J.S.C

Operates as a real estate and investment company in the United Arab Emirates.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives